Since we are constantly getting new readers, we like to start our weekend piece with a quick note every once in a while...and the first piece of the year would seem to be a good time to do this once again.

Our “Weekly Top 10” piece is not meant to be a review of the week’s 10 most important developments. Instead, we try to focus on what most people are not focusing on...and when we do talk about the mainstream issues, we like to look at them from a unique angle. We also talk about issues from both sides of the bull/bear ledger...and thus sometimes our bullet points conflict with one another. However, we’re just trying to give both sides of the story...and we always try to let you know which side of that ledger we stand on any given issue.......Finally, we provide the commentary in three different “versions”...so that you can spend as much time...or as little time...on each one of them as you would like........Thank you have we hope you all have a very happy, healthy, safe and prosperous New Year!

THE WEEKLY TOP 10

Table of Contents:

1) After the initial big bounce last spring, the rally has been all about liquidity.

2) The Fed will be committing suicide if they keep the spigots wide open once the pandemic subsides.

3) The biggest surprise in the first half of 2021 will be a contra-trend bounce in the dollar.

4) After an upcoming “breather,” commodities should see another strong run in 2021.

4a) Silver and gold should end 2021 at a much higher level.

5) “Golden crosses” in the energy stock ETF’s.

6) Long-term rates look poised to move higher...and that does matter on several levels.

7) Seeing a few (small) cracks in the chart of the housing stock ETF.

8) We still think rotating WITHIN the tech sector is a good idea.

9) Will Biden be like LBJ?.....Taiwan is the globe’s #1 geopolitical issue.

10) Don’t listen to anybody who says the new high in margin debt is nothing to worry about!!!

11) Whatever you do, don’t buy Tesla or Bitcoin on margin!

12) Summary of our current stance.

Short Version:

1) The stock market is priced for perfection, so although it could rally a bit further in early 2017, the odds are very low that it will rally in a meaningful way next year. Even if we reach the best levels of economic & earnings growth that are being predicted by Wall Street right, it will not be enough to justify today’s levels on a fundamental basis.....In other words, this market is all about liquidity...and it will be vital to understand this as we move into 2021.

2) Of course, there is still one way the market could keep on rallying. If the Fed & other central banks keep the liquidity spigots wide open after the pandemic subsides, the markets could move much higher. However, that will create a bubble in the stock market...which, once popped, will clobber the corporate bond market. So we believe the Fed will want to avoid that...because the real risk in the global economy (due to the insanely large levels of corporate debt in the world) is still deflation.

3) The fundamental picture for the dollar over the longer-term is decidedly bearish. However, sometimes sentiment and positioning cause a serious contra-trend move in any asset class...when those issues reach extremes. The have reached huge extremes in the dollar...and thus we believe that one of the biggest surprises in the first half of next year will be a strong/sharp (multi-week & maybe even multi-month) bounce in the dollar. Therefore, investors need to have a plan in place for this likely move in the currency market.

4) Over the next year or two, we think that any inflation in asset prices will begin to shift away from equities and towards commodities. However, given our call for a multi-week bounce in the dollar, we should see a pull-back in commodities that goes with it. That said, if the CRB commodity index can eventually move above its current level (either now or after a pull-back), it’s going to confirm a change in the long-term trend for this asset class.

4a) As we mentioned in our “Morning Comment” last Thursday, both silver and gold are testing key resistance levels...and thus any further rally will be bullish for these precious metals on a technical basis. Due to our belief that we’ll see a pull-back at some point before long, we don’t want to jump the gun, but 2021 should be another good year for the precious metals.

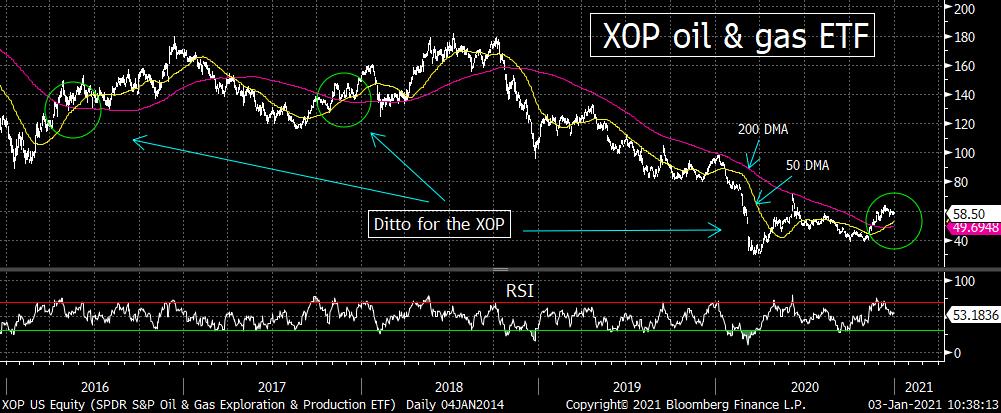

-5) We think the energy stocks will continue to do well in 2021. They should take a “breather” if/when the dollar bounces and commodities pull-back, but this under-owned and over-hated group still has plenty move upside potential in our opinion. Not only are these stocks trading at levels that they saw when WTI oil was trading in the low $30s, but the XLE and XOP have recently experienced “golden crosses.” They haven’t seen those kind of bullish “crosses” since late 2017, but the last two times they took place, both ETF’s saw very nice (further) rallies.

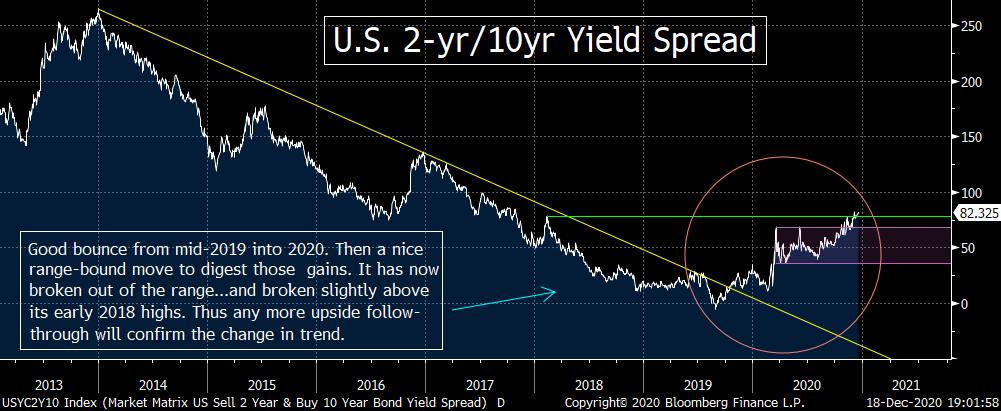

6) Interest rates....The yield on the 10yr note has broken above several key resistance levels...and it has done this after forming a very nice “base” over the summer. The chart on the yield curve (as measured by the 2yr/10yr spread) has seen a similar move. Both are bumping up against another resistance level. If they break those levels, it will confirm a change in the their two-year tends...which, in turn, should have an impact on several other investment vehicles going forward......Yes, it’s great that yield are still VERY low on an historical basis, but it’s not as great as it used to be.

7) The rise in long-term rates has led to a nice rally in the bank stocks, so if rates breakout even further, it should help that group even more. However, the flattening out of the rally in the housing stocks has also corresponded with a rise in long-term rates. This is not problem yet...and there are many reasons to remain bullish on the housing sector. However, there are some levels we’ll be watching closely on the charts...that, if broken, will lead us to turn much less constructive on this group.

8) Tech is far from dead, but investors are going to need to be more selective in 2021. The FAANG names are still great companies, but they’re still over-owned and overvalued (though most of them are a bit less so than they were in late August). We are worried about several of those FAANG names due to regulatory issues under the new Administration, so we think investors should rotate WITHIN the tech sector towards AI, cloud and chip related stocks.

9) On the political side of things, we’d note that President-Elect Biden will be the first President since LBJ who has an intimate knowledge of how to get things done with Congress...and has the relationships to help get some things done. You might not like what he gets done, but at least he might be able to break the grid-lock.......On the geopolitical front, we still believe that Taiwan will be the most important geopolitical issue of this decade. We do not think the U.S. & others will sit idly by (like they did with Hong Kong) if/when things come to a head with Taiwan.

10) Leverage is a lousy timing tool, BUT it’s still VERY dangerous!!!!......Arguments about whether we’re in a bubble or not don’t matter...because the stock market does not have to reach bubble proportions to fall into a deep correction of 15%-20%. In fact, it does not have to move into bubble territory before it can fall into a bear market either!.....Also, those who say that record leverage is a lousy timing tool are correct, BUT don’t take solace in this argument. When record leverage is reached, the eventual unwinding of that leverage is always VERY painful for the stock market.

11) We believe that Tesla and Bitcoin are in bubbles. Yes, they might move higher over the very-near-term...and we definitely think that Bitcoin will move a lot higher over the very-long-term. However, at some point over the next few months we believe that it is likely that these two asset will see declines of 30% or more. Therefore, it will be very dangerous to own them using margin going forward. If you own them on margin, instead of using the decline as a great opportunity to buy it on weakness, you’ll be forced to sell it at exactly the wrong time (when it’s just staring to bottom)!!! You cannot “ride out” a large decline in a stock or any other asset if you own it on margin....your broker won’t let you!

12) Summary of our current stance.....Although we have been very bullish on the stock market for most of the last quarter, e believe the stock market has moved far ahead of the economy...and anything the economy will likely become over the next 12-18 months. Therefore the stock market will likely see a deep correction of 15%-20% next year (probably starting in the first half). If the pandemic subsides, so will some of the central bank liquidity. If the pandemic becomes worse, the liquidity will only soften an inevitable decline, but it won’t prevent it.......Hopefully, 2021 will be NOTHING like 2020...but we DO think it will be very similar in one regard. It should be a year when nimble and active traders who take advantage of moves in both directions will profit much more than those investors who use the old the buy and hold strategy that has worked so well for a long time.

Long Version:

1) Even though the next few weeks will be tough for the pandemic, this healthcare crisis will definitely subside before long...and the new strains of the coronavirus will not become a big problem because the vaccines will indeed work very well against them. Also, the 2021 economy is going to grow a lot more than the consensus is thinking right now...and earnings are going to beat the consensus expectations for next year by a wide margin as well.

If you have been reading our work recently, you know that the above statement is not what we believe...BUT it IS what the stock market is pricing-in right now. Thus, it is pricing-in perfection..........This does not mean that it cannot rally a bit further in early 2021, but the problem is that despite what the old saying on Wall Street says, the stock market is NOT “always right”...it’s only “always right” EVENTUALLY.

Right now, the stock market does not reflect what is going on in the economy or what is going on with earnings. More importantly, the market is not currently reflecting the kind of growth we’ll get next year either. (This is especially true for earnings. Earnings almost never reach their consensus early-year estimates by the end of the year. They are almost always shaved considerably as we move through the year.....Yes, the S&P 500 companies ALWAYS beat their broad earnings estimates every quarter...but that’s only after those estimates have been cut significantly in the months before the quarterly earnings are reported.) Therefore, given its extremely high valuation levels of 22.5x forward earnings and a record price to sales ratio of 2.8x, we think it will be very difficult for the stock market to rally in a significant way next year.

Another way of highlighting what we’re trying to say is to point out that even if the the most bullish estimates for next year come to fruition, it will only take us back to growth levels that existed before the pandemic. Many pundits try to say that this would be great, but those pre-pandemic growth levels (both economic and earnings growth) were not fabulous at all...so we seriously question how they will justify a material rally in stocks next year!

GDP growth was 2.33% in 2019...which was lower than the 3.18% rate we saw in 2018....and earnings growth for the S&P 500 was FLAT in 2019!!! Despite those mediocre (at best) growth rates, the stock market rallied 30% that year! Therefore, the stock market was overbought and expensive just before it topped out in February due to the coronavirus...and since the stock market is more than 10% higher than it was just before the pandemic clobbered the markets, it’s even more expensive today.

So what we’re saying is that if we do indeed get the kind of growth that takes us back to pre-pandemic levels next year! This leads us to ask, so what??? That will merely take the market back to an overbought and overvalued level...instead of very overbought and extremely expensive (like it is today). That is not the kind of set-up that provides for further substantial gains in the stock market.

Let’s face it, even if earnings explode to the upside...and the S&P 500 earns $200 (which would give it an unlikely YOY gain of more than 40%)...a rally to 4000 on the S&P would still leave it an expensive multiple of 20x. In other words, a move to 4,000...even one that is led by a 40%+ rise in YOY earnings growth...would give the S&P a rally of only 6%-7%...and still leave it at an expensive level. So think about what kind of earnings growth it will take to push the S&P 500 to a FAIRLY valued level...even if the index stayed at or below 4,000! It would take an earnings increase of more than 60% vs. 2020 to move the S&P to a fairly valued level if it does not rally at all next year!

Don’t get us wrong, a 6%-7% gain in the stock market (to 4,000 on the S&P) would still quite good on an historical basis. But the point is that we’re going to have to see a HUGE increase in the fundamental growth to justify the CURRENT level of the stock market...not to mention what it will take to give the stock market a gain in the mid-single-digits! Thus a double digit gain in the stock market will be very, very hard to achieve...and if we do get it, it will take us into bubble territory. That might be good for investors over the short-term, but it will be a disaster for them on a longer-term basis.......In other words, this market is all about liquidity...and it will be vital to understand this as we move into 2021.

2) Of course, as we alluded to in the last sentence of point #1, there IS one thing that COULD take the stock market much higher. If the global central banks keep the liquidity spigots wide open...even after the pandemic subsides and the vaccines help bring the global economy back to its previous levels...the stock market could become even more over-valued. In other words, if they keep the pedal to the metal in terms of liquidity, the stock market could continue to push further above a level that would be justified of the fundamentals. Instead of the fundamentals catching up to a flat or declining stock market, the stock market will continue to move further above those fundamentals.

The problem with that scenario is that it will cause more bubbles...and certainly move us into one in the stock market. We believe that the Fed does not want to create a situation where a wide spread and massive bubble develops. If that happens, when the bubble eventually (and inevitably) bursts, it will be one that they will not be able to control.

This time last year, the only thing anybody could talk about was the bubble in corporate debt. Well guess what, that bubble has grown in a major way in the last year. U.S. corporate debt is up to more than $10.5 trillion...which is almost half of the country’s GDP. As we mentioned recently, $3.6 trillion of that debt is just one notch above junk. If another Fed-induced bubble is formed in the stock market, it’s eventually bursting will freeze-up the debt market in a way that would make this past spring and 2008 look like a picnic.

In other words, the Fed will have to pull-in their horns at some point if/when this most recent wave of the pandemic subsides. If they don’t nobody is going to be worried about inflation down the road, it will be deflation that will make a BIG come-back...and the Fed will have few tools to fight it this time around.

3) Let’s move away from the stock market and talk about some other asset classes. We’ll begin with the dollar. Although we expect the dollar to end 2021 lower than it is right now, we believe that the biggest surprise in the markets in the first quarter of next year will be a “tradeable” (multi-week) bounce at some point in the first quarter of next year. (We think it will likely begin in the first half of the 1st quarter.) This will have an important impact on other asset classes...but we talk about those issues in later bullet points...and stick with the greenback in this bullet point.

The reason we believe that the dollar has become quite ripe for a bounce that will last several weeks (maybe even a couple of months) has nothing to do with its underlying fundamental picture. The twin deficits should theoretically keep the dollar falling. HOWEVER, sometimes it is essential to look beyond the fundamentals...when other factors reach extreme levels.

We’re seeing several of these outside factors coming into play all at once right now. The first one is the sentiment behind the dollar. You can’t go a day without reading or hearing a bearish comment about the greenback in the financial press. We’d also note that bullish reading in the DSI data is pushing 90%. So you can see that sentiment is about as bearish as it gets on the U.S. dollar.

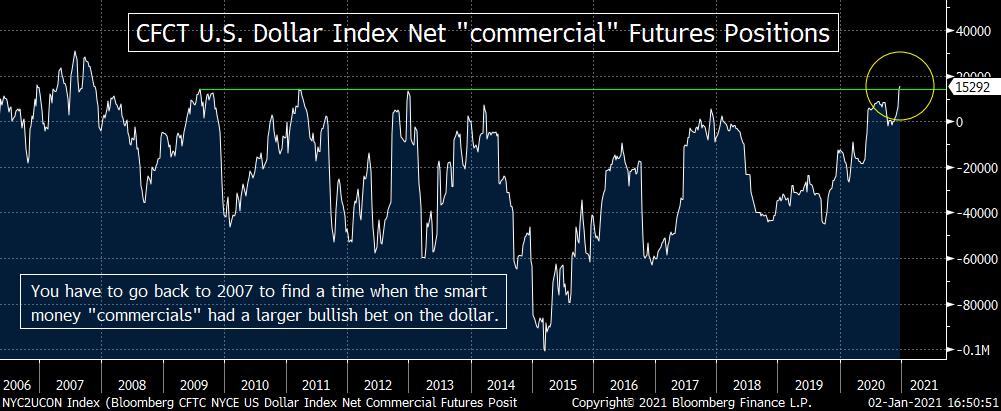

The same is true for the issue of “positioning.” The recent BofA fund manager survey highlighted that the “short dollar” trade was the second most crowded trade around the globe. On top of this, the COT data shows that the dumb money “speculators” (or “specs” as we call them on Wall Street) have their largest net short position since 2011...and the smart money “commercials” have their largest net-long position since financial crisis!!!....Finally, the weekly RSI chart on the DXY dollar index is very close to its most oversold level of that past decade.

In other words, way too many people are on one side of the boat in the dollar trade...and thus there is nobody left to sell the greenback. No, this does not mean that the dollar will bounce strongly on Monday of next week, but it does mean that it has become VERY ripe for a relatively strong bounce soon. These readings are so extreme that they also tell us that any bounce should last for a lot more than just a few days.

Again, it could take several more weeks before the bounce takes place, but we STRONGLY believe that investors who have leveraged positions that could/should be impacted by a contra-trend bounce in the dollar will need to be very careful over the first few months of 2021. We also STRONGLY believe that this kind of bounce can easily take place even though the longer-term fundamental picture is decidedly bearish for the dollar.

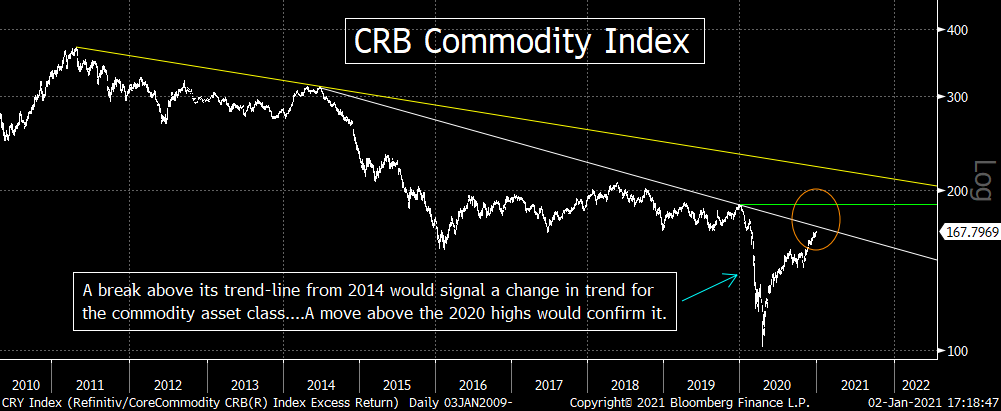

4) Commodities......We have been saying for many months that we believe that the 8-9 year bear market in commodities has come to an end...and that a new bull market is emerging. The more than 60% rally in the CRB Commodity index since the March lows seems to be bearing us out. Having said this, the CRB is now testing its trend-line going all the way back to its 2011 highs...so it will need to see some more upside follow-through before it breaks above that line in a significant fashion and confirms the change in the long-term trend for this asset class. (Remember, as we just stated above, the Fed wants to avoid deflation at all costs...and in a weird twist of fate, keeping deflation at bay could/should entail keeping the stock market from inflating too far over the next year or two. Therefore, inflation should shift at least some-what away from the equity market...and towards the commodity markets.)

Given what we just said about the dollar, there is a decent chance that we won’t get this confirmation in the very-near-future. If the dollar sees a multi-week (and relatively sharp) bounce, it’s almost certainly going to cause a pull-back in the CRB. This will not be a problem at all with our long-term call on commodities. After the outsized rally it has seen over the past nine months, a pull-back would actually be normal and healthy (just like it will be normal for the dollar to bounce strongly at some point in the first quarter after such a big decline this year).

Since the dollar’s upcoming bounce might not come for a couple of weeks, we do not want to send up any kind of short-term warning flag on the commodity asset class just yet. However, we’re becoming more neutral on them over the near-term...and will be watching the currency market closely for signs that we should at least send up a yellow warning flag.

What we’re saying is that we expect an pull-back in commodities at some point in the first quarter, so we do not want to remain aggressively bullish up at these levels. Instead, we’ll be looking for a pull-back in the asset class before we get aggressively bullish in this area once again. However, just because we believe the group could/should see a pull-back, it does not change our longer-term bullish stance. So there is little question that we will get much more bullish on commodities once again at some point as we move through 2021. (We’ll talk more specifically about crude oil and the energy stocks in point #5.)

On the charts, we’ll be watching the CRB commodity very closely in the coming weeks and months. After an expected pull-back in the commodity asset class, we’ll be watching to see if the CRB can move its trend-line from 2014, it will make a test of the early 2020 highs of 188 quite likely. If it can then break above that level, the trend-line going all the way back to 2011 will come into focus. That level is more than 30% higher that today’s level...which would have some very interesting implications for several stock groups as well.

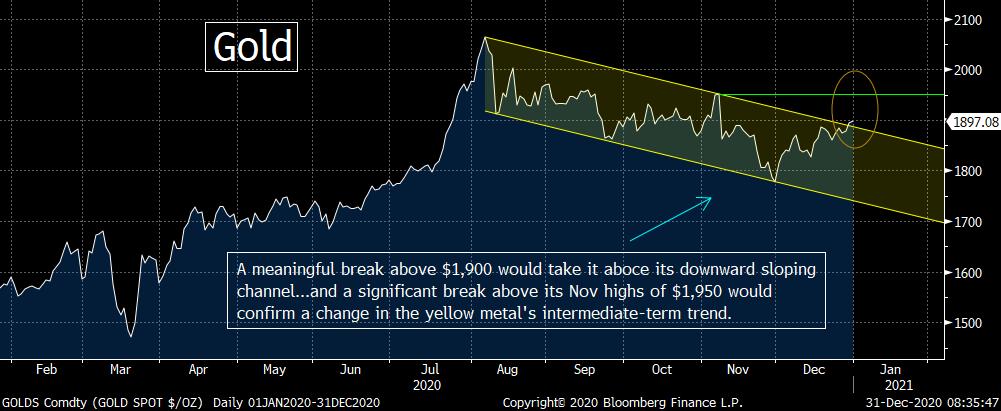

4a) Before we move onto WTI crude oil and the energy stocks, we want to reieterate what we said about two other commodities in one of our “Morning Comments” last week...silver and gold.

Let’s start with chart on silver. This precious metal made a nice “double-bottom” at about $22.75 in late November...and it has followed that up with a nice “higher-high” above its early November highs. That said, silver did fall below its trend-line from March last month, but it is now testing that line once again. Therefore, if it can regain that trend-line...and move above that line in a meaningful way...the combination of a “double-bottom,” a “higher-high,” and a move back above the trend-line should be very bullish for silver on a technical basis. In other words, this is a long winded way of saying that any further rally in silver as we move into the new year will be bullish for the commodity.

As for gold, the yellow metal has been in a downward sloping trend-channel since early August. It is now testing the top line of that channel, so a meaningful break above $1,900 would signal a breakout of that channel. If it can then rally further and move meaningfully above its November highs of $1,950...it would follow the breakout of its current “channel” with a nice “higher-high”...and thus confirm a change in the intermediate-term trend for gold to the upside.

Of course, since we’re looking for a near-term bounce in the dollar of significance, we definitely HAVE to wait for a more meaningful breakout in both of these precious metals before we can raise a major green flag up the flag pole. However, once we move further into the new year, these precious metals should follow-up last year’s good year with another strong one. (The move in Bitcoin has taken the thunder from the record years that these two precious metals had in 2020.)

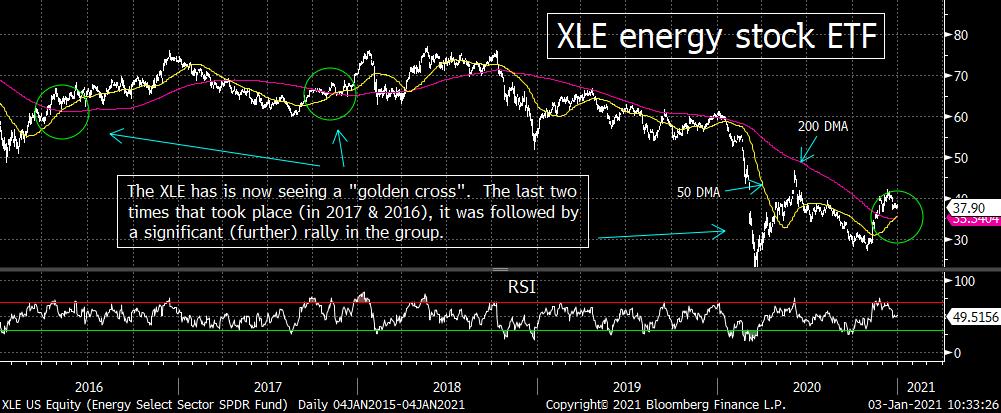

5) Needless to say, if we think that commodities in general could be vulnerable to a short-term correction at some point in the first quarter, that would include WTI crude oil as well. If the black gold sees a pull-back, so should the energy stocks. However, given that the XLE energy stock ETF rallied strongly over the past two months and still stands 43% above its late October lows (and more than 64% above its March lows)...a pull-back at some point in the first quarter of the new year would actually be normal and healthy. (We’d also note that the XOP oil and gas E&P ETF stands 48% above its late October lows and a whopping 94% above its March lows!)

Therefore, we remain bullish on the energy sector over the longer-term, but we would not be aggressive at current levels...even though many of these energy names have pulled-back a little bit already. Having said this, we believe that a pull-back from their overbought levels in crude oil and other commodities (due to our expectations for a bounce in the dollar) will provide a great opportunity to buy the best run and best capitalized energy stocks in the market place. Once these overbought conditions are worked-off, we will turn much more aggressive on the energy stocks once again.

There are a lot of non-believers in terms of this rally in crude oil and the energy equities, but we think it can re-establish itself once the recent extremes are worked-off. (If the Fed was smart, they’d be more interested in buoying the oil market than the stock market. As we have seen over the past five years, it has been a decline in the high yield market that has had the biggest impact on creating important problems in the credit markets...in 2016, 2018/19 and last March. Yes, the sharp decline in the stock market can obviously had an impact on the credit markets, but in recent years, it wasn’t until the high yield market fell apart that the Fed needed to step to the plate and provide liquidity. They weren’t protecting the stock market, they were merely doing what the needed to do to keep the credit markets open and running. Yes, a deep bear market in stocks is something that could cause the credit markets to freeze up once again, but given how much exposure the high yield market has to the energy sector, a decline back into the $20’s for crude oil is something that would almost guarantee a major problem in the fixed income markets.

Anyway, looking at the energy stocks, since they’ve already seen a mild pull-back recently, they might not get hit as hard by decline in crude oil prices as they have in the past. We’d also note that the XLE has experienced its first “golden cross” since late 2017! That “cross” was followed by a further rally of 18% in the XLE over the several months. (The golden cross before that one...in 2016...was followed by a further rally of 22%!) Of course, we’d like to see the “golden cross” become a more meaningful one before we get too excited...and that might not come until we take a “breather” in the group. However, we believe this under-owned and under-loved group has a lot of upside potential for the full year in 2021.

We’ll finish this point by highlighting that the XOP made a “golden cross” two weeks ago...and the rallies that followed those kind of bullish “crosses” in 2017 and 2016 were 20% and over 40% respectively..........(Remember, a “golden cross” is when an asset’s 50 day moving average crosses above its 200 DMA when they both moving averages are rising. A “death cross” is the exact opposite.)

6) Interest rates.......We’ve talked a lot about the technical condition of the yield on the U.S. 10yr note...and the U.S. yield curve (2yr-10yr spread). They are both at a very important technical juncture, so we’ll review their charts first...and then we’ll talk about what it means for the markets next year.

First of all, the chart shows that the yield on the 10yr note has set up quite nicely in 2020 for an important change in trend. That does not mean it will skyrocket next year...and we certainly don’t think it will. However, if it breaks above the 1.0% level, it’s likely going to signal a move up to at least 1.5% and maybe even higher in 2021......The yield formed a very strong “base” over the summer...which included a nice “double-bottom” at 0.5%. It has since moved higher and broken above its 200 DMA...its June highs...AND its trend-line from late 2018! It has been bumping up against 1% for almost two months now, so if it can break above that big round number, it’s going to follow the breakout above all of these resistance levels we just mentioned...with yet another key “higher-high.” That will be a strong signal that the two year trend for lower long-term interest rates has been reversed. (Yes, yes...the tend of lower interest rates is several decades old. We’re merely talking about a change in the most recent...2-year trend...that saw long-term rates drop in such a severe manner. So it’s still a change in trend...even if the very-long-term trend remains in tact.)

As for the U.S. 2yr/10yr spread, it broke above its trend-line from early 2018 a long time ago...and it has made a series of “higher-lows” and “higher-highs” since September of last year! In fact, the yield curve has steepened so much that it has moved to a level that is higher than it was in early 2018!!! Now, this “higher-high” above the early 2018 highs is only a slight one, but if it can see any more upside movement (more steepening), it will also confirm a change in the multi-year trend for the yield curve.

As we will touch-on in the next point, this should have an important impact on several equity groups in 2021 (assuming the 10yr yield and the 2yr/10yr spread both do indeed see a breakout in these charts). However, we also want to note two important issues. First of all, we readily admit that both would still be a ULTRA low levels on an historical basis even if they breakout, so we don’t want to say that 10yr Treasury notes will suddenly provide some serious competition for stocks. However, they will still lower what should be considered fair value for the S&P 500...and thus 22.5x forward earnings will be more expensive than it would be if long-term rates remained at 0.5%......No, that might be anywhere near enough to cause problems for the stock market any time soon, but it will make an already expensive stock market even more expensive.

7) Since we took so much time talking about the bank stocks last week, we’ll focus on another interest rate sensitive group this week: the housing stocks. However, we’ll start by give a very quick update on the chart of the KBE bank ETF...to add what we said two weeks ago about the banks. The KBE is now bumping

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member