We agree with the consensus that says the likelihood we’ll get a split government once the final results are in from the election is the main reason the market rallied strongly yesterday...and why the futures are trading a lot higher this morning as well. However, we also think that Senator McConnell’s comments yesterday about a possible fiscal plan before the end of the year (during the lame duck session) is something that he favors has had a big impact as well.

Based on what we’re seeing out of Europe (and especially the UK), there is little question that the new wave of the coronavirus is going hit the U.S. hard as the weather gets colder...and that some sort of further lockdowns are coming to this side of the Atlantic in the not-too-distant future. Therefore, as we move into the holiday selling season, it is ESSENTIAL that we get some more money into the hands of consumers in the U.S. The inability to get money to Americans in the most important selling season of the year (by far) will have a very negative impact on our consumer driven economy, so a failure by Congress to get something passed would be a crushing blow to our economy. (Ok, ok...using the term “crushing blow” might be a little strong, but it WOULD be quite negative.)

Either way, we strongly believe those comments from Senator McConnell was exactly what the stock market needed to give it a further boost during what is still a time of uncertainty.

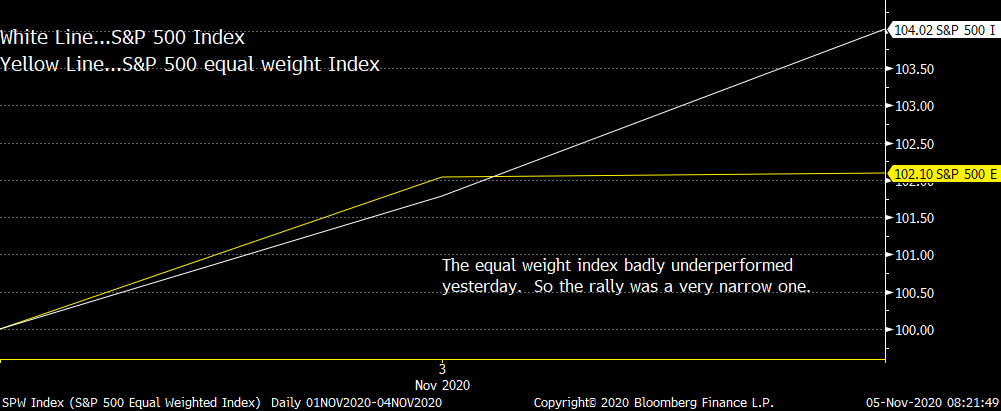

Having said this, we do need to point out that the post election advance we got yesterday gave a whole new meaning to the term “narrow rally”...as the 2.2% advance in the S&P 500 came on breadth that was actually negative for that index!!! Also, the 3.8% rally on the Nasdaq Composite came on breadth that was essentially flat. Finally, we’d also note that the much broader NYSE Composite Index rallied “only” 0.79% and that came on negative breadth as well......On top of all this, the S&P 500 equal weight index only was essentially flat...with a rise of just 0.6%!!! (First chart below.)

The technology stocks led the way higher, but with an equal weighted index of the FAANG stocks up almost 6% and the NDX Nasdaq 100 Index rallying 4.4%, it’s another sign that the rally was a very narrow one. We’d also note that the Russell 2000, the XLF(financial), the KBE (bank), XLU (utility), XOP (energy), XLI (industrial) and IYM (materials) ETFs all declined yesterday. When the broad indices rally more than 2%, there is rarely more than one or two groups that close in the red, so the fact that half of them did exactly that yesterday is yet another sign of a rally that was not a broad one at all.

Of course, the main reason for the decline in the financial-related groups had to do with the substantial decline we saw in long-term interest rates yesterday. The lack of an expected “blue wave” caused the yield on the 10yr note to plunge from 0.899% to 0.765% yesterday. (This is a key reason for the decline in the Russell 2000 as well...as that index is heavily weighted in the regional bank sector.).....We think that investors need to be careful about drawing any definitive conclusions from yesterday’s action in the Treasury market. As we have highlighted (and shown) in recent weeks, the positioning in that market is still quite “long”...so there is no guarantee that the this week’s test of the summer highs on the 10yr yield will be the last one we see over the coming weeks.

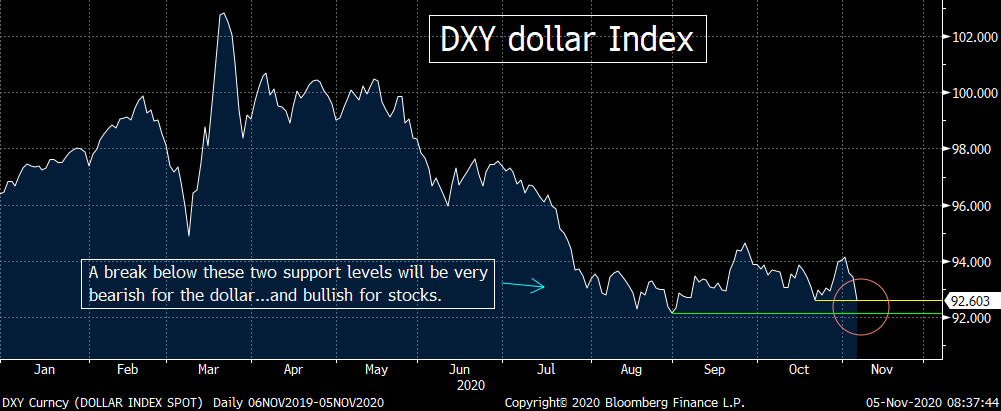

Speaking of “positioning,” we have also highlighted (and shown) how the net short positions in the dollar (and the net long position in the euro) are quite extreme as well. Therefore, we are not as sure as some pundits that the decline that we’ve seen in the dollar this week will turn into a significant one over the near-term. That said, the dollar is much lower again this morning (which is ANOTHER reason why the stock futures are trading a lot higher this morning). Therefore, we will be watching the DXY very closely to see if it can hold its key support levels. If it does not, it will signal that we’re wrong about our short-term constructive view on the greenback.

It is testing its first support level already...the October lows of 92.50. However, the more important level will be the late August lows of 92.00. Any meaningful break below that level will be VERY bearish for the dollar. That, in turn, should tell us that the current rally in the stock market is not going to take a breather despite the fact that it has been so narrow this week...and that the year-end rally we’ve been calling for will be even stronger than we have been thinking.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member