December 11, 2015:

NASTY SELLING IN DECEMBER?WHAT HAPPENED TO SANTA CLAUS?THIS CAN’T BE GOOD!

Here are some random observations before we get into today’s analysis:

- The risk markets have been uncharacteristically weak for the month of December thus far.Normally, we would see neutral trading activity at worst and some kind of “Santa Claus Rally” at best.This year, the bulls all seem to be getting the dreaded pair of new socks as their holiday gifts – at least thus far.

- What does this treacherous trading activity mean in terms of news yet to be released?The possibilities are very unpleasant to think about (i.e. terrorism, systemic issues, etc.).

- Let us hope that there is nothing too awful looming out there.Hope is one thing, though, and the message that the markets are telling us is another thing altogether.

- We urge caution out there for our readership!Don’t be too bold on the long side of risk right now.As we noted to one client today – be skiddish with longs and be leaning towards selling rallies instead of buying dips.

- Let’s go to the charts to see if we can get some more direction on things….Have a great rest of the week and a wonderful weekend!

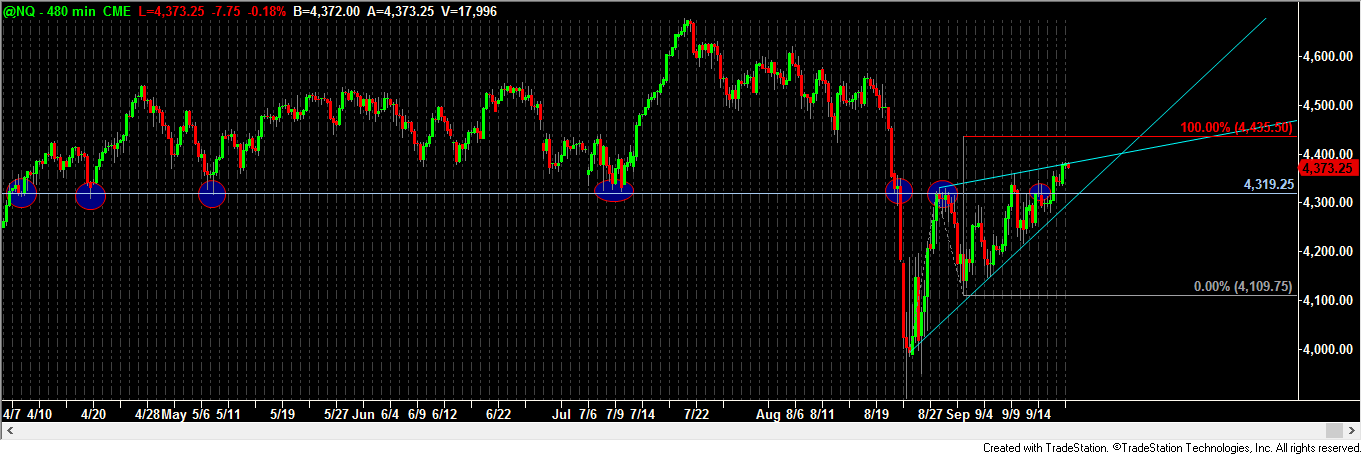

Here's the bullish look at things:

Here's the bullish look at things: