The small caps and the Nasdaq have seen great volatility and range yet the S&P has been trading in a relatively tight range. Today this range is getting tighter and could be on the verge of a break in trend.

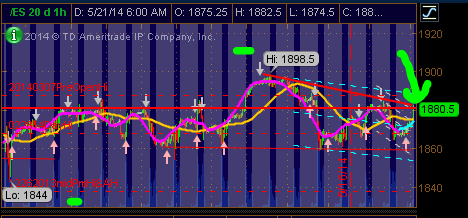

Bulls have tried so many times to convincingly break the 1900 SPX wall to no avail. This week's options positions suggest that they will fail again at it. But, the last twenty days or so in the S&P there are range limits meeting at today's open prices. The following ES (representing the S&P) chart shows a sideways channel where 1880 is the upper end. But there also exists a descending trend of highs (as they say 'lower highs' - bearish) from about five days ago. Today's 1880 ES is about the meeting point of both. Bulls have a chance to break out of the descending trend and from the lateral channel. This could lead to higher lows and the start of an ascending trend for another run at the 1900 SPX wall.

I personally think that the bears have the upper hand in this fight. The bulls will need a clear positive catalyst to break out. I just don't see one coming. On the other hand, bears only need the threat of uncertainty and they see impending doom; hence, nervous traders push the sell buttons. Here is a list of sources of uncertainty holding the bulls from regaining the conviction of 2013:

- Indecision especially in the NDX and RUT (can't sustain runs)

- Momentum stocks: they too can't hang on to bids

- Elevated levels of TLT & Yen which have been a market killer

- Weak small & mid cap complexes

- Free-falling TNX. Bulls need it rising

- A high level of disregard of Geo-political risk

- A very low level in the VIX (doesn't usually last low for long; spikes follow)

Conclusion: I am more comfortable shorting these runs than going long them. Buying momentum has been a sure loser trade in 2014. I am not forecasting doom but I just don't believe that markets have much more room to go in the near term. Message me for some of my ideas on how I do this.

Teaching traders make money from a relatively safe distance: Create Income with Options Spreads, a large community of Options Traders looking to create extra income by trading credit spreads. For just about the cost of a cup of coffee per day, you can get all the benefits of the CIWOS subscription, including analysis, alerts, trade recommendations, chats & video updates.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member