There are two days left in 2021 and this is going to be a year where no Boston professional sports team won a championship. In fact, none of them even made the finals. There is no question that this is disappointing…especially since New York was finally able to take home one championship…the MLS Championship. This was the first championship for any New York team since 2012, so NY fans must be very happy……..Of course, there IS some solace that Boston fans can take from this year: The Red Sox beat the Yankees in the playoffs this year…again. 😊

Anyway, we had another uneventful/low-volume day in the stock market yesterday…as there seemed to be more people at the New Era Pinstripe Bowl in the Bronx…than were at their trading desks in NYC yesterday. (It was nice to see the University of Maryland win that Bowl game in Yankee Stadium yesterday…given how many key playoff games the Yankees have lost on that field in recent years.) 😊

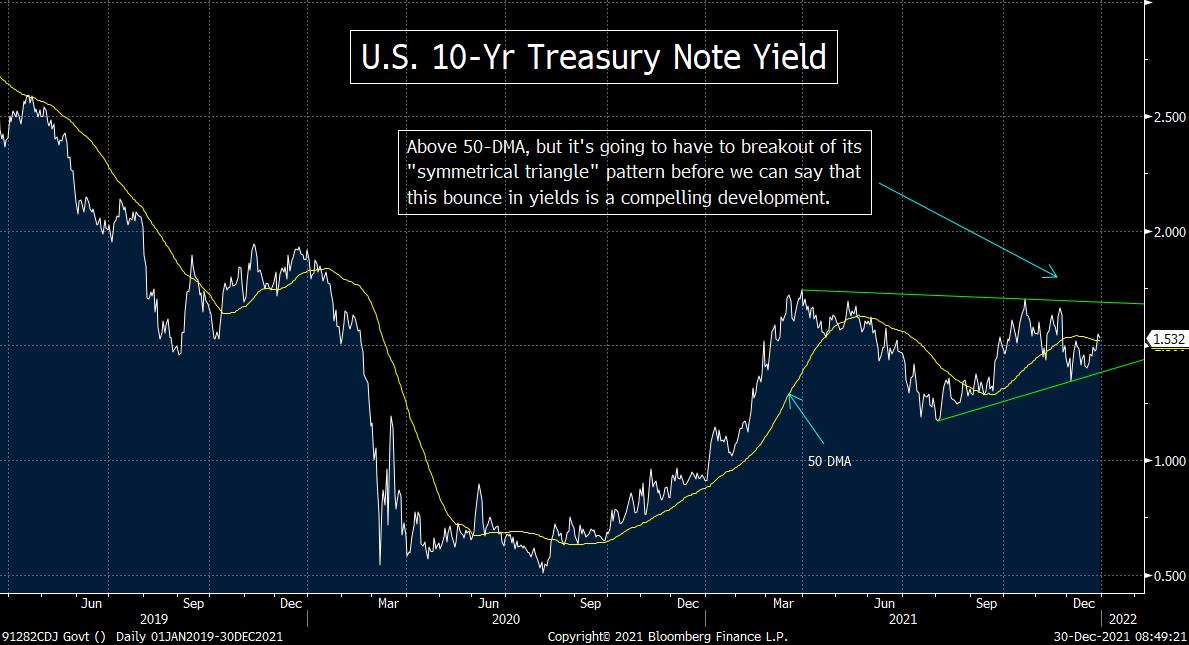

Seriously though, even though the stock market did not see much movement, the bond market did…as long-term Treasury yields spiked higher. The move seemed to be spurred on more by supply/demand issues (the Fed will not buy any more bonds in their QE program this month), and the move really didn’t have much of an impact on the technical condition of the Treasury market. Yes, the 10yr yield did break slightly above its 50-DMA, but it’s still inside the “symmetrical triangle” pattern that we have highlighted recently…and far from making any kind of a “higher-high”…so we’re going to have to see a lot more upside follow-through in rates before we can say that the bounce since early December is a compelling one. (First chart below.)

Another asset class that has a decent sized move this week is the cryptocurrency market. Cryptos like Bitcoin and Ethereum have fallen back down to their December lows (with Bitcoin testing its 200-DMA once again)……We’re going to be watching this asset class very closely at the beginning of the New Year. We think that part of the recent move has to do with year-end rebalancing by institutions…and the selling that has resulted from that could flip to the buyside in the New Year. (In other words, the upcoming expiration in the crypto market…that has been getting a lot of attention…might not be the only thing that will take some pressure of this market once it passes.)

Think about it. Institutional investors like to pump up their large holdings at the end of the year and scale back (or in some cases, dump) their losers. Well guess what? A lot of institutional players were late to the game on Bitcoin and other cryptos this year. Unlike some investors (and many individual investors), most mutual funds, insurance co’s, banks, etc. did not start buying this asset class until the spring months. In other words, even though the cryptos are still up nicely YTD, a lot of these institutions…who got into the asset class after the beginning of the year…have much smaller gains (or even losses). Therefore, they just might be selling Bitcoin this week.

Not only do many of them have losses, but cryptos are still VERY small positions in their portfolios. Therefore, even if they have gains, they’re not trying to boost the prices of these assets at year-end…because it won’t help their portfolio’s performance. “Window dressing” involves trying to push the stocks in which they have the biggest weightings…because THOSE are the ones that will help their full year performance. (That, in turn, will help their bonuses…and help in the marketing of their funds in the following year.) So this is another reason why we think many institutions may have been selling cryptos recently (and using the money to buy their bigger holdings).

However, that could flip on a dime next soon. Once the year is over, they just might be much more comfortable buying those cyptos once again…especially now that they’ve come down so much.

Having said all this, we readily admit that we don’t have any data to back up this theory…so we are certainly not pounding the table with a bullish call for cryptos early in 2022. However, experience tells us that the scenario we just described could very well be taking place this week. This does not mean that Bitcoin and the others will bounce strongly on Monday (the start of the New Year)…or that they’ll rally strongly right from the get-go. However, the change in the calendar just might be something that takes some pressure off this asset class…and if it can start to gain any upside momentum, a lot players (both individual and institutional) just might be willing to jump back into the asset class before we get too far into 2022. Therefore, we’ll be watching for some technical signs of an upside reversal in January. If, (repeat, IF) those signs emerge, it could/should be quite bullish. (Second chart below.)

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member