The stock market fell yesterday…which makes it 4,372-days in a row that it has declined…….Okay, okay, it’s only been seven days in a row for the Nasdaq (and 6 out of 7 for the S&P 500), but it sure SEEMS like it has gone down every day since God was a child, doesn’t it? Whenever the stock market closes in negative territory for so many days in a row, it tends to see a relief bounce at some point. This is especially true when the market becomes oversold and sentiment becomes quite negative.

The problem is that the stock market has certainly fallen for more than seven days before it has bounced in the past. Also, even though it’s starting to get somewhat oversold, many readings are not at levels that would show that the market is definitively (or significantly) oversold. For instance, the RSI on both the S&P 500 and the NDX 100 are still above 30…34 on the SPX and 33 on the NDX……Therefore, even though it’s getting ripe for a bounce at some point soon…that “some point soon” might not be for a few days…and from a level that is still solidly below last night’s close.

Speaking of the S&P 500 index, it closed basically right on its key support level. We see the 3910 level as key support. That’s a Fibonacci 61.8% retracement of the summer rally. (Many people are pointing to 3900 as that key level…because it’s a round number and sounds better. To be honest, it doesn’t matter which one you use. They’re basically the same. We always need a “significant” break ANY support level for it to be a compelling development, so we’re all pretty much on the same page with that 3900-3910 range as the key level to be watching.) Besides, the 3900-3910 range for the SPX is where the trend-line from the June lows comes in! Therefore, whether we break below that range in a meaningful way over the next few trading days…or bounces off it in a big way…is going to be important on a technical basis.

We have two possible catalysts for the direction of the next move. First is today’s product announcements out of AAPL. Second, is Chairman Powell’s public comments Thursday morning……To be honest, if the market was a bit more oversold than it is right now, we’d be looking for a nice bounce right here (on a short-term basis). However, since the market has not reached the kind of level that makes calling for a short-term bounce a lay-up, it’s hard for us to be overly confident that a bounce will take place immediately.

There is one thing, however, that DOES tell us that we could/should get at least some kind of bounce soon. It’s sentiment…and sentiment is quite bearish. No, the official numbers (II, AAII, DSI, etc.) are not as bearish as they were in June, but they are still getting bearish once again. Also, if you listen to the rhetoric around Wall Street, it has also become very bearish as well. No, this part of sentiment cannot be measured, but most people would agree that you cannot read or hear from most financial news outlets right now without getting a heavy dose of bearishness. Of course, we are included in this bearish take…and THAT makes us nervous about our stance…at least over the very-short-term.

Don’t get us wrong, we are still very cautious about the stock market over the coming weeks and months. Therefore, we believe that any bounce over the near-term will be a short-lived one. However, with sentiment getting quite bearish again…and the markets getting close to oversold territory…it wouldn’t surprise us one bit if the market saw a very-short-term bounce at some point soon. (Maybe after one more move lower to make it fully oversold?)…..However, any short-term bounce should be used to raise cash and get more defensive…and the real impact of the Fed’s tightening policy is in front of us. As rates move higher and earnings come down, we believe the odds that we break below the June lows is quite high.

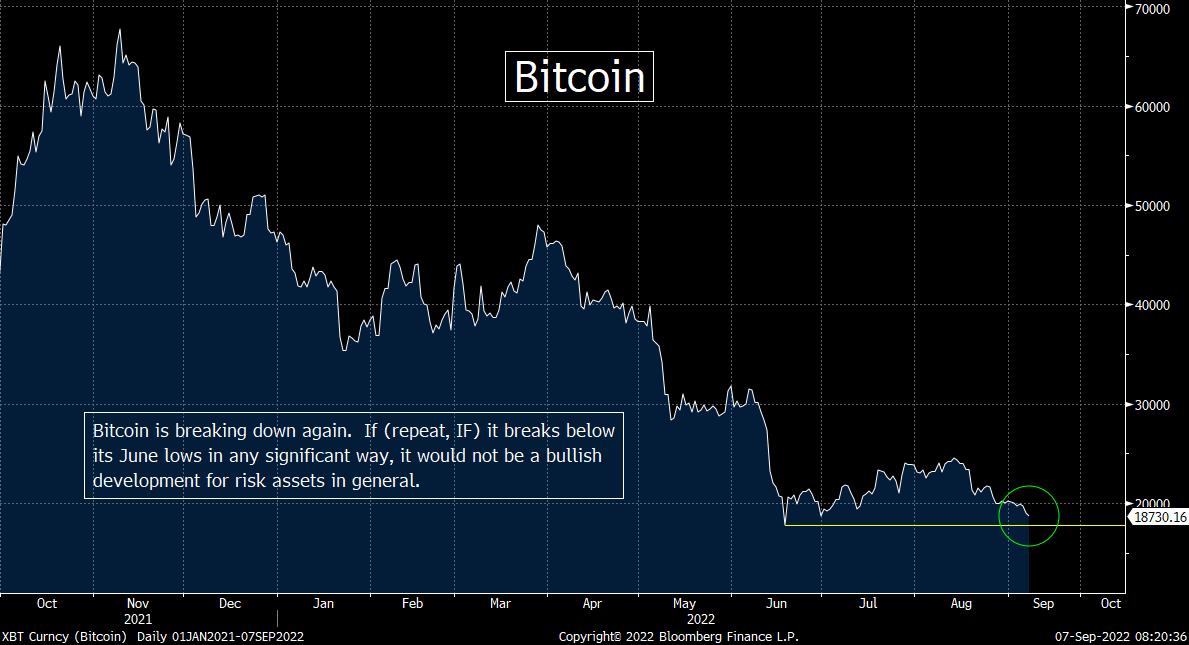

Speaking of catalysts, we must admit that the news that Poolin…one of the largest providers of Bitcoin mining-pool services…halted withdrawals yesterday in an effort to preserve liquidity didn’t get more attention. Remember what happened the last time we saw these kind of restrictive developments in the crypto market? It was followed shortly thereafter by some serious “forced selling” in that asset class. That, in turn, caused some serious selling in the stock market…because the crypto market was not liquid enough for the leveraged investors in that market to raise the money they needed to meet their margin calls. Therefore, they sold what they could…which was mostly big cap tech names. (Crypto holders don’t own GE, GM and MMM!)

Of course, a lot of leverage was wrung out of the crypto market in the spring, so maybe the renewed decline in Bitcoin and other cryptos will not create the same kind of pressure on the stock market as it did in the spring. However, it is still a key “risk-on/risk-off” asset, so if it

continues to decline in the coming days and weeks, it will not be good for other risk assets…especially as QT become much more pronounced going forward.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member