THE WEEKEND REPORT

Table of Contents:

1) History tells us that the first down leg of a bear market is not the worst part of the “bear.”

2) High inflation always leads to recessions…which always leads to earnings declines.

3) Who cares if we’re in a recession yet or not? The data is pointing to a further significant slowdown.

4) Actually, the Fed usually DOES do what they say they’re going to do. (They’re just wrong a lot.)

5) Updated charts on the S&P 500, the NDX 100, the SMH and the HYG. (They don’t look good.)

6) Goldilocks, schmoldilocks….The employment report will not raise the odds of an early Fed pivot.

7) Can gold finally see a bounce that lasts for more than just a few days?

8) AAPL sits at a VERY important juncture on the technical side of things

9) A very smart and even-handed view of the upcoming mid-term elections. (I didn’t write it. 😊)

10) Summary of our current stance.

1) History tells us that the first down leg of a bear market is not the worst part of the “bear.” It’s when the second leg develops (or sometimes, the third leg) that things get ugly. That’s when the biggest downgrades in economic growth and earnings growth take place. It’s also when the “naked swimmers” (investors) get exposed…and when poorly run companies get exposed as well. Therefore, the September/October timeframe could indeed be an ugly one this year.

A couple of weeks ago…when the S&P 500 was testing its 200-DMA to the upside…A LOT of pundits were saying that there was very little chance that the stock market would rollover and retest its June lows. In fact, even when the stock market initially started rolling-over from that key moving average, pretty much all of those bulls were still saying the same thing.

They don’t seem to be as confident about this now…as they did in mid-August…for good reason. Chairman Powell has confirmed what his colleagues on the Fed have been saying for several weeks…that they’re not going to pivot any time soon. This has caused long-term interest rates to rise significantly…and the stock market to decline in a material way. The 10yr yield is now 24% above its summer lows (at 3.19%)…and the S&P 500 has retraced almost 2/3 of it summer rally.

Of course, we said consistently throughout the summer that what we were experiencing was only a “bear market rally”…and that it would roll-over as we moved towards the fall months. The market did rally for longer…and pushed higher…than we though it would…but it does seem to be rolling over in a meaningful way right now.

If we are correct…and we see some more downside follow-through to the recent decline before too long…we believe that the decline will not end with just a “retest” of the June lows. Instead, it will likely involve an undercut of that low…and it will probably be a significant undercut. The reason for this is that history tells us that when the second leg lower takes place, THAT’S when we find out just how bad things really have become.

First of all, on the fundamental side of things, we all know that the stock market usually tops-out 6-9 months before the economy falls into a recession. Therefore, as the economy weakens in a more meaningful way, THAT’S when earnings growth starts to fall in a more substantially. (It takes time for certain things like interest rate hikes to negatively impact the economy and earnings.)

As investors come to understand that the fundamentals are going to deteriorate (further) in a significant way, they also begin to understand that the stock market’s valuation level is higher (more overvalued) than they realized. This is takes place…EVEN after the market has already fallen quite a bit (in the first leg of the decline). In other words, investors do know that things are weakening, but history tell us that it’s only when we are later in the process…usually in the second leg of the bear market…that they come to realize just how deep the down turn will be over time. This, in turn, causes them to pull away from the stock market further than they already had during the first leg of the decline…which causes the market to see another outsized decline.

However, the process doesn’t end there. There are a few other areas that create problems for the market during the “second leg” of decline. Again, when the first leg of a bear market comes to an end, a lot of damage has already been done, BUT many of the biggest problems have not been pushed to the surface yet during that “first leg.”…….These “problems” fall into several categories. For instance, there are always some companies who have run into some substantial head winds in the “first leg,” but they are still able to keep their heads above water. When the second leg hits, the full extent of the downturn becomes much more evident…and these companies fall on much harder times. This means that earnings growth will have to come down for many companies…which we have already highlighted. (The average earnings decline during a recession is 20%.) However, it also means that it becomes evident that some companies will have a tough time surviving. (We read this weekend that 5,000 internet companies went bankrupt when the tech bubble burst.)….THAT is when things really start to get rough!

In other cases, the “second leg” exposes many leveraged investors…who run into even bigger problems than they did in the “first leg.” Yes, many of those leverage investors had probably already been forced to unwind SOME of their leverage bets, but have been able to avoid a major liquidation move. However, when the next big decline hits, the situation gets SO bad, that they are forced to liquidate their portfolios. (“Liquidating portfolios” is different than simply closing their doors and returning the money. It involves “forced selling” into declining markets…and it causes the decline to snowball as it feeds on itself.)….In the MIDDLE of the bear market that took place when the tech bubble burst, almost 2,000 hedge funds had closed their doors. Many more would do the same before it was over.

Of course, we also frequently see a wave of unscrupulous market participants or companies have been flat out breaking the law…which are exposed to the public. This can also cause more forced selling…and it certainly takes away investor confidence in a significant way. When these “second waves” develop, it creates a situation where these people can (or, in some cases, the crimes they are committing). WorldCom, Enron and Bernie Madoff come to mind as examples of what we’re talking about.

So as you can see, when the second leg of a bear market hits that fan, THAT’S when the big problems take place. We could use the example of Lehman Brothers…and the collapse they saw during the second leg of the bear market during the Great Financial Crisis, but we always have to be careful about making comparisons to that particular bear market. However, it IS another example of how the situation gets worse in the second wave of selling in a bear market.

With this in mind, we believe investors should use any bounces along the way to raise cash and get more defensive once again. We have highlighted how the bear markets of 2000-2003 and 2007-2009 both retraced just over 50% of their “first legs”…before they rolled over in a major way. Well, as we have just highlighted, there is a reason why the second leg tends to be a very difficult one as well. Therefore, we should be very careful about buy dips…given that the market has once again rolled-over in a big way following a 50% retracement of the “first leg” of the decline.

2) Every time (at least since WWII) we get a serious period of inflation, it has always been followed by a recession. Every recession since WWII has given us a decline in earnings. In other words, first comes inflation…and then comes the recession and a decline in earnings. Therefore, even if the worst of inflation is behind us, the worst of the economic slowdown and the worst of a decline in earnings is likely in front of us. This means that that the ultimate low for this bear market are likely in front of us as well.

We believe that people need to stop worrying so much about inflation and start worrying about a recession…and what a recession will mean for the stock market. Don’t get us wrong, inflation WILL continue to be a problem…and will likely remain elevated for a longer period of time than the bulls think it will. However, we have to remember that the real issue when it comes to the stock market is not inflation itself. It’s the problems that inflation create!

Inflation creates lower margins for companies. Then, it creates higher interest rates (in order to tame inflation). THEN, those higher interest rates…which are needed to help fight inflation…cause the economy to slow and sales to decline (at even lower margins)…and the whole thing snowballs into a recession…not just a mild recession…and certainly not a soft landing. (Okay, okay…the fact that inflation creates these problems DOES make it a very important issue…but you get what we’re trying to say.)

In other words, the strong inflation we have experience for a long time now…is pretty much going to expose that the stock market is still trading at a level that leaves it well above what its underlying fundamentals would justify. When interest rates are at 4%, 17x-18x earnings is not going to be fair value for the stock market. When earnings fall to $210…$200…or even lower…whatever multiple you want to choose as fair value will come-in at a level on the S&P 500 that is much lower than where that index is trading today.

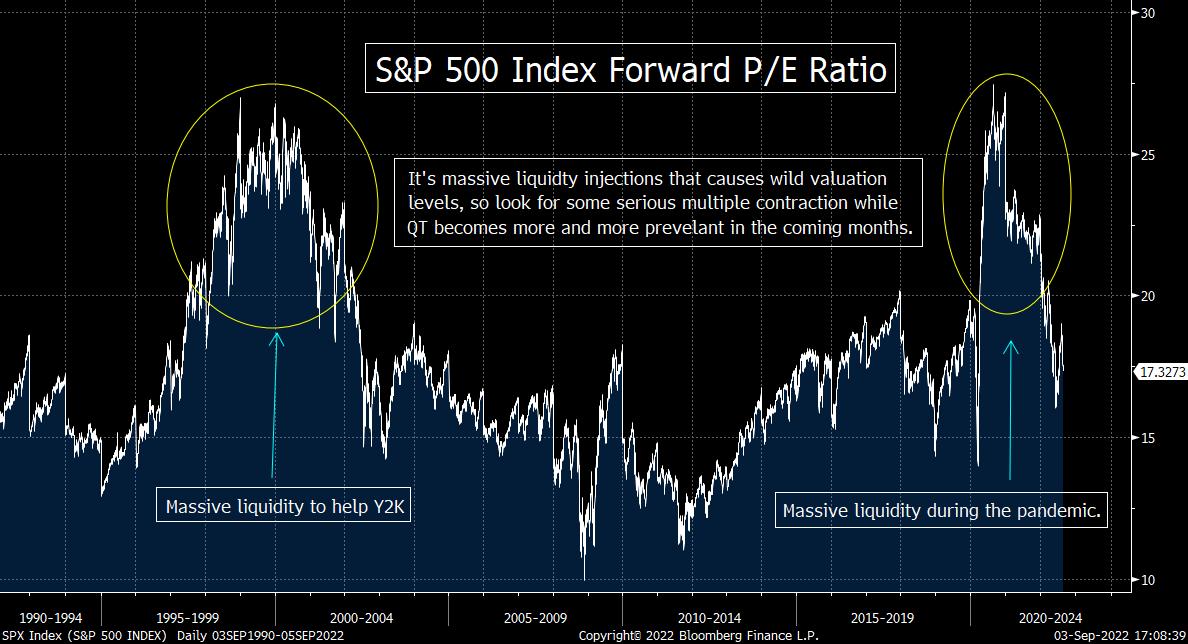

What would be the correct level of valuation at 4% yields…and what level would the stock market reach if earnings to indeed fall in a meaningful way? Well, let’s start with level of yields. When long-term yields were at 4% in 2005, the S&P traded at less than 15x earnings. (The same was true in 2008 and 2010.) Also, as we highlighted a week ago, if you take away the two times where the central banks flooded the system with liquidity in the late 1990s and during the pandemic…and thus skewed the historical average multiple…that average multiple is actually 15.5x. (We did not exclude times when the stock market’s multiple rose to very high levels on its ownin our calculations.) So, we have a long way to go before the market is really considered to be at fair value on a historical basis.

As for the level of the stock market would slump to if earnings do indeed fall like they always do in a recession, we’d point out that even if we were a little generous…and said that 16x earnings was a good multiple to use, the S&P would have to fall to 3,350 if the total earnings for the S&P 500 dropped to $210…and 3,200 if the earnings tumbled to $200…..Of course, every bear market since WWII has not stopped at “fairly” valued. It has always fallen to an undervalued level before it bottomed, so these statistics paint a very rough picture for the stock market going forward.

Of course, nothing is set in stone. The war in Ukraine could suddenly come to an end. That would have a very positive impact on the supply part of the inflation problem. Also, maybe a high level of demand destruction will magically cause the supply induced inflation problems (which has been the main source of this higher inflation) to disappear…even though that has never happened before………..In other words, a soft land is possible, but it is not probable at all.

We’re not really sure why a lot of pundits believe that demand can be destroyed enough to tame inflation…but not be damaging enough to cause the economy to slow in a serious enough manner…which will knock earnings down in a serious way…and thus expose the stock market as (still) being very expensive. They’re trying to have their cake and eat it too…and that’s going that’s going to be EXTREMELY difficult to achieve if the sanctions on Russia remain in place (and thus food & energy prices remain at an elevated levels).

3) We continue to see signs that the economy will slow enough to force earnings estimates to come down for the second half of 2022 and for 2023 in the not-too distant future. Are we in a recession or not?....Who cares! Whenever “they” decide it officially started, it will only be in hindsight…and it will be worthless information by then. The fact that the economy continues to show signs of slowing is enough for us to be a lot more cautious than the consensus on Wall Street right now.

We hear some people debating whether we’re in a recession yet or not. To be honest, we really don’t care. The official dates for when it began and when it will end will be decided long after it matters. However, there is no question that growth has been slowing this year. Whether it be the IMF, the World Bank, or basically all of the Wall Street firms…they’ve all been cutting growth estimates for the U.S. and the globe all year. More importantly, there continue to be signs that growth will slow further. As that happens, it should finally lead to a meaningful decline in consensus estimates for earnings.

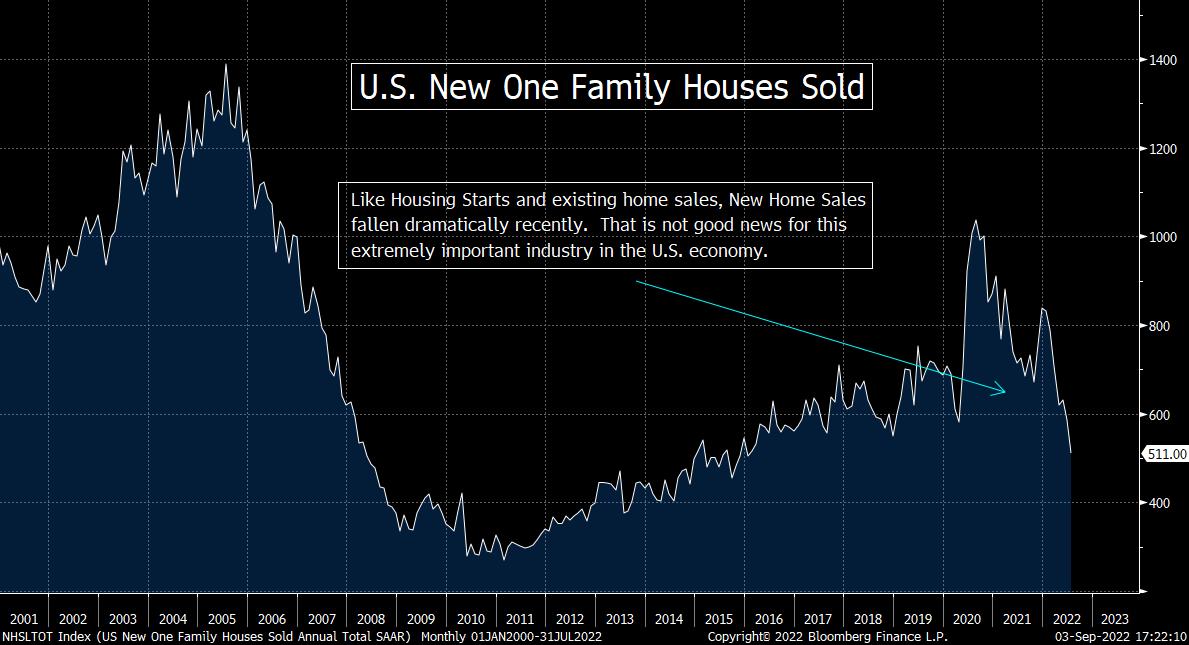

Probably the biggest problem is the sharp decline in real wages. Sure, some people pointed to the slightly lower-than-expected hour earnings growth in the employment report as a reason to be bullish about the employment situation. Well, that’s great, but real wages have been falling all year. In fact, as you can see from the chart below, they have fallen out of bed….We’ve also seen the housing market soften in a meaningful manner. Housing starts, existing home sales and new home sales have fallen significantly. (New Home Sales chart is below as well.) With mortgage rates climbing to back near their highest levels since 2008, this incredibly important industry to the U.S. economy will continue to face more headwinds….On top of this, the Baltic Dry Index has fallen to its lowest level since the pandemic…and even though the yield curve has steepened somewhat, you still have to go back to the 2000 to find a more inverted one than today.

Our biggest concern with this trend is that demand destruction can only do so much to curtail inflation. As we have highlighted in the past, it would have taken Volcker much longer to tame inflation 40 years ago if it had not been for the Iran/Iraq War. Those countries broke ranks with OPEC back in the early 1980s because they had to pay for their war. Therefore, the started flooding the world with oil…and oil price came falling back to earth. If the sanctions against Russia remain in place, inflationary pressures will take more than a few months to have the kind of dramatic decline that some people are looking for over the next 4-6 months.

With this in mind, we believe that even as we move into a recession, the Fed will not be panicked into pivoting as quickly as the bulls believe today. (BTW, going from 75 basis point hikes down to 50 basis point hikes is NOT pivoting!) Therefore, as the economy continues to slow, the concerns we highlighted above about valuation levels will come into focus for many investors. In our opinion, this will become even more relevant to investors when they see the impact of the Fed’s QT program…which will shrink the balance sheet much more aggressively in the months ahead.

4) Despite what many well respected pundits have said recently, the Fed DOES do what they say they’re going to do the vast majority of the time. Yes, sometimes they are wrong, BUT when they are wrong, they still take a lot of time to telegraph a change in policy. Therefore, if the Fed changes their stance, it’s unlikely to happen quickly.

We keep hearing people say that we cannot trust what the Fed says. These people are dead wrong. The vast majority of the time, the Fed DOES do what they say they’re going to do! Yes, in very late 2018/very early 2019, the Fed did indeed flip VERY quickly…and pivoted their policy from a tightening one to an accommodative one. However, that ONLY took place because the fixed income markets began to freeze up (led by the high yield market). Therefore, they had no choice but to shift quickly. (If we get some kind of extremely negative news, they’ll likely have to do it again.)

However, the Fed DID NOT change their policy quickly last year when they decided to start tightening their policy. Yes, they were wrong about inflation being transitory, but they did not pivot suddenly. They started laying the groundwork by August and September of last year…and gradually changed the narrative for the rest of the year. It wasn’t until late December that they confirmed that they were going to shift their policy to one of tightening one…and they didn’t start raising rates until March!

Therefore, they have done exactly what they told us they were going. Throughout much of 2021, they said they were going to keep the liquidity flood gates wide open…and that’s exactly what the did! When they finally decided to change this policy, they did in a VERY gradual manner….but when they finally DID change, they have done exactly what they told us they were going to do. A lot of people didn’t believe them when they said they were going to tighten in a significant way (and a lot of people fooled themselves into thinking their tightening move would not have a negative impact on the markets)…but nobody can say they changed their minds quickly. They also cannot say that the Fed has done something this year that was different than they told us they would do.

Of course, if the situation becomes an emergency, all bets are off. If the financial system starts to freeze up again…like it did in late 2018 and then again in March of 2020…they will indeed pivot VERY quickly. However, if it’s just a matter of the economy slowing enough to fall into a recession, their change in policy will take time. No, it won’t be as gradual as it was in when they switched to a tightening policy, but they have told us time and again that they will need several months of much better inflation data to get them to change their policy. Why do some many people disregard what the Fed is telling us what they’re going to do…when the facts actually tell us that they almost always DO exactly what they saying they’re going to do?

We believe that people are equating the fact that the Fed is wrong a lot…with the thought that the Fed pivots very quickly quite often. This just isn’t true. We DO agree that the Fed is wrong a lot (😊), but history tells us that unless they are faced with a crisis, they will go too far in one direction…and move too slowly to rectify the situation. Therefore, it is our opinion that those who are saying that the Fed will be wrong once again…are incorrect when they say that the Fed will act in time to avoid a recession and a meaningful decline in earnings going forward!

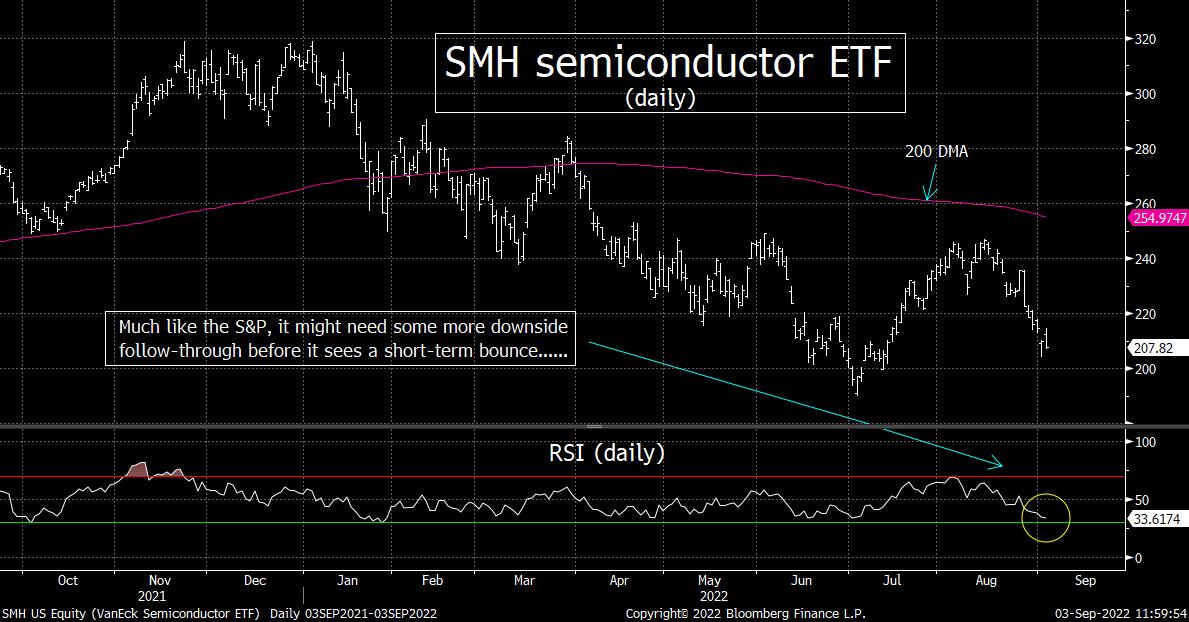

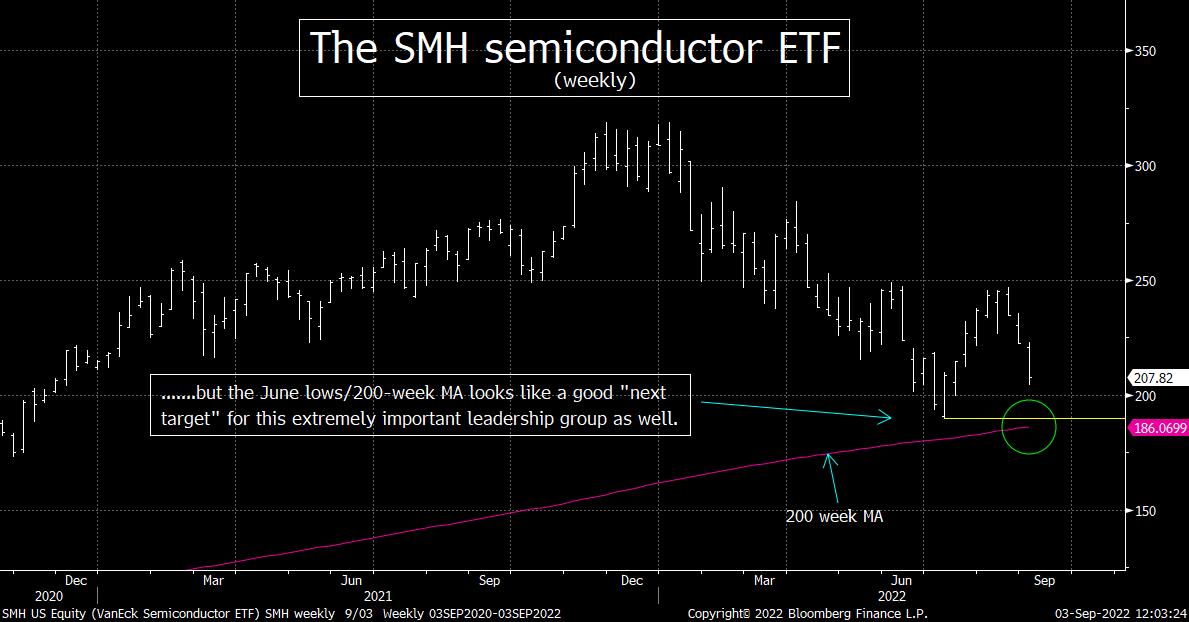

5) Let’s update the charts on the S&P, NDX, SMH and HYG. Friday’s intraday reversal to the downside might (repeat, MIGHT) cause some serious problems next week. However, all of these charts are approaching oversold levels. Therefore, we should see some sort of a short-term bounce soon. However, we believe the June lows on all of them will be retested…and likely breached…before the ultimate bottom is made in this bear market.

As we mentioned in our “Morning Comment” Friday morning, the stock market was approaching oversold levels late last week. Therefore, we were not surprised by the initial bounce in the market after the rather tame employment report came out. No, the market was not extremely oversold, but we thought it would take a very strong number to knock the market down further over the very-short-term. Sure enough, the market bounced nicely Friday morning after an only slightly strong headline number hit the tape.

However, when the news that the Nord Stream pipeline had been shut down again became public, the market rolled-over in a significant way. As Jeff Tabak pointed out to me, this reversal led to a weekly/Friday close on the NDX 100…right on its lows for the week…for the third week in a row!!! (The S&P 500 also closed very near its lows for the week…each of the past three weeks, but not right on its lows.)……As far as we can tell, that has not happened in the NDX in over the past 30 years (which is as far back as we looked)…not even during the 2000-2003 and 2007-2009 bear markets! (It did come somewhat close in late 2018, but the middle week only closed near its lows, not right on its lows for the week.)

This could cause some problems next week. Last weekend, we were coming off an 1,000 point decline in the DJIA on the Friday leading into the weekend. Now, we’re facing a third “down week” in a row for the stock market…which included both a rough Friday…and as we just mentioned, it close right on its lows lows for the week. (The move in the S&P 500 and NDX 100 on the Friday of the last three weeks has been as follows: -1.3%, -4.1% and -0.77% for the SPX…and -1.9%, -4.1%, and -1.4% for the NDX.)

We worry that a lot of investors who own mutual funds might spend time over this weekend worrying about their stock holdings after yet another rough week. At least some of them have got to be thinking, “I wish I had paired back my holdings a little bit during that summer rally.” Some of them have likely been thinking this for a couple of weeks now…and hoping for just one more bounce to sell a few stocks. However, they haven’t gotten one. With three days to think about it this weekend, we worry that they might call 1-800-mutual fund and shift some of their money out of their stock funds and put it into a money market account. If enough of them do act this way…like they did in 1987…the situation could get ugly early next week.

No, we are NOT calling for a 1987-style crash next week. In fact, we’re not calling for a crash of any kind next week at all. However, we ARE saying that it is possible that we could get some meaningful down-side follow-through. Therefore, investors should not take too much solace in the fact that these indices and ETFs are starting to get oversold on a very short-term basis. The next bounce might not come until they have become VERY oversold (at much lower levels.)

Basically, what we’re saying is that the stock market still seems quite vulnerable to us. We expect some likely downside follow-through next week...BUT we should get a bounce before too long. (The problem is that this bounce might come soon in terms of time…but the price still might be much lower.) However, any bounce should be short-lived…due to the issues we’ve talked about above (in terms of lower economic growth and lower earnings growth). Therefore, we believe that the summer lows for these indices and ETFs will be tested in the coming weeks.

We also want to highlight that for the S&P 500, the NDX 100 and the SMH chip ETF, those summer lows are ALSO very close to where their 200-week moving average comes-in! Therefore, this is another reason to use the summer lows as a target right now. We believe that these levels should provide some strong support on a short-term basis once they are reached. In other words, the market could/should bounce for more than just a couple of days if/when they reach those summer lows/200-week MA’s. However, there is NO guarantee that these levels will mark the ultimate bottom for this bear market.

Finally, we want to call attention to the weekly chart on the HYG high yield ETF. The daily chart on this ETF is also getting somewhat oversold on a very-short-term basis, but its weekly chart does not look good at all. It is much closer to testing its summer lows than the others…and it’s weekly chart has a ways to go before it becomes oversold. Also, its weekly MACD chart is curling over. If that chart sees a negative cross before long, it should indicate that we’ll see an important lower-low for the high yield market before too long. (Fifth chart below.)

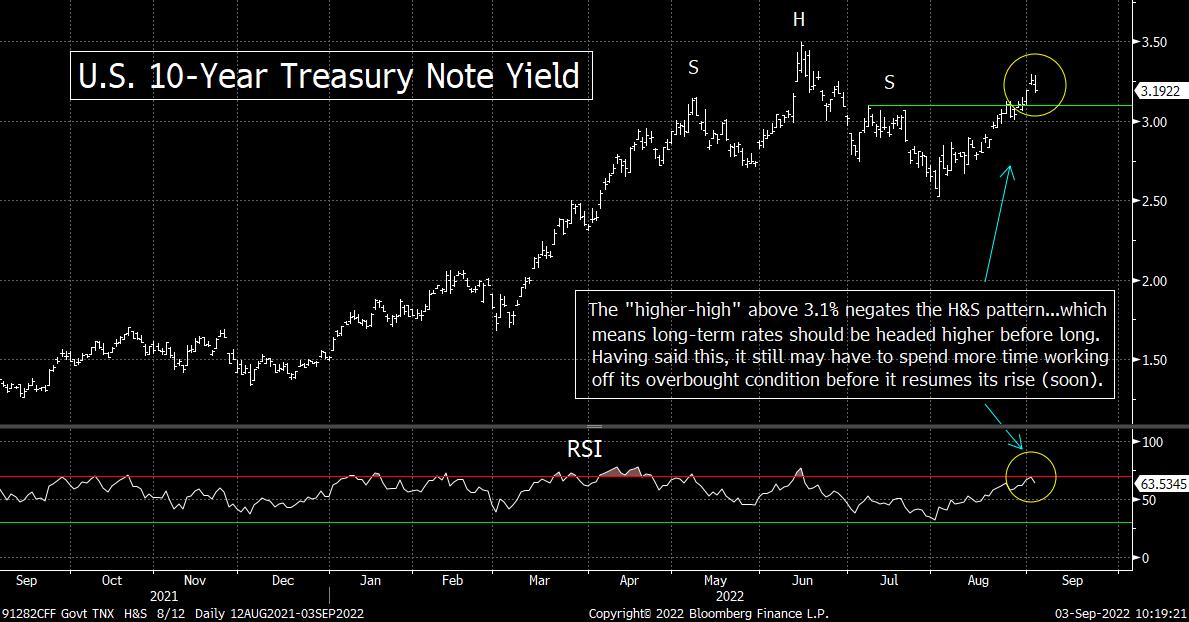

6) We spent a lot of time reading and hearing people say that Friday’s employment report was a “Goldilocks” report. Well, that might be true, but why in the world would anybody think that would be something that would lead the Fed to pivot earlier…after what they have said over the past few weeks?....Yes, the Treasury market did rally somewhat, but that’s only because it has become oversold on a short-term basis. It has nothing to do with the employment report……….Yields should be headed higher again before long.

We must admit that we were dumbfounded by the comments that came out after Friday’s employment report. Everybody was calling it a “Goldilocks” report. Well, we actually do understand why they used that term. The non-farm payroll number was stronger than expected…but not wildly stronger (like it was last month). The Labor Participation Rate came-in slightly higher than expected…and Average Hourly Earnings (wage inflation) was slightly lower than expected. So yes, the report was not too hot and not too cold…BUT why in the world would anybody say it was something that would cause the Fed to pivot anytime soon???

These numbers were only VERY SLIGHTLY better than the expectations! Besides, we have just gone through three weeks of the Federal Reserve going out of their way to pound the table about they need to keep tightening for the foreseeable future. This was all capped by a resounding speech from Chairman Powell last week…which confirmed all of this hawkish rhetoric. (This, in turn, was followed by even more follow-up hawkish rhetoric this past week by several Fed officials.)……After all of this talk, how in the world did people take this merely slightly better report…and conclude that it would likely cause the Fed to become less hawkish soon??? (BTW, only raising rates by 50 basis points this month should hardly be considered “less hawkish.”)

In our opinion, many of these pundits merely looked at initial rally in the stock market…and the mild bounce in the bond market…and then jumped to the conclusion that the report must mean that the Fed is going to have to pivot much earlier than they’ve been saying. However, the real reason is that the stock and bond market bounced on Friday was that both had become oversold on a very-short-term basis…and therefore, unless it was a very strong report, they were going to bounce either way!!!.....This is something we talked about in our “Morning Comment” on Friday morning…before the report hit the news-tape. We highlighted how the S&P 500 had fallen 4 days in a row…and 8 out of the previous 11 days…and thus the market could/should bounce unless the data was extremely strong. We’d also note that TLT had fallen almost 9% since August 1st…and yield on the 10yr note had bounced 27% since that day…and had reached an overbought condition on its RSI chart. Thus, both the stock and bond markets had become ripe for a very-short-term bounce in price…and a very-short-term decline in yield.

(Of course, the stock market’s rally faded quickly when the news about the renewed shutdown of the Nord Stream pipeline became public…but that did not prevent people with sticking with the “Goldilocks” report = a quicker Fed pivot…because the bond market’s rally did not fade on this news.)

When we combine this analysis of the technical aspects of what was going on last week…with the CONTINUED hawkish rhetoric from the Federal Reserve…we believe that the conclusions that were reached by many on Wall Street on Friday were way off the mark. This does not mean that the stock market cannot bounce at some point next week…nor does it mean the Treasury market cannot bounce further (and give us a further mild drop in long-term interest rates). However, we think any upside movement in prices in these markets will be short-lived.

As for the chart on the U.S. 10yr Treasury note yield, it has indeed broken well above the 3.1% resistance level we have been talking about recently. It gave the 10yr yield a definitive “higher-high” and thus negated the “H&S” pattern that had been developing over the summer. As the old rule goes, there is little that is more bullish in technical analysis than a “failed H&S” pattern, so this is a very compelling development. (The big problems is that its “bullish” for higher interest rates…and thus “bearish” for bond prices…and for stock prices as well.)

Of course, if/when things get ugly in the stock market, the Treasury market should rally…and give us lower yields…in a flight to safety trade. So, investors and traders will have to remain nimble in the weeks ahead. However, Friday’s move was just a technical one…and we strongly believe it will not have much of an impact on the Fed’s thinking.

7) People have been bewildered over the fact that gold hasn’t performed better in this inflationary period so much that nobody talks about it much anymore. We don’t know when gold will gain more traction on a long-term basis, but there some serious potential that will see a short-term bounce soon…one that lasts for at least a couple of weeks. (Maybe longer.)

A year ago, a lot of people thought that cryptocurrencies would provide a great hedge against inflation and would also become a “flight to safety” asset. Needless to say, that has not worked out at all…..If someone told you a year ago, that they cryptos would fail to provide effective protection, you would have said that this would mean that gold would have probably rocketed to the moon when inflation shot higher. Well, as we all know, this has not take place at all. In fact, after an

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member