The bounce in the S&P 500 still faces headwinds

The recent bounce in the S&P 500 index has been impressive. However, it still faces serious headwinds and I believe a deeper correction of 10%-15% is likely over the next two to three months. To find out why I believe more downside potential exists for the stock market and the levels I'm watching to confirm that full blow correction has begun,click here to subscribe to my premium news letter.

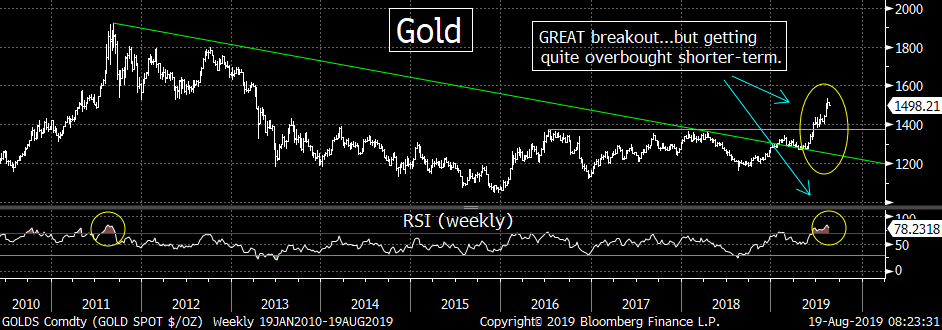

Gold is overbought near-term (but I love it longer-term).

If the stock market does indeed see a deeper correction, it should be quite bullish for gold. However, it has become very overbought on a near-term basis and thus it could/should see a pull-back over the short-term.

However, I still love gold on an intermediate and long-term basis, so any near-term pull-back should provide another great opportunity to buy the yellow metal. To find out why I'm concerned about gold's short-term potential, but love it on a longer-term basis, check the attached chart below and click here to subscribe to my premium news letter.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member