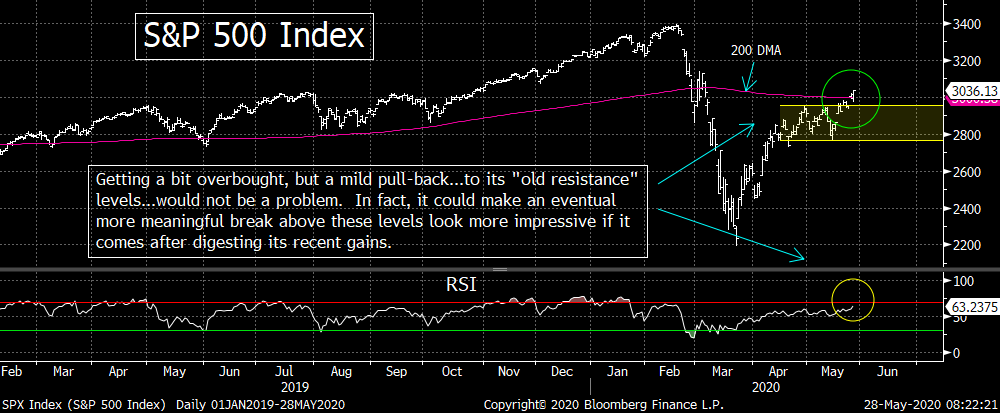

We’d like to start this morning’s piece with a scenario that would provide the best chance of a strong (further) rally after yesterday’s advance in the S&P 500 above its two key resistance levels (its 3,000 level and its 200 DMA). This is NOT the scenario that we believe will be the one that will definitely play itself out. We’re just spelling out what would help the market the most as we move through the rest of Q2. (We’d also say that the moves involved in this very-short-term scenario are not big enough to be called “tradeable” ones. Therefore, the first part of our piece this morning is more of an academic exercise than anything else.)

Believe it or not, the most bullish thing the stock market could do right now is take a “breather”...or even pull-back some-what. In fact, the S&P back could pull-back down below its 200 DMA...to the top-end of its recent sideways range (near 2940)...and still not be considered a substantial problem. The market has rallied very nicely...with its 35% gain in just 2.5 months...including a 7.7% gain over just the past nine trading days. It’s getting a bit overbought on a very-short-term basis, so if it pulled-back a little bit to work off this condition...but stayed above its recent sideways range (and thus above its “old resistance” level....and THEN blasted above that 200 DMA in a more meaningful way...it should create the kind of momentum that will be impossible to stop.

No, this does not mean that the market cannot rally straight up from here. We’re merely saying that a “breather” right now...especially given the geopolitical situation that has re-developed between the U.S. & China...would take out some of renewed bullishness and complacency that has shown up in the market place this week. That, in turn, will actually give the market more upside potential as we move through the rest of the second quarter...even if it takes away some of the immediate upside potential over the first week of June. (First chart below)

Ok, enough of the academic exercise. Yesterday’s rally was another good one...and as we all know by now, it allowed the S&P to close above the 3,000 level and above its 200 DMA. As we said on Monday, we’d like to see a move above 3,100 in order to confirm the breakout (either now...or after a breather), but there’s no question that yesterday’s rally (which came on the second highest volume of the month and good breadth) was exactly what the bulls needed after Tuesday’s failure to hold above those key levels.

The rally in the bank stocks got a lot of the credit for the rally...and deservedly so. The KBE bank ETF and the KRE regional bank ETF both rallied more than 7% yesterday...and both made “higher-highs” above their April highs. Both were very slight “higher-highs” (especially on the KRE), but it was exactly what the doctor ordered for this group after its deep correction during the first half of May. (Remember, the KBE fell 19% and the KRE gave back 21% over those first two weeks of the month.)

However, another catalyst for the rally was the news that Q3 revenues for Micron (MU) were going to beat expectations. This news hit the tape at just before 1:30...and it helped MU bounce more than 10% from its lows (and +8% from Tuesday’s close). This move lit a fire under the SMH semiconductor ETF...which moved from negative territory at the time...to a 1.5% gain by the close of the day. This also helped the S&P 500...which was trading at 3,000 when this news became public. After that news from MU became public, the S&P rallied more than 1% above its key resistance levels by the 4:00 close. Therefore, there is no question that the new-news out of one key chip stock helped the broad market rally yesterday...after a up and down start over the first two hours of trading.

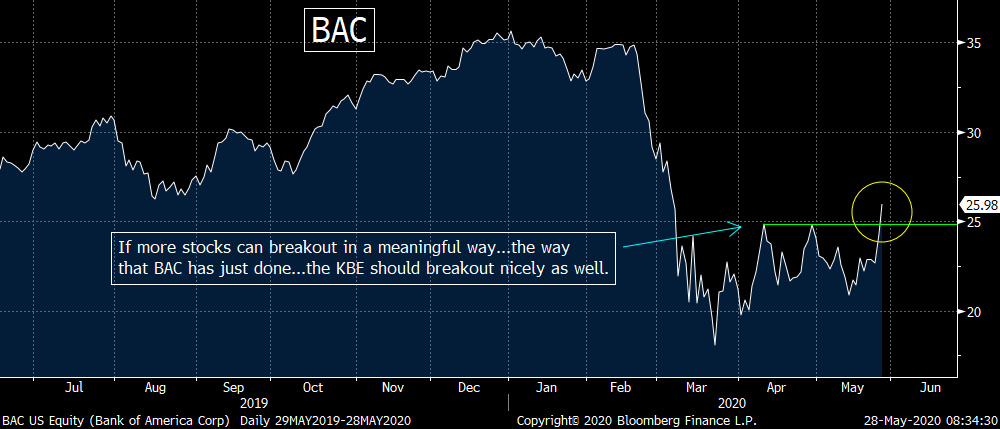

Having said this, we want to move back to the bank stocks and focus on the KBE...and one of its most important components: BAC. This stock rallied 7% yesterday and this enabled it to break well above its key resistance level of $25. That level provided important resistance for BAC in April...stopping rallies dead in their tracks on two different occasions. However, BAC opened well above that level in the morning yesterday...but then fell back down RIGHT TO the $25 level at midday...and held! It then started a strong and steady advance over the afternoon that left the stock more than 4% above its key resistance level by the close. THAT is quite positive on a technical basis.

Of course, technical analysis involves both price and time. Even when an asset breaks meaningfully above or below a key resistance or support level, we still have to guard against a “head fake” when the “meaningful move” comes all at once. In other words, to get a “meaningful” break of a level, it usually takes time. Thus, once it gets 3% or so away from that key level, it tends to confirm that the “break” is for real. However, when a “meaningful” breakout comes all in one day, we still have to guard against an immediate (and sharp) reversal. Right now, BAC looks higher again this morning, so the prognosis for BAC is very good right now.

We’d also note that JPM has not broken above its April highs yet. It’s very close, but if JPM can break significantly above those April high of $102.75...at the same time BAC is confirming its own breakout...it’s going to bode very well for the KBE and the banks stocks in general on a technical basis. (2nd, 3rd & 4th charts attached below.)

This is far from the first time that we’ve seen the banks have the potential to finally outperform over the past 2.5+ years...and each of the previous times, they fizzled out. Therefore, we will definitely have to see how much upside follow-through from JPM and some others away from BAC over the coming days and weeks to finally get excited about the bank stocks, but the action in BAC is definitely something that will give the bank bulls to lean on over the near-term.

We’ll finish by saying that as good as the momentum had been for the stock market recently, we’re pretty shocked about the complacency in the markets surrounding the rising tensions between the U.S. & China. Hong Kong’s autonomy is gone. This is a clear sign of China’s real intensions on many different fronts...including geopolitical and economic ones. This new Cold War with China is escalating...and will only escalate further in the future. It is a bipartisan issue...and thus the November election will not change the rate of escalation...no matter who wins the Presidency or either House of Congress.

This is all taking place at an incredibly vulnerable time in the global economy. This isn’t 2019...when the tensions surrounded only trade/economic issues...and did not include geopolitical ones...like they do right now. More importantly, the economy is not humming along like it was last year. Therefore, we worry that investors are whistling past the proverbial graveyard...just like they did when they ignored the coronavirus in January and the first part of February this year.

The Fed can solve a lot of financial problems, but can they really fix those problems...AND healthcare problems...AND geopolitical problems...all at the same time???

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member