MJNA is tanking hard. Beyond stop-losses being triggered, there are many potential fundamental reasons - weak Q3 results, the CANV dilution, the product safety accusations and the SEC inquiry (as of June 17th and disclosed in August through the OTC disclosure statement). It is the latter where I would like to share my thoughts.

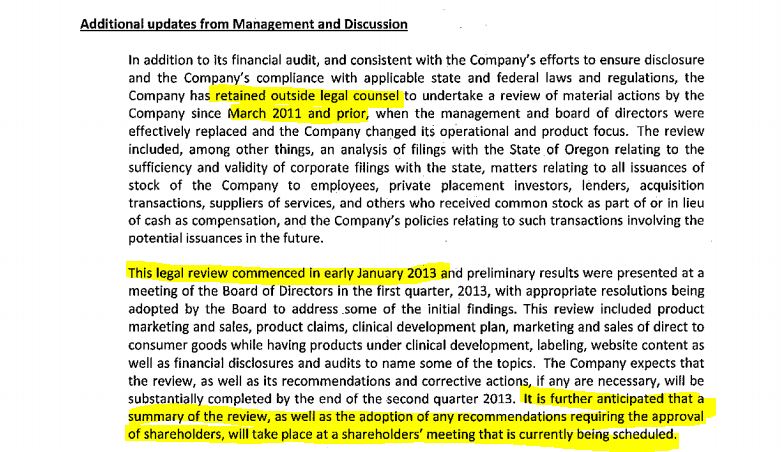

MJNA first announced its own internal investigation earlier this year. It began in January, as was disclosed in the Q1 filing (note that this should have been disclosed as a subsequent event in the annual report and wasn't). Keep in mind that every single director at that time has left the board with the exception of Michelle Sides, the Chairman and COO (rather alarming). Here is what was disclosed:

This was not repeated in the Q2 filing , though the company stated that it had made corrections to its articles of incorporation in Oregon, and the Q3 disclosure statement made no reference to it either. My take was that the company uncovered a lot of problematic issues related to pre-CannaBank (i.e Perlowin). Note that there has never been a summary of the review, nor has this elusive shareholders' meeting every been scheduled.

So, my take was that the SEC might be inquiring about these issues. Alternatively, the way that MJNA misrepresented the CannaVest deal (both in its Q4 report, when it accounted improperly as well as in the press release from February discussing sales guidance and operating income guidance for 2013). A final and more damaging possibility (though I am sure that the alternatives go beyond the three that I am discussing) is that the whole transfer of the company in 2011 may be the issue. CannaBank (then known as Hemp Deposit and Distribution Corp, or HDDC) was supposed to transfer assets to MJNA, but this never happened.

The 2011-Q2 disclosure discusses the asset/equity swap. My review of what followed suggests that the income-producing assets weren't actually transferred. There were press releases that discussed some of these assets, but they never appeared on the balance sheet, and the income-to-date surely indicates a short-fall from what was described. CannaBank ended up with 260mm shares (and subsequently more shares, as they now hold 411mm shares) for what?

A quick review of the 2011 press releases reads like fiction. Here are some excerpts:

FOOTHILL RANCH, CA--(Marketwire - March 24, 2011) - Medical Marijuana Inc (PINKSHEETS: MJNA) has completed an agreement with the Hemp Deposit Distribution Corp (HDDC), a Delaware based Co., d/b/a CannaBANK. This agreement calls for shares of MJNA to be issued to HDDC in exchange for assets which include real estate, Intellectual Properties, patents and future acquisitions.

SAN DIEGO, CA--(Marketwire - March 29, 2011) - Medical Marijuana, Inc. (PINKSHEETS: MJNA) is proud to announce that it has received an initial asset as well as a management contract transferred from the Hemp Deposit & Distribution Corp (HDDC), d/b/a CannaBANK, Inc. MJNA benefits directly by receiving the debt-free income producing property from HDDC. CannaBANK anticipates this landmark facility to generate in excess of $40 million in revenue annually. MJNA Management stated that the transfer will be immediately accretive to earnings.

SAN DIEGO, CA--(Marketwire - March 31, 2011) - Medical Marijuana, Inc. (PINKSHEETS: MJNA) is proud to announce that it has been assigned a second asset and management contract from CannaBANK. This second debt-free, income producing asset transferred from the Hemp Deposit & Distribution Corp. (HDDC) d/b/a CannaBANK, Inc. services the needs of health and wellness members in the greater Sacramento area. HDDC purchased the facility and invested an additional amount in excess of $750,000 to bring the facility up to CannaBANK standards. The facility is estimated to generate in excess of $4 million in net profits annually. The facility has been fully operational since January 1, 2011. Operations Director Jordanne Brenkwitz stated, "CannaBANK estimates the creation of 28 new, regional positions and anticipates another 23 to be created during the following two years. The transition has allowed the proprietary concepts that MJNA has been incubating to manifest through the power of CannaBANK."

SAN DIEGO, CA--(Marketwire - March 29, 2011) - Medical Marijuana, Inc. (PINKSHEETS: MJNA) is proud to announce that it has received an initial asset as well as a management contract transferred from the Hemp Deposit & Distribution Corp (HDDC), d/b/a CannaBANK, Inc. MJNA benefits directly by receiving the debt-free income producing property from HDDC. CannaBANK anticipates this landmark facility to generate in excess of $40 million in revenue annually. MJNA Management stated that the transfer will be immediately accretive to earnings.

MJNA will not be the sole beneficiary, however. CannaBANK's new operations at the property will create 115 new on-site jobs. MJNA also intends to contribute 10% of the facility's profits to the Our World Health Organization (OWHO), a non-profit organization which will join MJNA in spreading the message of better living through herbal remedies, effectively changing the world -- one mind at a time.

SAN DIEGO, CA--(Marketwire - May 10, 2011) - Medical Marijuana Inc (PINKSHEETS: MJNA) today received additional assets transferred by CannaBANK™. These assets include CannaBANK's interest in a Riverside County facility containing 10,000 sq feet of facility space. Twenty acres of land are also included in the transfer and plans are in place to add an additional 10,000 sq feet of facility space in the near future. The new 20,000 sq feet of facility space will be the recipient of additional asset transfers, described below.

CannaBANK™ has further announced the transfer of working equipment for the San Bernardino facility in excess of $350,000. The facility will soon be operational and details will be released in the near future. The San Bernardino facility will be a fully functional Wellness Center in the CannaBANK™ domain and will serve critically ill patients.

SAN DIEGO, CA--(Marketwire - May 16, 2011) - Medical Marijuana Inc is proud to announce that CannaBANK™'s patent pending CBD (Cannabidiol) extraction process will allow for direct infusion of the health and wellness benefits providing CBD's into three new bottled water enhanced beverages. This technology will be used by Medical Marijuana Inc (PINKSHEETS: MJNA) to bottle and distribute these beverages in the world beverage marketplace. Medical Marijuana Inc is reviewing several bids for the distribution rights in Latin America as well as the United States. Bottled drinking water market alone exceeds 8.7 billion gallons (wholesale market $11.2 billion) in the USA and is close approaching the Carbonated Soft Drink market in terms of annual sales. Source: www.bottledwater.org (2008 figures).

SAN DIEGO, CA--(Marketwire - Jun 2, 2011) - Medical Marijuana Inc (PINKSHEETS: MJNA) announced today that additional bidders have presented offers for rights to the distribution of Medical Marijuana Inc's revolutionary THC-free water products.

One offer being considered is brought in by BullnBear Group, S.A. for Central American distribution rights. This involves a $22.5 million up-front payment to Medical Marijuana Inc (PINKSHEETS: MJNA) on a 10 year distribution agreement plus an 18% back-end royalty as a percentage from sales.

Several other offers for US marketing rights have been presented from a variety of distribution companies, including one that services 77,000 stores worldwide. Terms of offers are still being finalized. In addition to these US and Central American bidders, Medical Marijuana Inc is in the process of reviewing offers from Europe, Asia and Southeast Asia for similar distribution rights. These distribution rights will include the rights to four separate beverages being produced by Medical Marijuana Inc, all within the THC-free line.

SAN DIEGO, CA--(Marketwire - Jun 9, 2011) - Medical Marijuana Inc (PINKSHEETS: MJNA) and CannaBANK™ are proud to announce the signing of a managed services contract with a California-based cooperative of 7,200+ qualified patient members. The facility management service program focuses on compliance solutions to local ordinances, state laws and tax issues as well as Medical Marijuana Inc's tracking system which features a seed-to-end-user closed loop, ensuring full compliance while dissuading diversion. Also included in the services contract is Medical Marijuana Inc's proprietary tax remittance card service that allows for the payment of all municipal use taxes. The tax payments may be settled on a scheduled basis. Officials at both MJNA and CannaBANK™ concurred: "This contract marks a milestone for Medical Marijuana Inc, bringing months of exhaustive research and program development to fruition. Each patient member can rest assured that they are receiving the highest degree of care and compliance under existing guidelines. Furthermore, the facility will undergo an extensive training program allowing integration of all aspects of back-end management and patient tracking services."

SAN DIEGO, CA--(Marketwire - Jun 13, 2011) - Medical Marijuana Inc (PINKSHEETS: MJNA) is pleased to announce completion of a draft for a preliminary petition to the Federal Government to obtain a DEA sanctioned License to cultivate marijuana for medicinal purposes. In the US there are now 15 States which recognize the medicinal benefits of marijuana and cannabis related products (containing THC, the psycho-active ingredient) for various medical uses. Connecticut may soon be the 16th State to approve medical marijuana.

If the SEC is looking, it would seem that there is plenty about which to inquire...

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member