Click Here for this Week's Letter

Greetings,

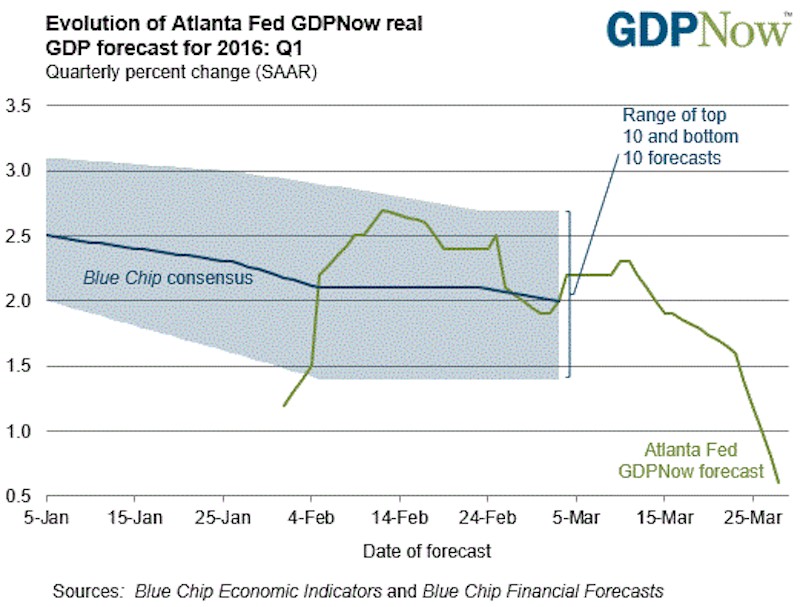

The Atlanta Federal Reserve‘s tool for forecasting first quarter GDP took a steep drop Monday, falling from +1.4% to just +0.6%. That’s well below the consensus of economist opinion, which predicts growth for the current quarter between roughly +1.4% and +2.7%. The decline was due to weak net export and personal consumption data released Monday. The Q1 GDPNow estimate was as high as 2.3% in mid-March, but has been falling with each release. Last week the forecast fell from +1.9% to +1.4% because of weak numbers in the durable goods and housing reports.

This is all a prelude to Friday when the real data fireworks begin. It starts with our first look at Chinese PMI for March, which is increasingly important because they did away with the flash PMI release a few months ago. We hear about soaring property prices in Tier-1 cities and financial conditions have improved in China, but there’s little evidence of growth momentum. The Politburo is back to encouraging stock margin trading, yet the Shanghai Composite is still trending lower. The Shanghai Property Index, comprised property sector stocks, looks even worse. Perhaps the government is too busy hunting the author of a letter asking President Xi to step down for “national stability” to worry about the economy?Tomorrow morning we’ll see what Chicago PMI looks like for March, but the main event is Friday when the jobs report, European PMI, US ISM, UMich consumer sentiment and US auto sales are all released within a few hours of each other. Despite the downdraft in GDPNow, it’s reasonable to expect the narrative from Friday will be an encouraging growth picture. Several regional indicators suggest ISM will pop back above 50 after a 49.5 reading in February, and economists are expecting the same. Non-farm payrolls have been largely stable around +200k jobs a month since 2010, and there’s little reason to believe that won’t be the case in March. Lending data indicates Europe is on the mend as well.

The problem is that investors have sniffed out this expected bounce already, and used it as justification for a 6% rally in the S&P 500 this month (+13% since February 11). In order for stocks to rally from here the data will simultaneously have to show solid-to-stable growth with lackluster inflation. That’s exactly what the Fed needs to see in order to stay on hold for longer. As of right now the market is pricing in a 32% chance the Fed hikes in June. However, a +250k non-farm payroll number would put a lot of heat on Yellen to walk the walk in June, or even earlier.

Conversely, a reading below +150k might portend lower for longer, but it would also mean this rally wasn’t justified. There are a shortage of trends in this market, which necessitates trading opportunities. It seems as though the stock market should stall here based on declining momentum, excessively positive sentiment, declining corporate profits (more below), and technicals. That doesn’t mean it can’t rally, but the risk/reward looks very attractive. And that’s all you can ask for in a trading environment.

The Cup & Handle Fund is up around +1.5% YTD, and +8.0% Y/Y. Not much action in the portfolio recently. The decline in volatility has weighed on some of our option bets, but we got in at extremely reasonable vol levels, so not a huge concern. We gave back some profits during this market rally, but were able to convert some stock positions into options. That’s hurting us short-term, but they should still pay off over time as volatility is priced at more realistic levels. The monthly letter for April is almost finished and subscribers should expect it as early as tomorrow. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

March 30, 2016

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

The Fundamental Bounce - March 9, 2016

— 3/08/16

The Fundamental Bounce - March 9, 2016

— 3/08/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member