The market was very volatile this past week. But, we were patient on our trades and had another profitable week. My Ecstatic Plays portfolio is now up +116.6%!

Our puts on BIDU and V added to our portfolio and were more than enough to offset the losses that we took on DWA calls:

| Sell to close 10.00 (3.27%) of BIDU Oct 18 2014 Put 205.0 at 6.80000 | 33.33% ($1,700.00) Profit |

| Sell to close 10.00 (5.74%) of BIDU Oct 18 2014 Put 217.5 at 12.20000 | 75.54% ($5,250.00) Profit |

| Sell to close 10.00 (4.78%) of BIDU Oct 18 2014 Put 217.5 at 9.80000 | 41.01% ($2,850.00) Profit |

| Sell to close 20.00 (3.43%) of V Oct 18 2014 Put 210.0 at 3.50000 | 54.19% ($2,460.00) Profit |

| Sell to close 10.00 (1.79%) of V Oct 18 2014 Put 210.0 at 3.60000 | 58.59% ($1,330.00) Profit |

| Sell to close 25.00 (0.19%) of DWA Oct 18 2014 Call 26.0 at 0.15000 | -92.86% ($-4,875.00) Loss |

| Sell to close 25.00 (0.69%) of DWA Oct 18 2014 Call 26.0 at 0.50000 | -76.19% ($-4,000.00) Loss |

| Sell to close 5.00 (0.64%) of BIDU Oct 18 2014 Put 215.0 at 2.50000 | -64.29% ($-2,250.00) Loss |

On Monday, the market was basically flat. By Tuesday afternoon, selling pressure had picked up. Wednesday saw a big bounce as buyers rushed in after Fed's dovish comments. But, the bullishness did not last. The selling returned on Thursday, which ran into Friday. Techs were heavily hit as semiconductors were really weak after MU reported weak demand from China.

For the week, the Dow was down 645.59 points; SPX fell 61.77 points; Nasdaq tumbled 199.39 points. Oil had another big down week; WTI is now below $85/barrel. Gold got a nice bounce, trading around $1233/ounce. At the time of this writing, Asian markets were down. Here's where the US markets closed on Friday:

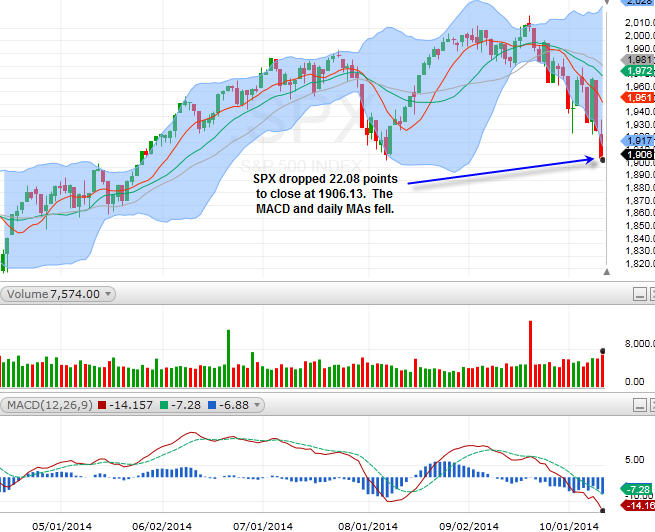

SPX

SPX dropped 22.08 points to close at 1906.13. The MACD and daily MAs fell.

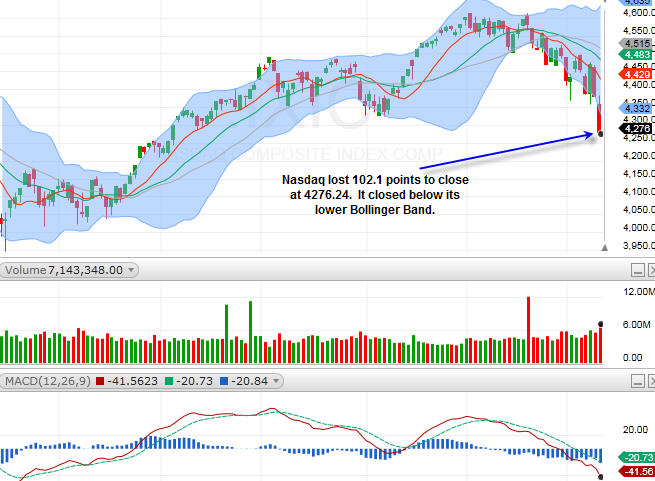

Nasdaq

Nasdaq lost 102.1 points to close at 4276.24. It closed below its lower Bollinger Band.

All three major market indices took a big drop on Friday. SPX was pretty much testing its August low, while Nasdaq penetrated below its respective mark. For the new week, some big bellwether stocks are going to report. We start out on Tuesday morning with C, JPM, and WFC:

Tuesday: (AM) C, JPM, WFC; (PM) CSX, INTC, LLTC

Wednesday: (AM) ASML, BLK, BAC, PNC; (PM) AXP, EBAY, LVS, NFLX, NE

Thursday: (AM) BHI, CY, GS, OSTK, PPG, TSM, TZOO; (PM) COF, AMD, GOOG, SNDK, SYK, XLNX

Friday: BK, KSU

Most sectors experienced sharp falls last week. Financials will be very important, especially their earnings. Biotechs could see more selling to catch up to the broader market. Below 1900, SPX has support at 1880. Nasdaq has support at 4240.

Sector Watch

GLD (gold)

GLD is trying to draw a base. We could see it challenging $119-$120 next week.

BTK (biotech)

BTK is still holding on quite well. Comparing to the broader market, biotechs still have a lot of room for pullbacks. Let's keep an eye on this sector: BIIB, CELG, GILD, ILMN, JAZZ, MDVN, BMRN.

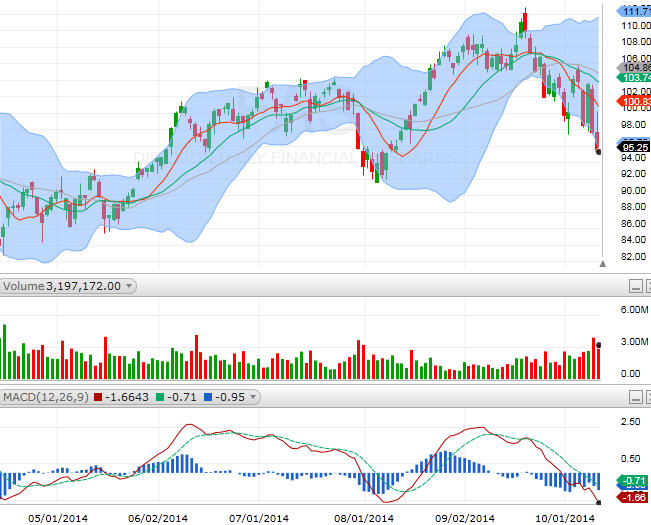

FAS (financial)

Earnings will be very important this week: C, WFC, JPM, GS, BLK, PNC, COF, BK, BAC. If the earnings are strong, we could see some bounces.

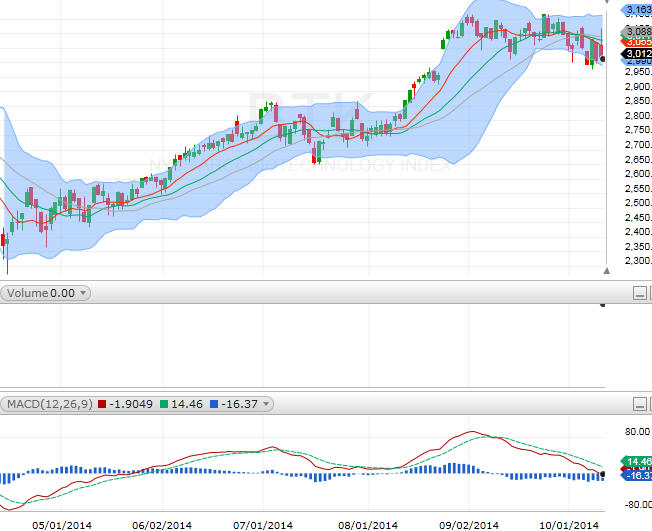

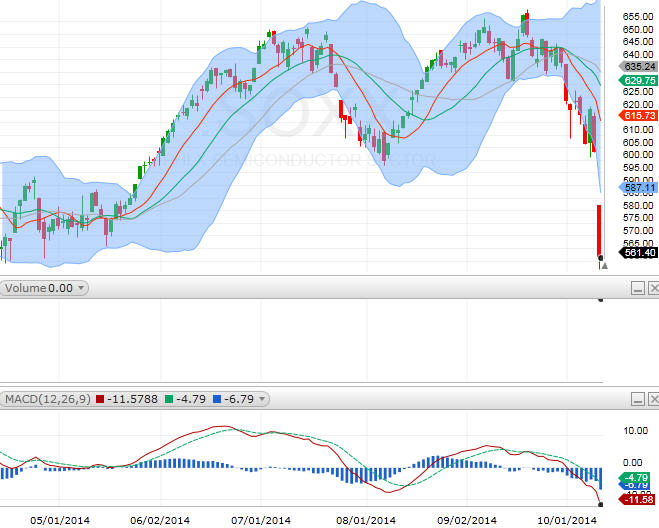

SOXX (semiconductor)

Semiconductors took a huge drop on Friday. Among others, INTC, ASML, XLNX, and CY will report in the coming week. After Friday's big pullback, we will have to evaluate each stock separately ahead of its earnings. But, overall, this sector is very weak.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Stocks Ready For A Bounce

— 7/07/22

Stocks Ready For A Bounce

— 7/07/22

-

Two Quick Trades: FB, GME

— 5/12/22

Two Quick Trades: FB, GME

— 5/12/22

-

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

-

(Much) More Downside to Come?

— 5/11/22

(Much) More Downside to Come?

— 5/11/22

-

Is Gold A Safe Haven Again? GLD

— 2/09/16

Is Gold A Safe Haven Again? GLD

— 2/09/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member