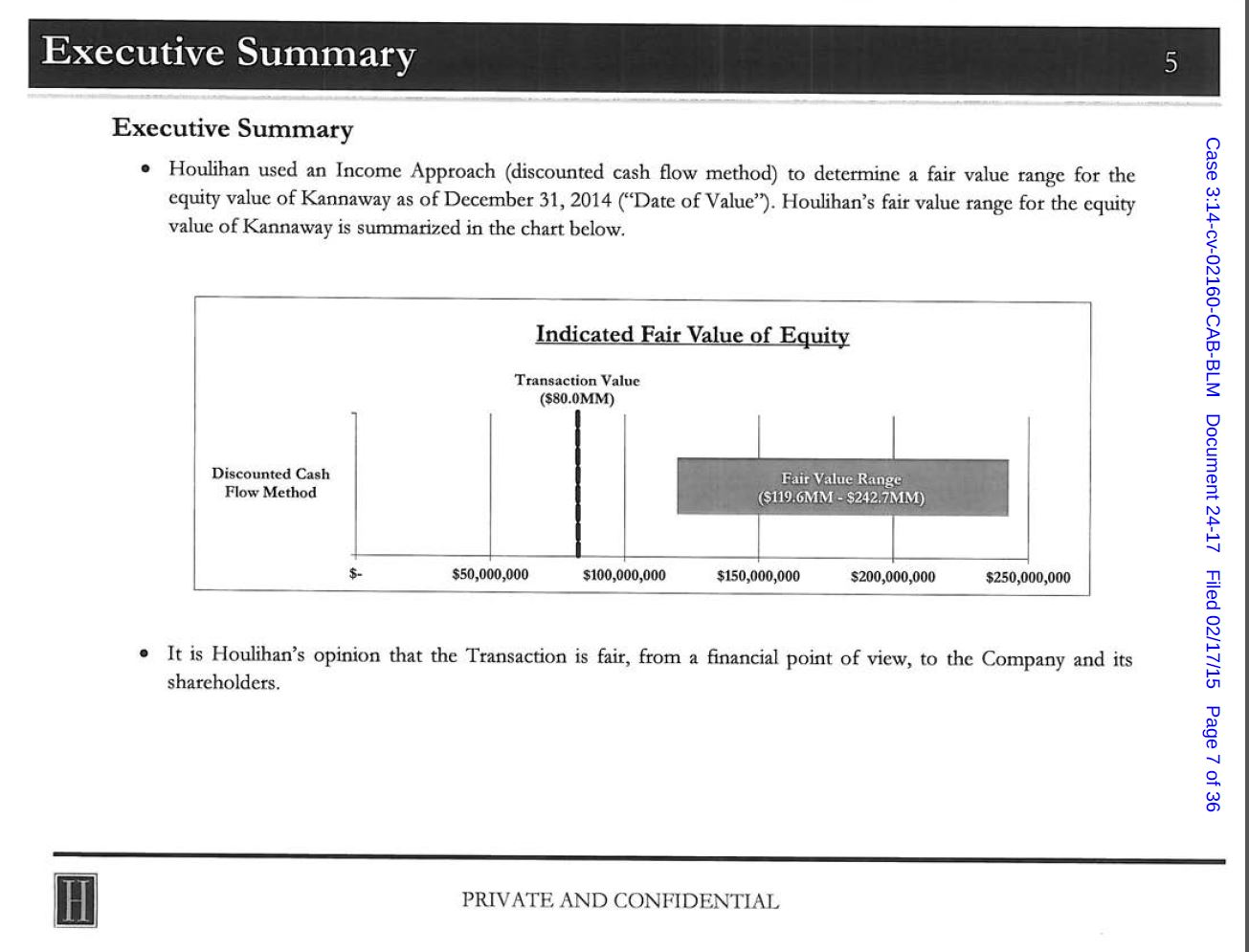

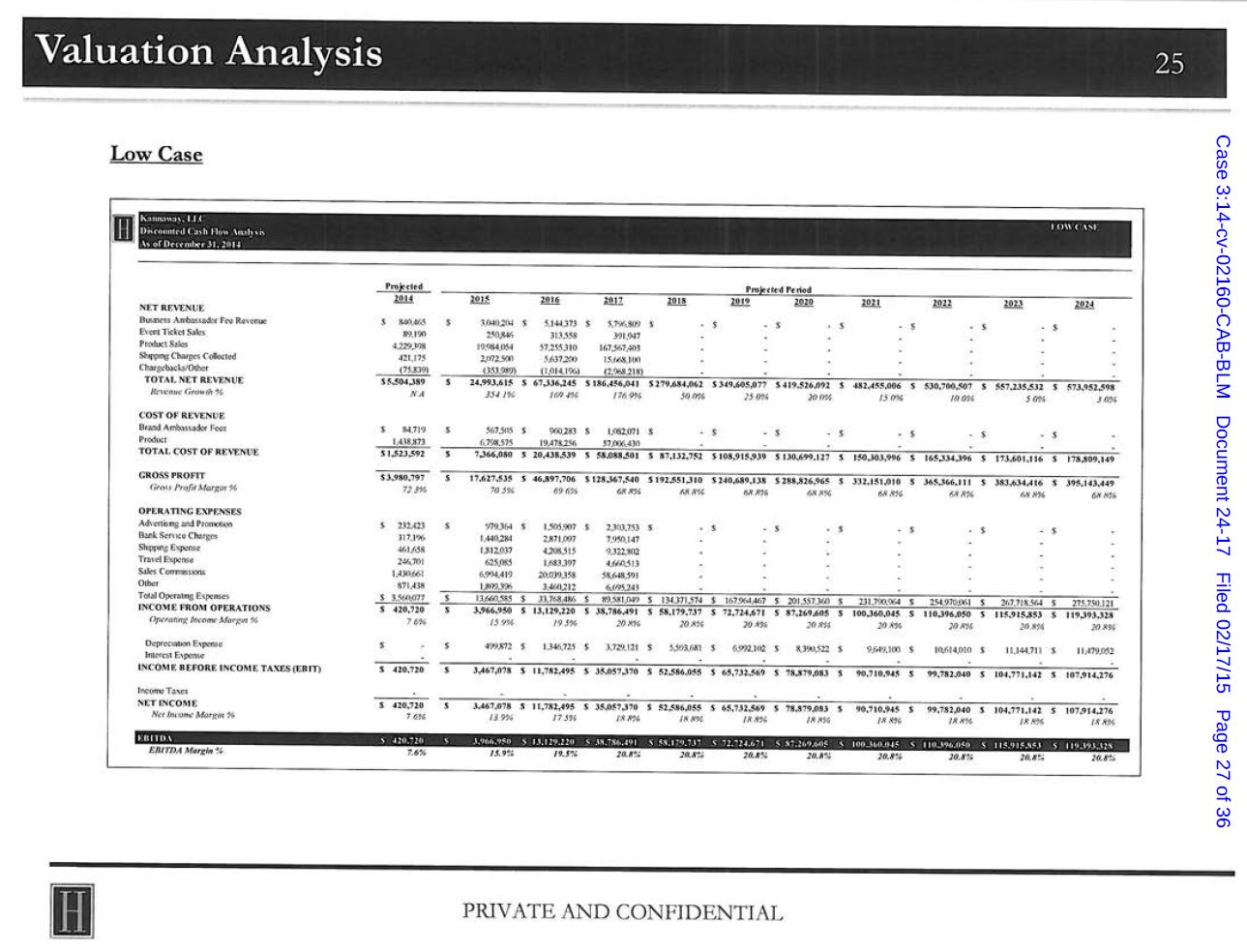

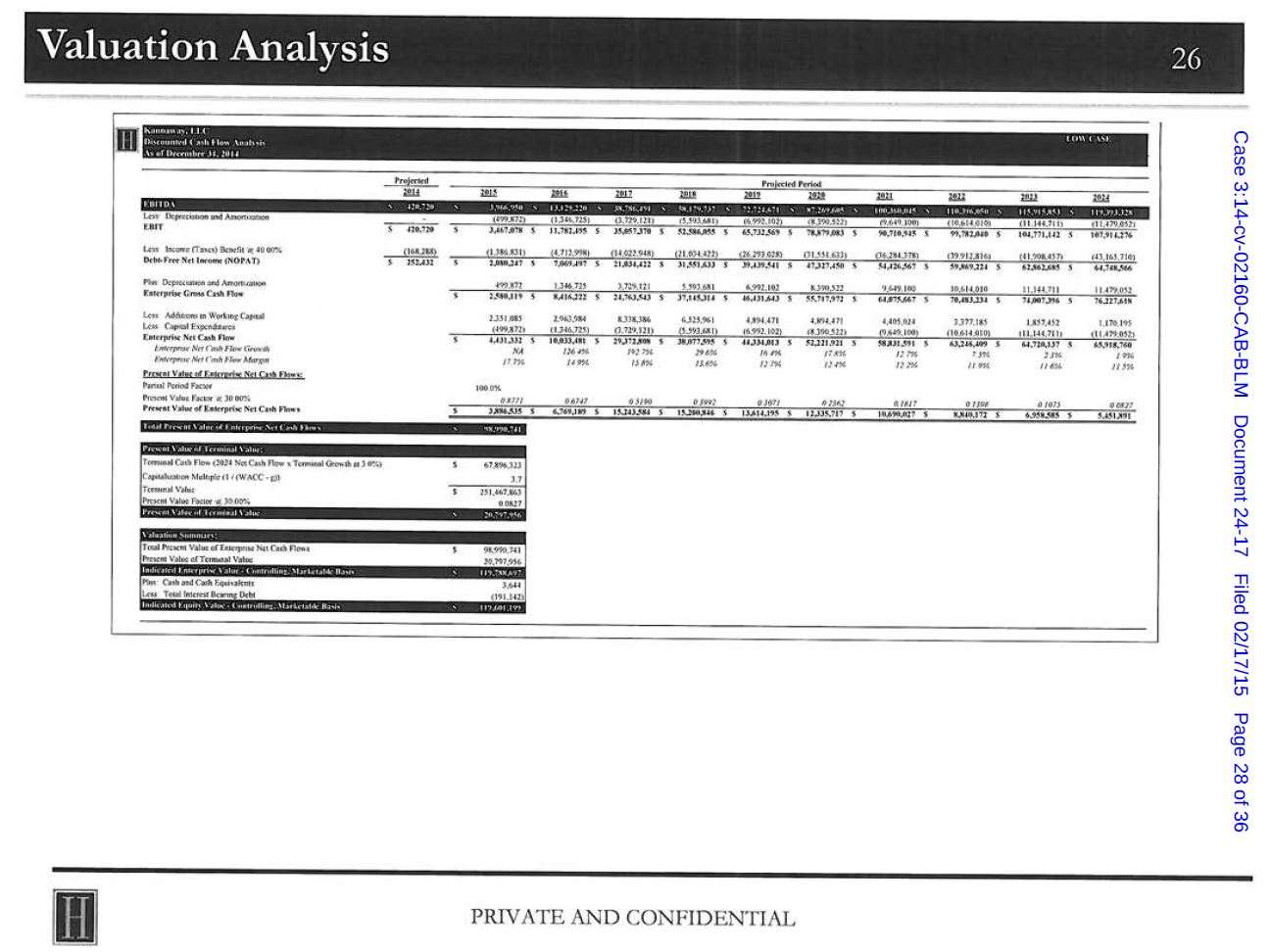

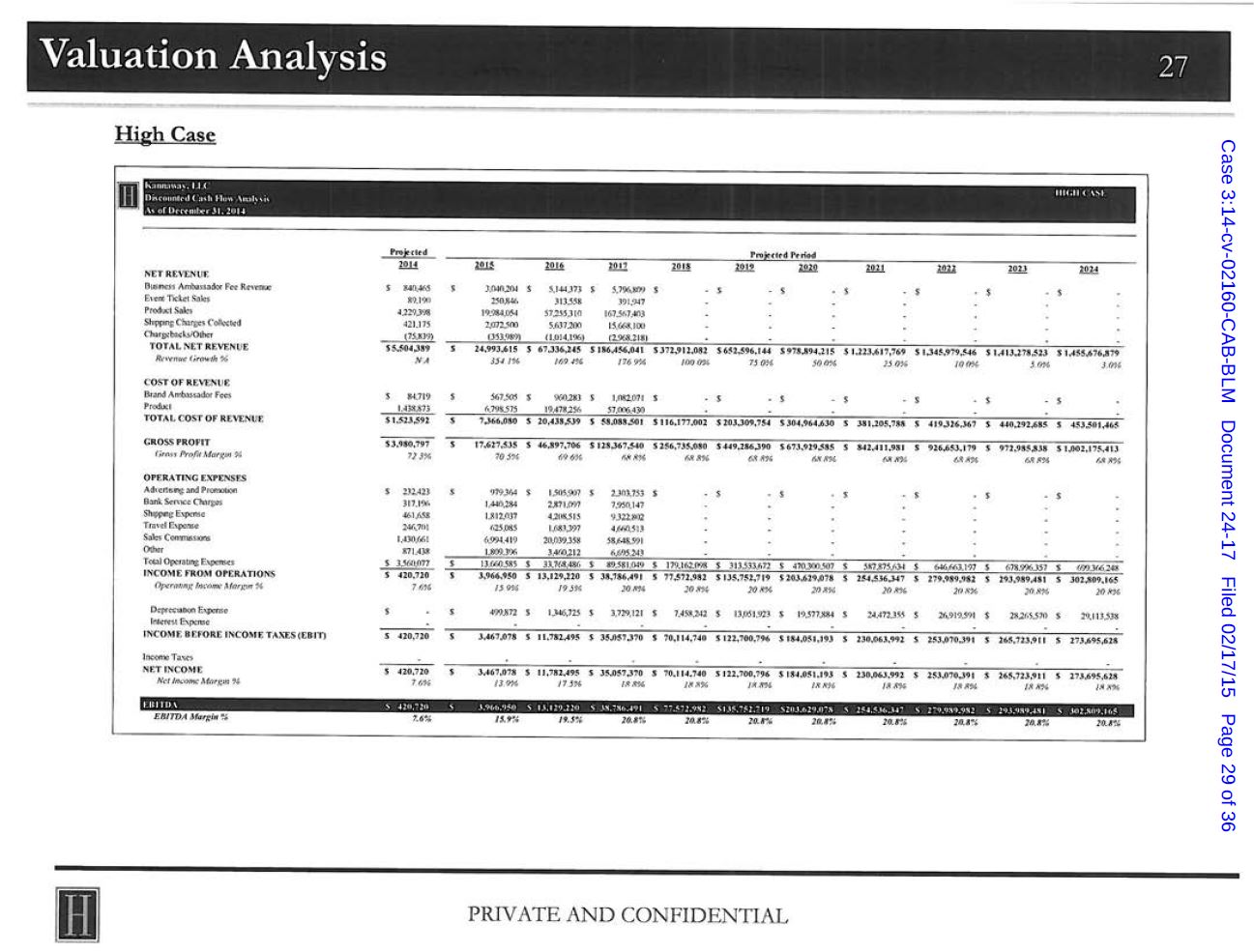

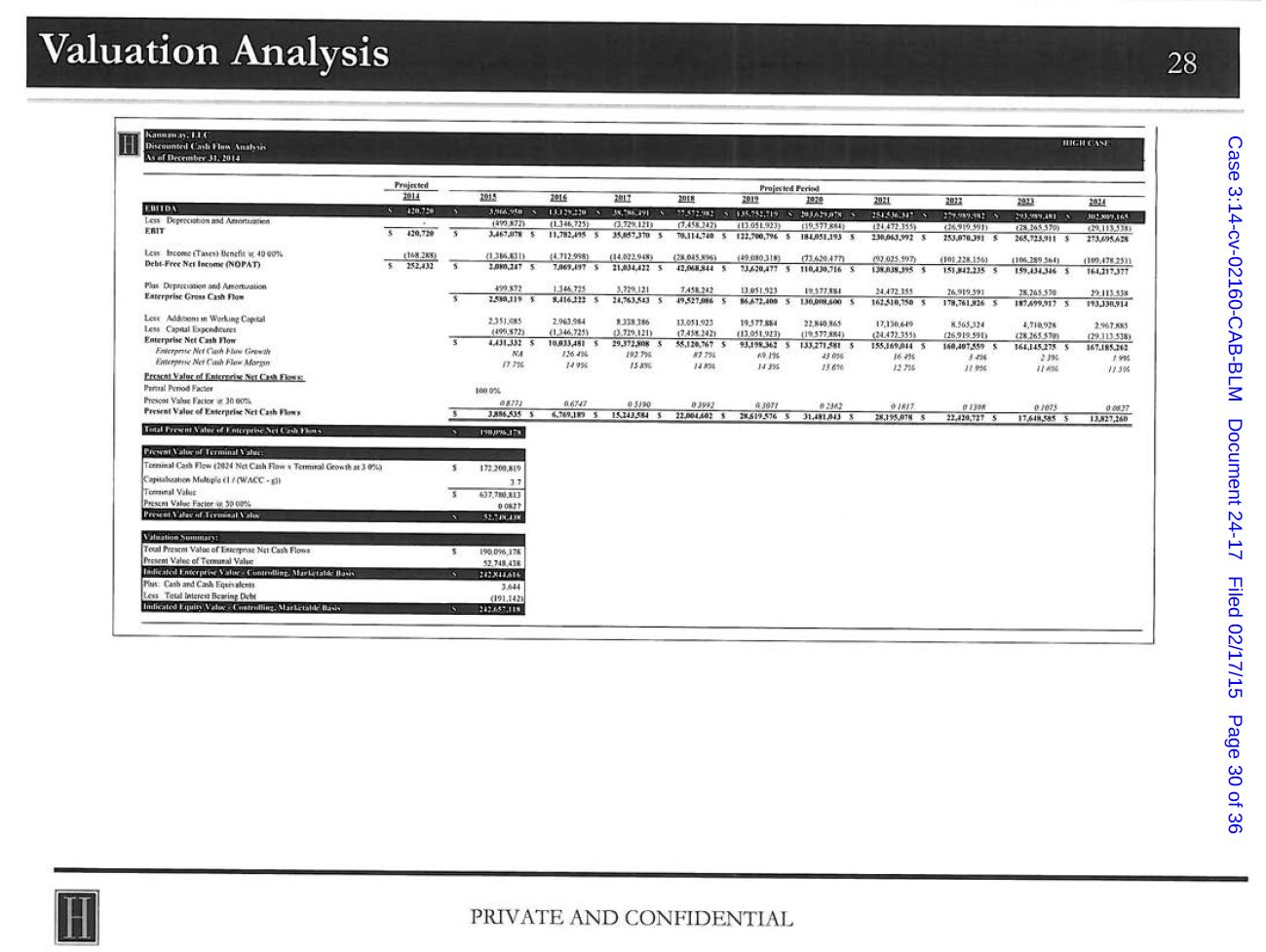

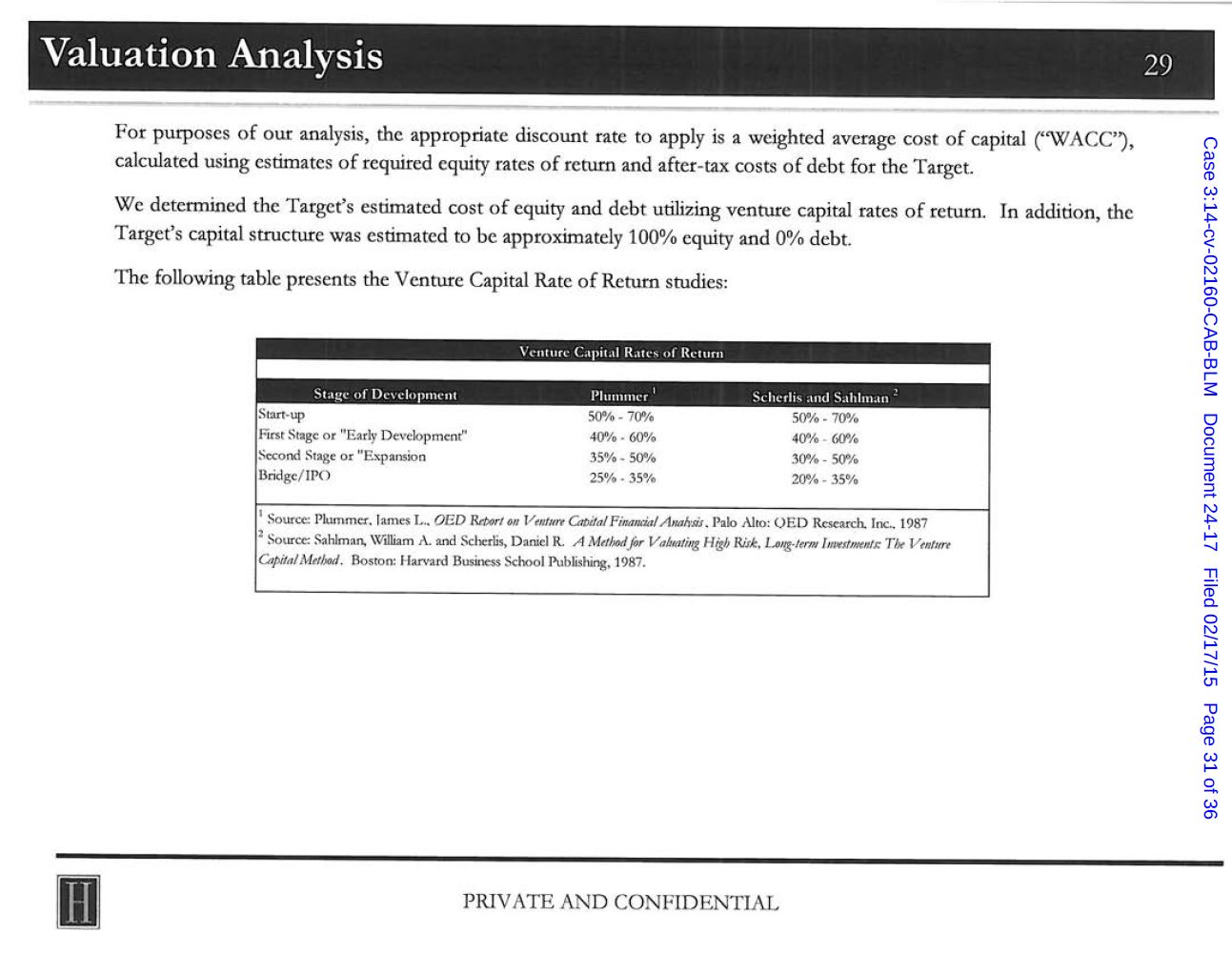

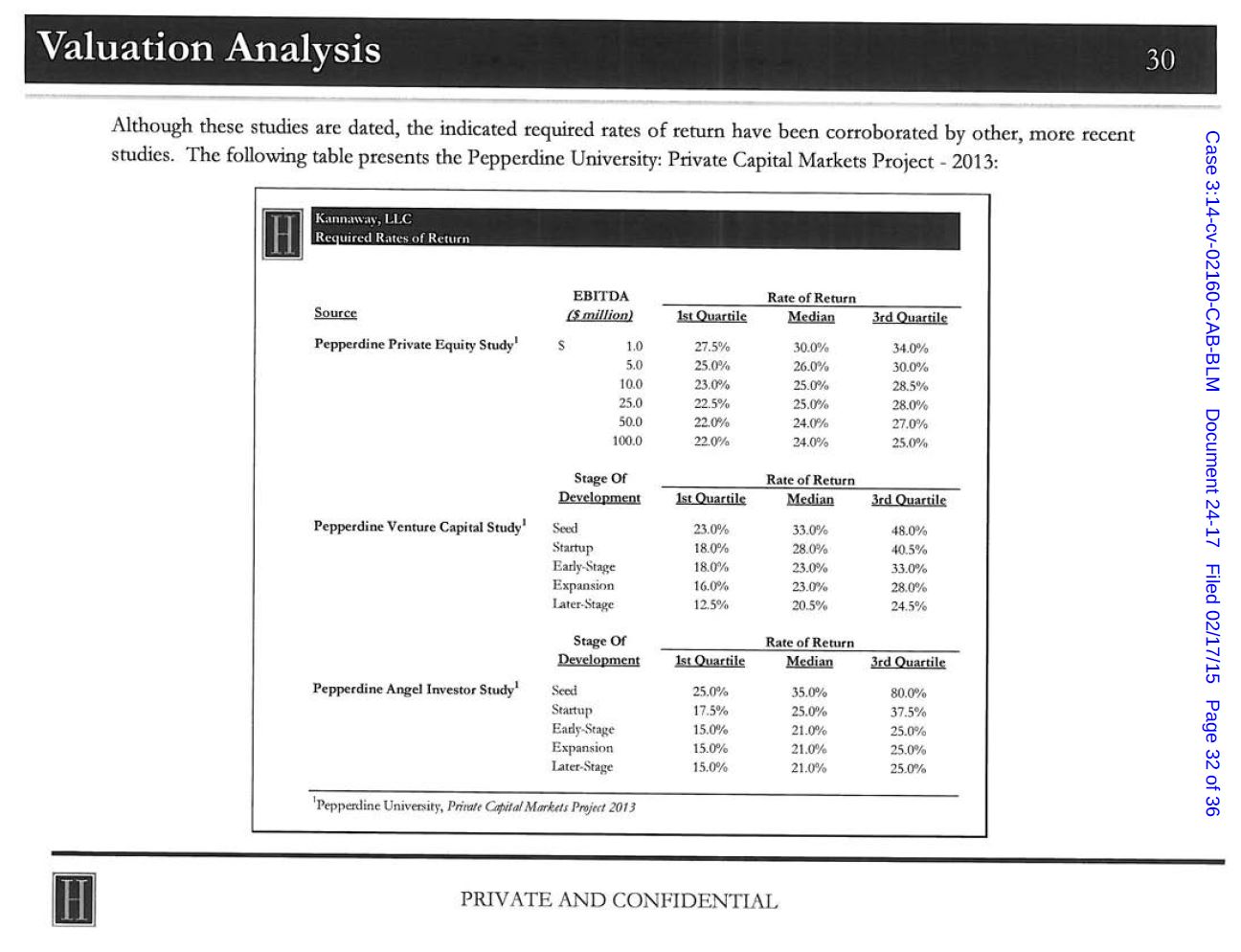

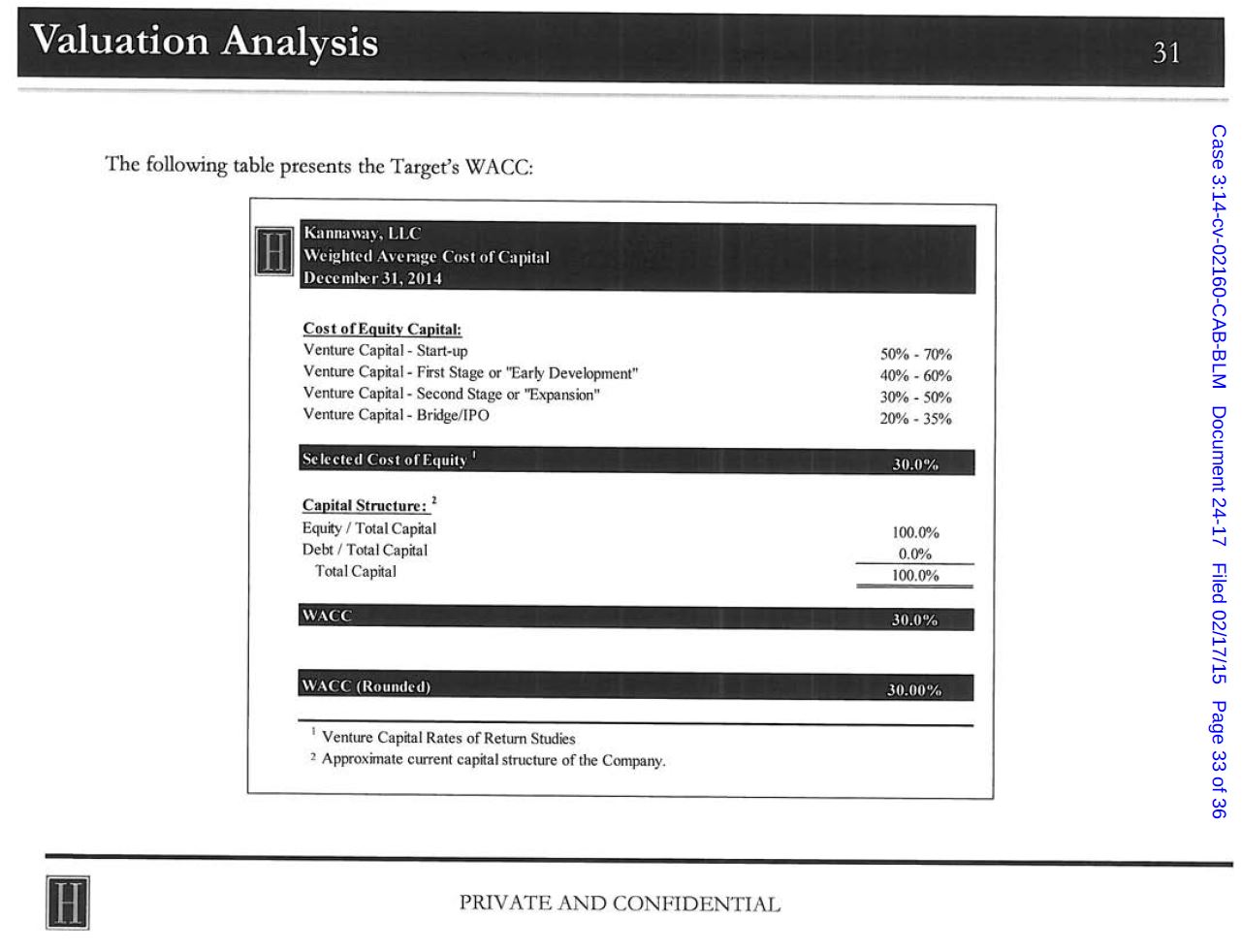

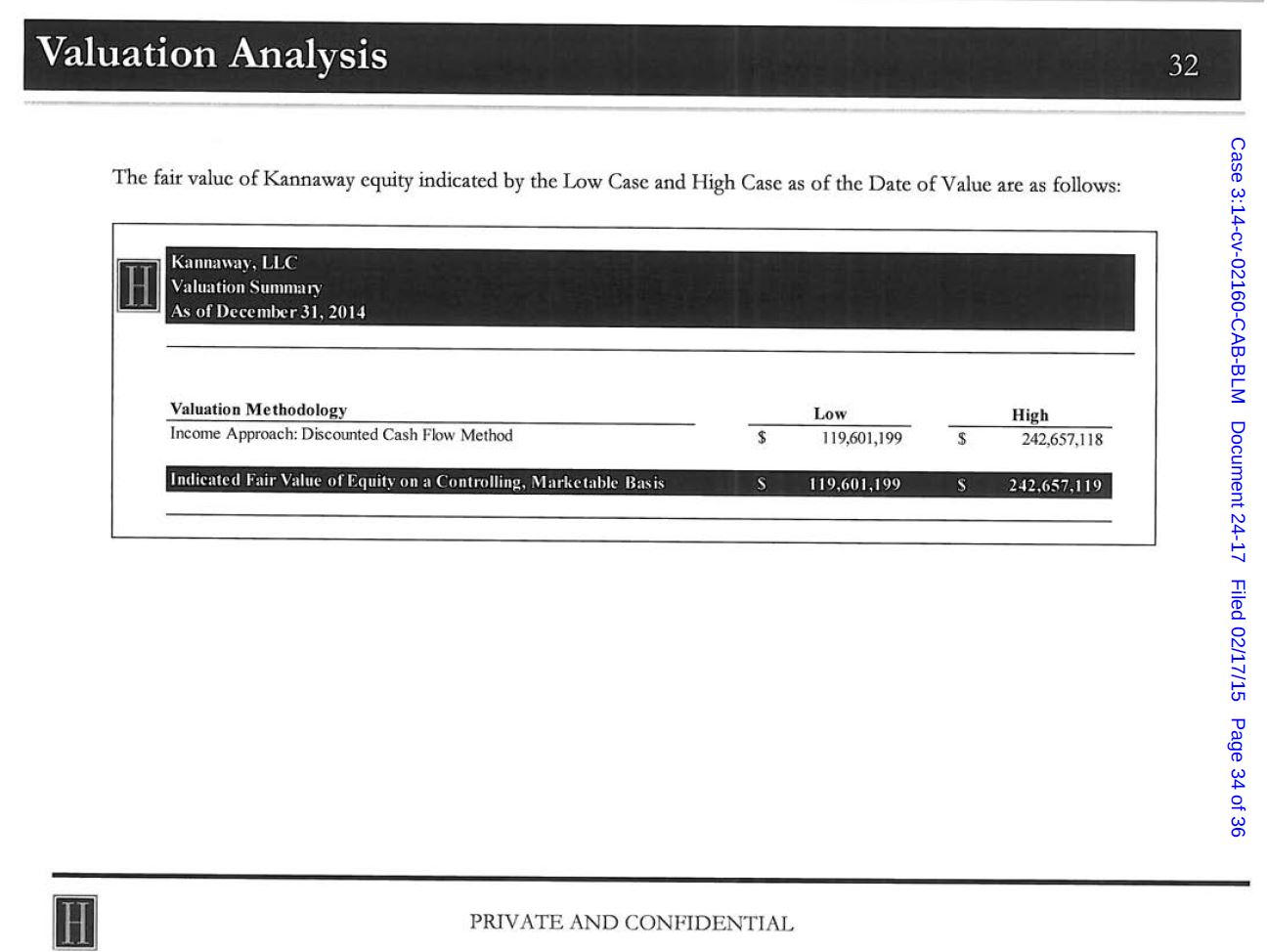

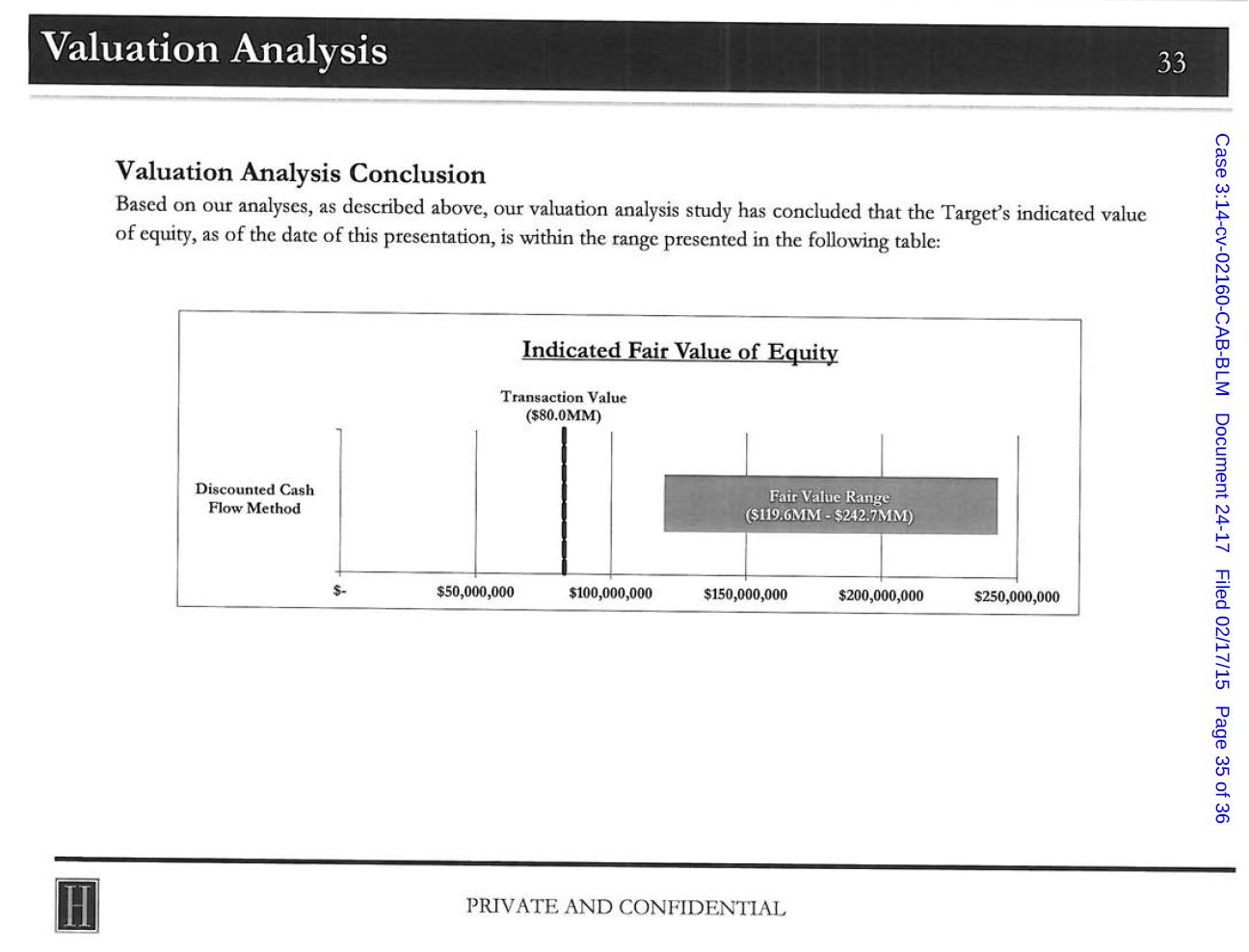

5 weeks ago, MJNA announced that it was buying Kannaway, the MLM that distributes some of its products. The press release, which didn't detail the terms of the transaction, alluded to a valuation analysis performed by Houlihan Capital that suggested Kannaway is worth $120-$242mm, but it didn't share the assumptions that went into that analysis. My initial reaction was cautious: MJNA: It's What They Didn't Say About Kannaway That Should Make You Run Away.

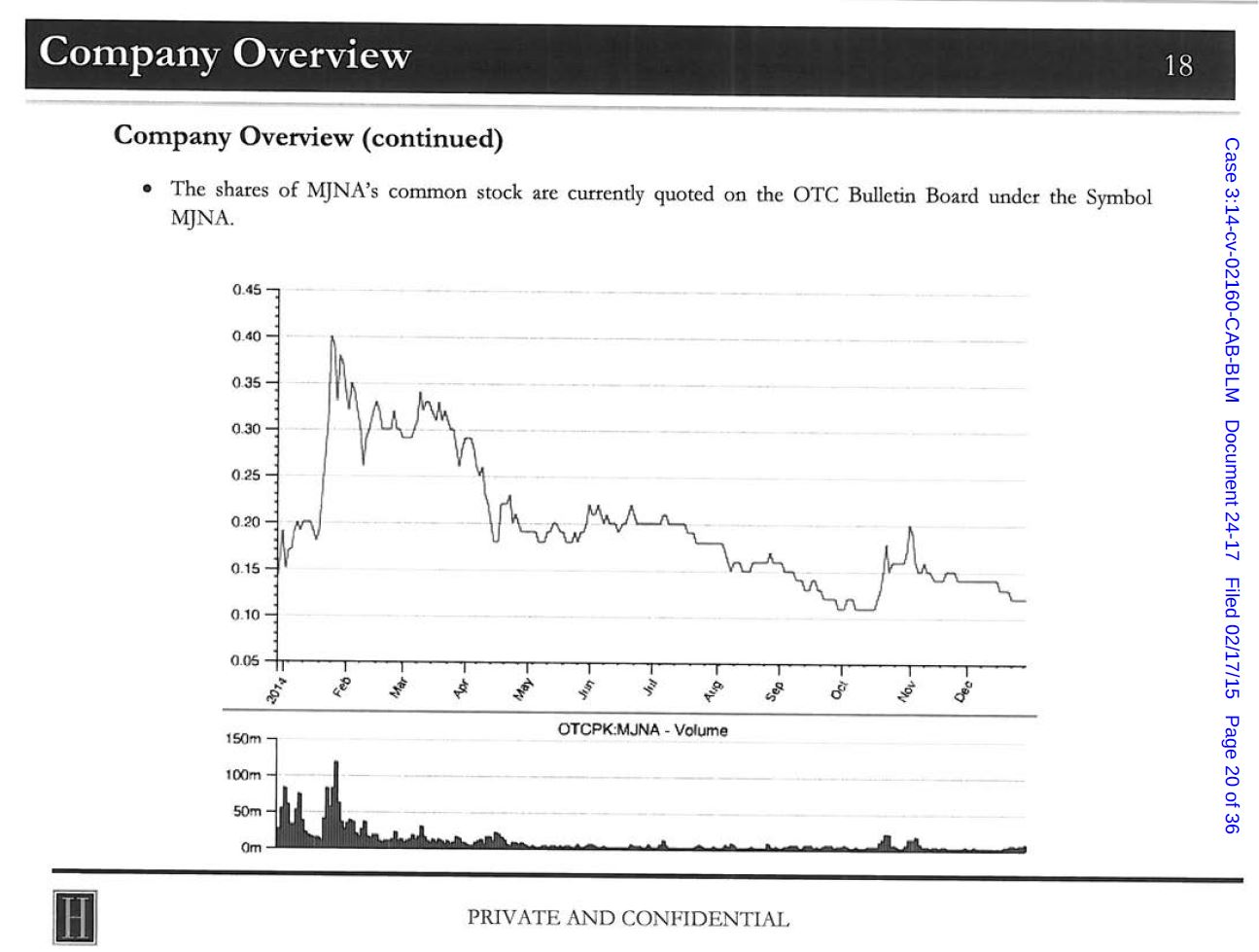

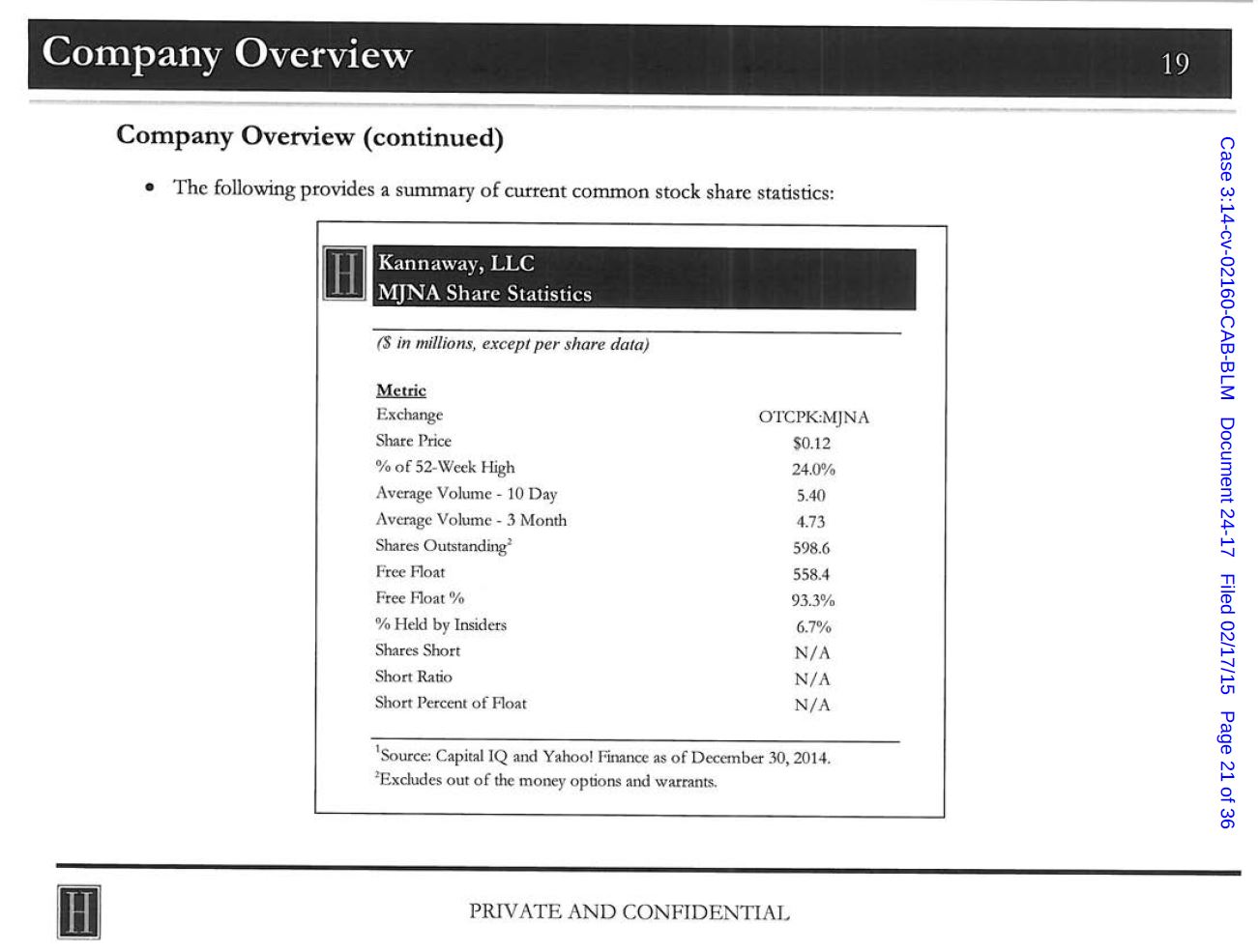

As a result of litigation between Kannaway and CannaVest, the valuation analysis is now in the public domain. Based on the current price of .11 for MJNA, it appears that the company will need to issue approximately 970mm shares (about 100% of the current outstanding shares) to complete the acquisition. The slides, posted below, indicate that the valuation analysis was based on inputs provided by management. My own review is that they seem outrageously high and unrealistic, not unlike the revenue projections MJNA provided publicly two years ago.

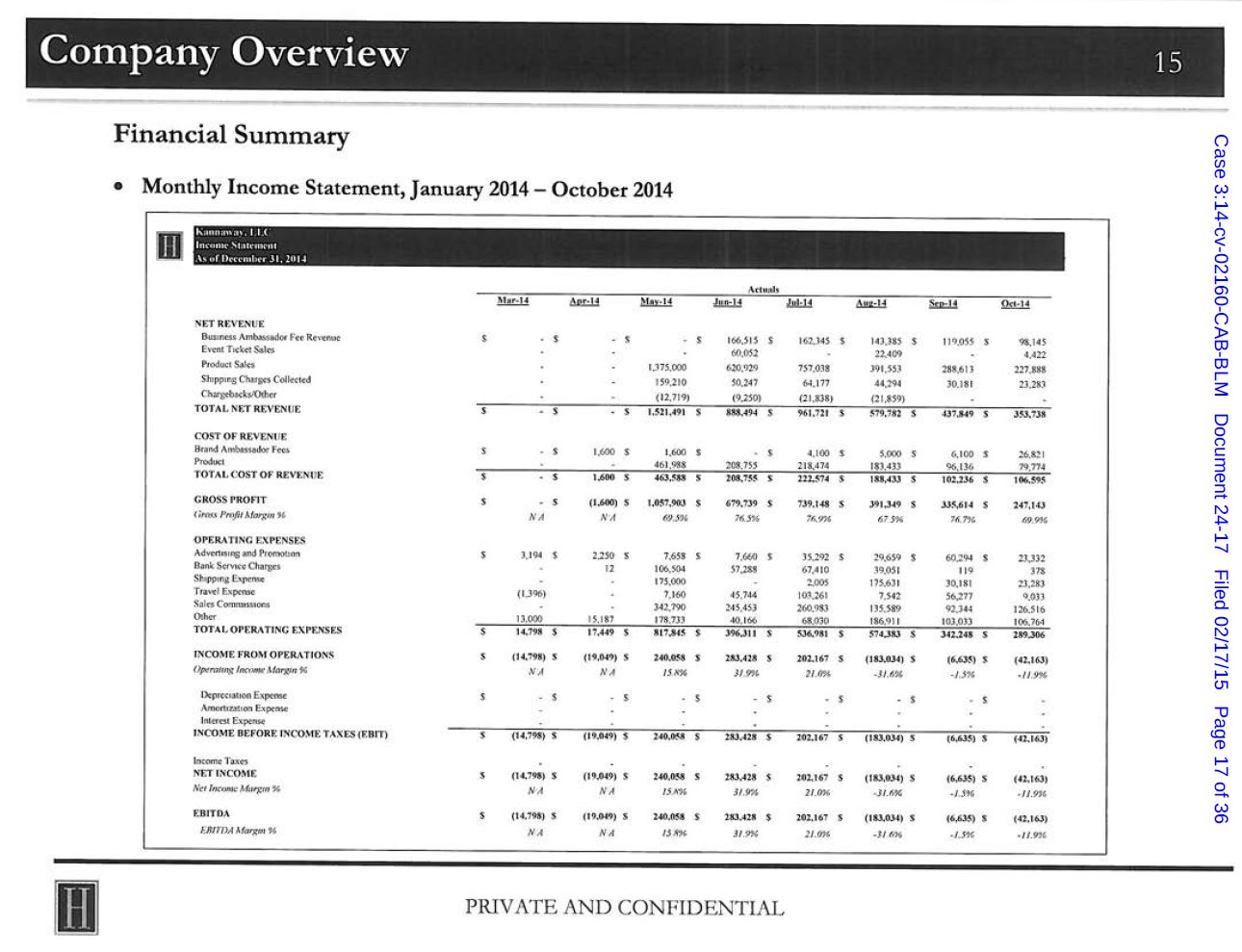

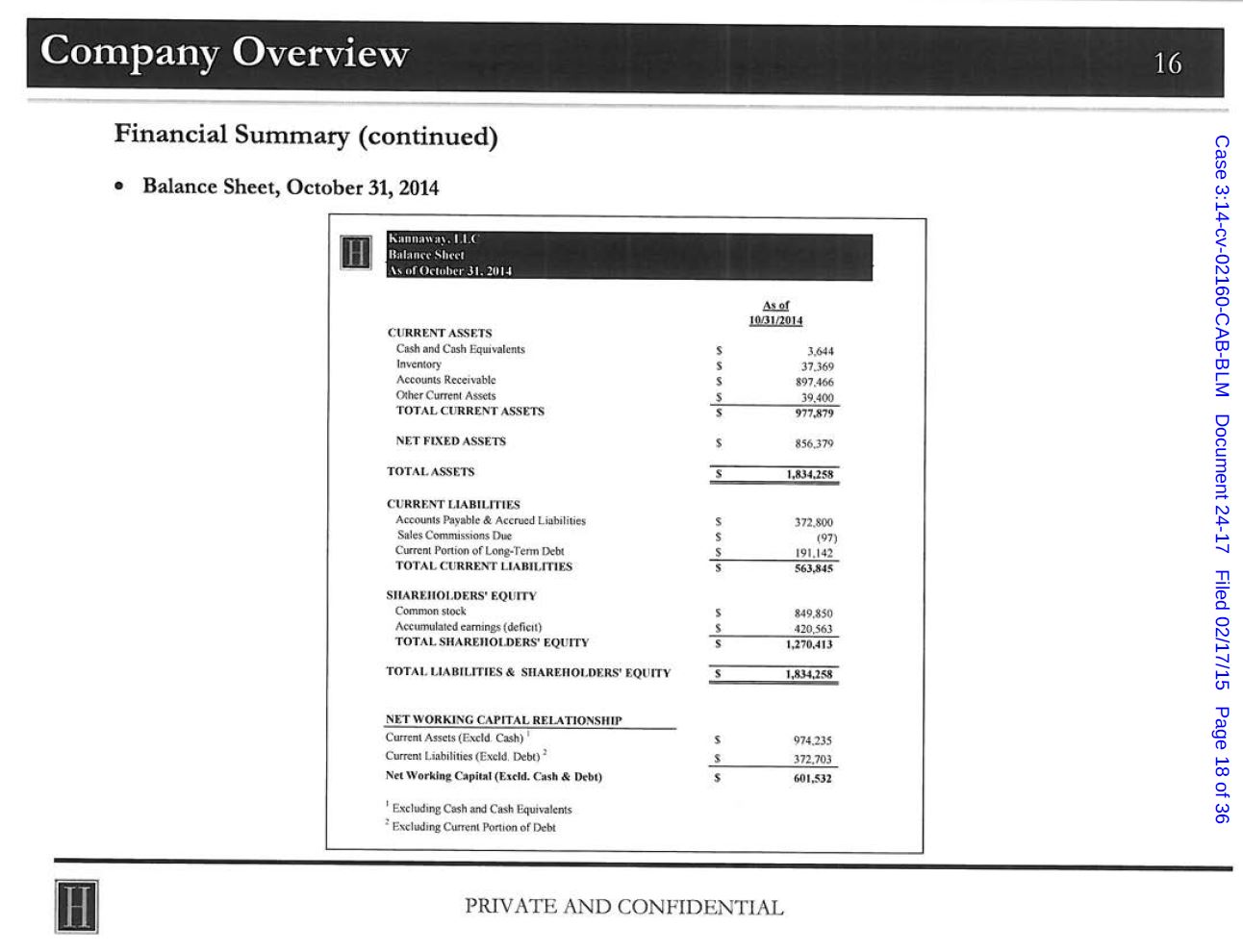

Alarmingly, the revenues have plunged since the launch of Kannaway (see Slide 15). The company booked revenue of $5.5mm for 2014 (8 months) and provided detail for May to October totaling $4.7mm. This implies that the last two months of the year of about $761K. For the last 2 quarters of 2014, then:

- Q3: $2.0mm

- Q4: $1.1mm

This is NOT a growing enterprise!

Garbage in, garbage out...

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22