Click Here for this Week's Letter

Greetings,

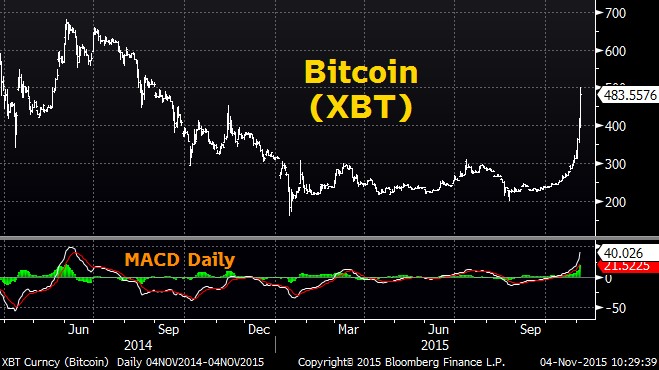

Bitcoin is up +55% month-to-date and it’s November 5. The markets were closed on the 1st and 2nd, meaning the move has taken place over three trading sessions. Yet, on Wednesday, the Wall Street Journal had no mention of Bitcoin in the newspaper. The growth of Bitcoin, and cryptocurrencies more generally, is a major macro-theme that the mainstream still doesn’t take seriously. Even though these currencies are rallying, the wild fluctuations are likely to scare investors even more.

It’s scary because, over the short-term, there isn’t one explanation for these moves. When Mario Draghi cuts deposit rates below zero, there’s no mystery why EUR declines. Bitcoin isn’t manipulated by policymakers and it’s still a relatively thin market, so these moves can be explosive without a major catalyst. At the same time, digital currencies are appealing to many because they aren’t driven by politicians or economists. In a sense, Bitcoin is tapping into the “pro-independence” sentiment fueling the presidential campaigns of Donald Trump and Bernie Sanders. The fact that neither candidate is beholden to Super PAC’s or lobbyists is a big selling point for both campaigns. Like Bitcoin dethroning USD, Trump and Sanders might not achieve their ultimate goal, but their popularity can soar in the meantime.In a similar vein, two weeks ago Europe’s highest court ruled that Bitcoin should be exempted from VAT and treated like any other currency. Avoiding taxation on an exchange makes it that much more appealing. In September, the CFTC classified Bitcoin as a commodity, making it eligible for derivative trading. Increased liquidity is a very positive development, although that doesn’t guarantee higher volumes, especially in the short-term.

However, it’s clear that volumes are rising rapidly. In early September, trading on BTCC, the biggest bitcoin exchange, was averaging around 20,000 bitcoins a day. Tuesday set a new record at 90,000, and it’s been averaging close to 80,000. There are a few theories to explain the uptick in volume. Many think it’s related to China, home to 80% of Bitcoin transactions, according to Goldman Sachs. In late September, China capped the amount of money holders of bank and credit cards could withdraw outside the country. This may be spurring nationals to use Bitcoin to evade controls. The Winklevii launched a new Bitcoin exchange in October, that’s supposedly friendlier to institutional investors. US Marshals are auctioning off Bitcoins confiscated during the Silk Road raid, and cryptocurrencies tend to see increased volumes around such auctions. Others say the uptick in activity is related to a Ponzi scheme.

It’s likely the price of Bitcoin is being influenced in part by all these theories, but there’s one thing everyone can agree on: Bitcoin, unlike fiat currency that can be printed at whim, is a finite commodity that suffers from the basic economic theory of scarcity at times of increased demand. The growth of supply is declining and demand is rising. We may not know why Bitcoin is surging, but its fundamental simplicity is bullish.

The Cup & Handle Fund is up around +4.5% YTD, and +11% Y/Y. We’ve cut risk and increased cash holdings. Obviously, tomorrow’s non-farm payroll number is hugely important and I don’t want much exposure going into that. The bond market is very choppy, and I’m not sure what to make of it yet. I have my longer-term views, but need to trade tactically. The November investor letter went out last Friday. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

November 5, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member