Weekly Wrap-Up + Market Forecast + Sector Watch: SPX, Nasdaq, FAS, FDN, TLT, GLD, MS, STI, STT, GOOG, AMZN, BRCM, QCOM, FB, YHOO, XLNX, CTXS, LLY, ALTR, EBAY, HAL

The markets were very volatile last week. On Monday, stocks opened higher, but, closed down. On Tuesday, stocks opened lower, but, closed up. On Wednesday, stocks jumped, but, could not break out on Thursday. Friday was met with a steep sell-off.

In my Market Forecast last weekend, I said,

" This market has been flirting with the top of this trading range for a while now. It's difficult to say if it's got enough fuel to escape from the gravity of this trading range."

Indeed, it seemed that the market shared and showed my sentiment. Buyers were unwilling to let the market break out with the earnings season just starting. Instead, they shifted their focus to Greece, which is still struggling to come to agreement with the IMF and EU over economic reforms required by its lenders in order to unlock the remaining bailout fund.

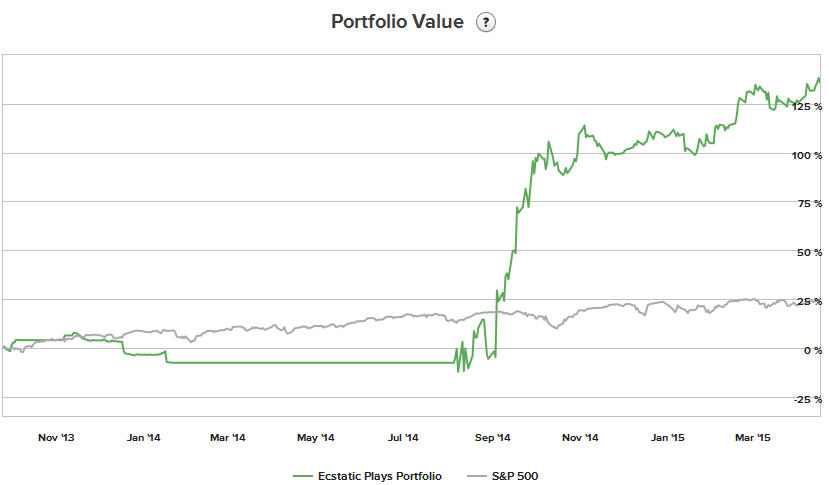

Nevertheless, we had another nice week, and my Ecstatic Plays portfolio value continued to push higher:

Here are the closed trades for the week:

To subscribe to Ecstatic Plays, please click HERE.

For the week, the Dow was down 231.35 points; SPX fell 20.88 points; Nasdaq lost 63.77 points. Oil (WTI) had a strong week and traded above $55/barrel. Gold slid a bit, but, still closed above $1200/ounce. At the time of this writing, Asian markets were mixed. Here's how the US markets closed on Friday:

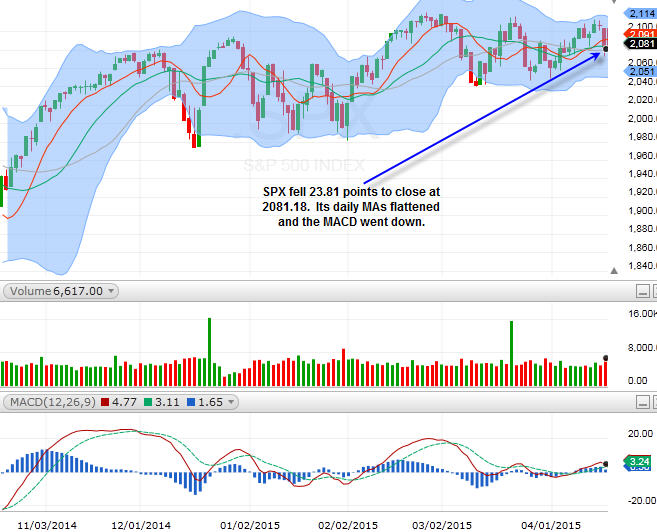

SPX

SPX fell 23.81 points to close at 2081.18. Its daily MAs flattened and the MACD went down.

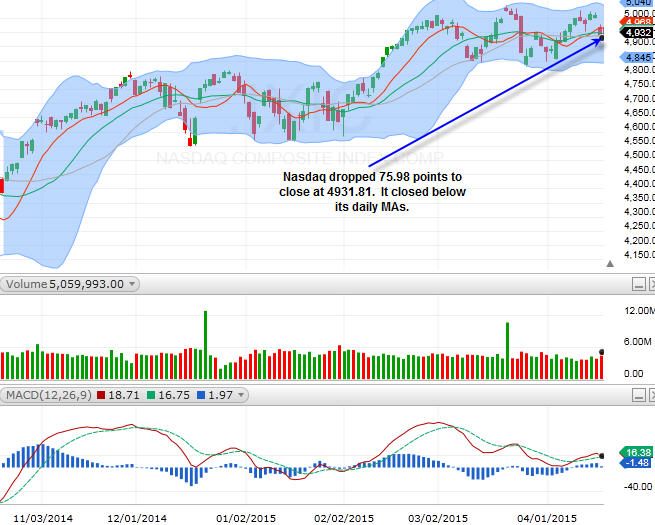

Nasdaq

Nasdaq dropped 75.98 points to close at 4931.81. It closed below its daily MAs.

Both market indices seem to be testing their respective initial support levels. For the new week...

If you'd like to read the rest of the articles, please subscribe to my Ecstatic Plays product (Click Here).

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member