So far this week, we've been talking about various market models and indicators. To be sure, the subject can get confusing as oftentimes the indicators can contradict one another. And then yesterday I went so far as to opine that negative readings from a couple longer-term, big-picture models might actually be positive this time around. So, feel free to insert an eye-roll here.

This morning, let's forget about external factors, monetary conditions, the Fed, the economy, and/or valuations and turn our attention to the action of the market itself.

Long-time readers know that one of the reasons I like to look at price trends is that unlike so many other indicators/models, price cannot deviate from itself. While you may not always agree with what is happening in Ms. Market's game, it is usually a very, very bad idea to believe that a market move is "wrong." (Remember the old saw, markets are never wrong, but people often are!) In other words, the great thing about price is, it is what it is.

Of course, the interpretation of what is happening on the charts of the stock market indices tends to be more art than science. But since the models are presenting a cloudy picture at best these days, I decided it was time to take a look at some charts to see if there wasn't a message to be gleaned.

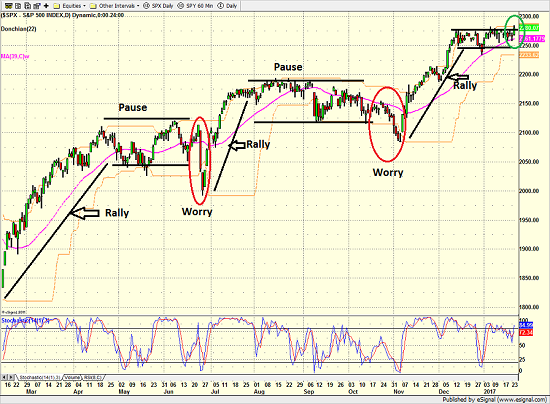

Let's start with a daily chart of the S&P 500...

S&P 500 - Daily

View Larger Image

To reiterate, what is "seen" on a chart is indeed based on the eyes of the beholder. But here's my take.

Cutting to the chase, I see a familiar pattern that has been unfolding since the latest cyclical bull market began on February 11, 2016. First, stocks rally. Then they pause as the rally is "digested" for a while. Then some "worry" comes out of the woodwork to give the bears the edge for a few days/weeks. But then traders remember the original reason for the move and the rally resumes. Rinse and repeat.

Since February 11, 2016, this pattern has definitely played out twice. And frankly, it looks like a variation on the theme is occurring right now.

For confirmation of this type of stuff, I like to look at other indices. The idea is to see if the theme appears anywhere else besides the S&P 500. So, I checked on the Russell 2000, the Midcap index, as well as the NASDAQ and NASDAQ 100.

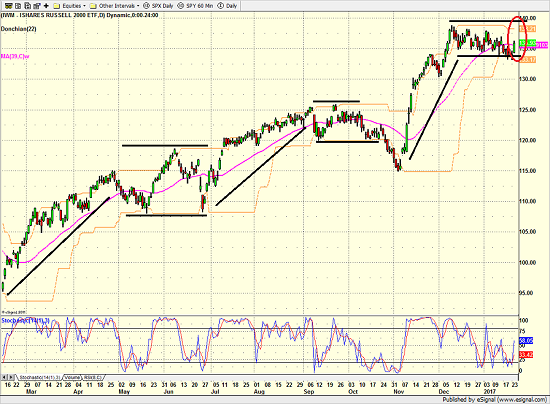

The first point is that for the most part, my rally-pause-worry-rally-resumption pattern can definitely be seen across the rest of the major indices. For example, below is a chart of the IWM - the iShares Russell 2000 ETF.

iShares Russell 2000 ETF (IWM) - Daily

View Larger Image

The major difference between the Russell small-caps and the S&P is what is happening right now. While the "generals" of the S&P appear to be attempting a jail break from the recent trading range, the "troops" are not following along. Well, not yet, anyway.

The bears are quick to point out that this is a technical divergence - and not a good one.

So, I checked in with the Midcap index to see if the same thing was happening there. As might be expected from a "mid" index, the recent chart action for the MDY is somewhere in between the S&P and the Russell. So, that's no help.

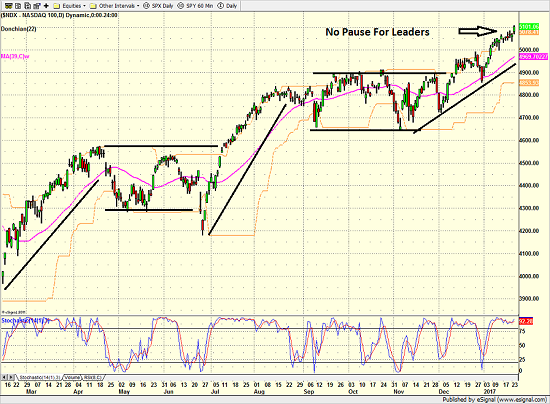

Then I pulled up a charts of the NASDAQ and the NASDAQ 100 and found something completely different.

NASDAQ 100 - Daily

View Larger Image

What is interesting here is that there hasn't really been a "pause" on the NDX, which arguably has been the market's leading index for some time now. No, the NDX as it is called, appears to have skipped the "pause" stage and is marching steadily higher.

Which Chart Should We Follow?

The question here is which chart is telling us the real story? The NDX seems to be moving merrily higher. The S&P 500 and Midcap 400 both look to be trying to break out of their ranges. While the Smallcaps are lagging behind.

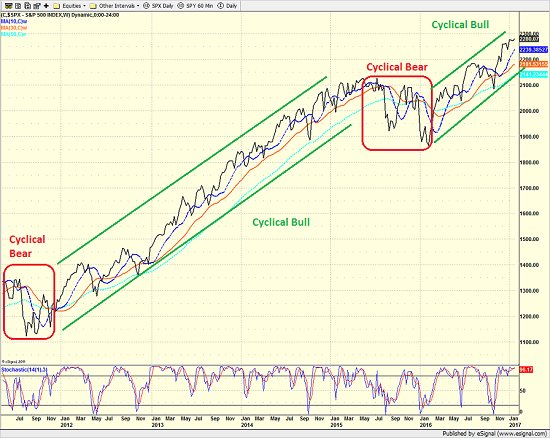

What I did next was to take a step back from the blinking screens and the daily hysterics and looked at a weekly chart. I find that by looking at several years of data at a time, it is often much easier to see what is going on.

The chart below is the weekly version of the S&P 500 since mid-2011 - about the time the "debt downgrade bear" was in full swing.

S&P 500 - Weekly

View Larger Image

What I see on this chart is the end of the 2011 cyclical bear, the entirety of the QE-induced cyclical bull, the brief cyclical bear that occurred from August 2015 until February 2016, and the current cyclical bull move.

Here's my take. Unless you believe that the current cyclical bull is about to end, it is probably a good idea to bet that our heroes in horns will ultimately prevail here. As such, I'm going to use the chart of the NDX as my "leader" and assume that the rest of the indices will follow along and get in line - in due time. After all, based on historical measures (and the computers at Ned Davis Research), the average cyclical bull lasts longer than a year and gains a lot more than the 22.3% seen since February 11 of last year. So for me, this remains a bet on the bulls and buy the dips environment.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

4. The State of Bond Yields

Thought For The Day:

Remember, your perception of others is likely inaccurate...

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member