I am very excited about a change that will be taking place with my publications. I will begin self publishing next week and thus I will no longer be publishing through Marketfy. I will send you details about how to subscribe to my work early this week.

With this change, I will also be changing the names of each piece, but they will be essentially the same as I've been providing for several years. The "Morning Comment" will now be called, "Before the Open"...and the weekend piece will now be called, "Weekend Insights".

Again, I will continue to publish through Marketfy until this Friday (September 30)...and I will send you details about how to make the switch this coming week. Thank you very much!

THE WEEKEND REPORT

Table of Contents:

1) A soft landing is off the table…and the market will eventually take out the June lows.

2) Valuations are still stretch…and the level of interest rates won’t help as much as some think.

3) We should see a bounce in the markets at some point soon (but it won’t hold).

4) The Treasury market has become very oversold and very over-hated as well.

5) The housing stocks are getting ripe for at least a short-term bounce.

6) We see the downside in the energy stocks as being limited from current levels.

7) Higher unemployment = recession = lower earnings = lower stock market before it bottoms.

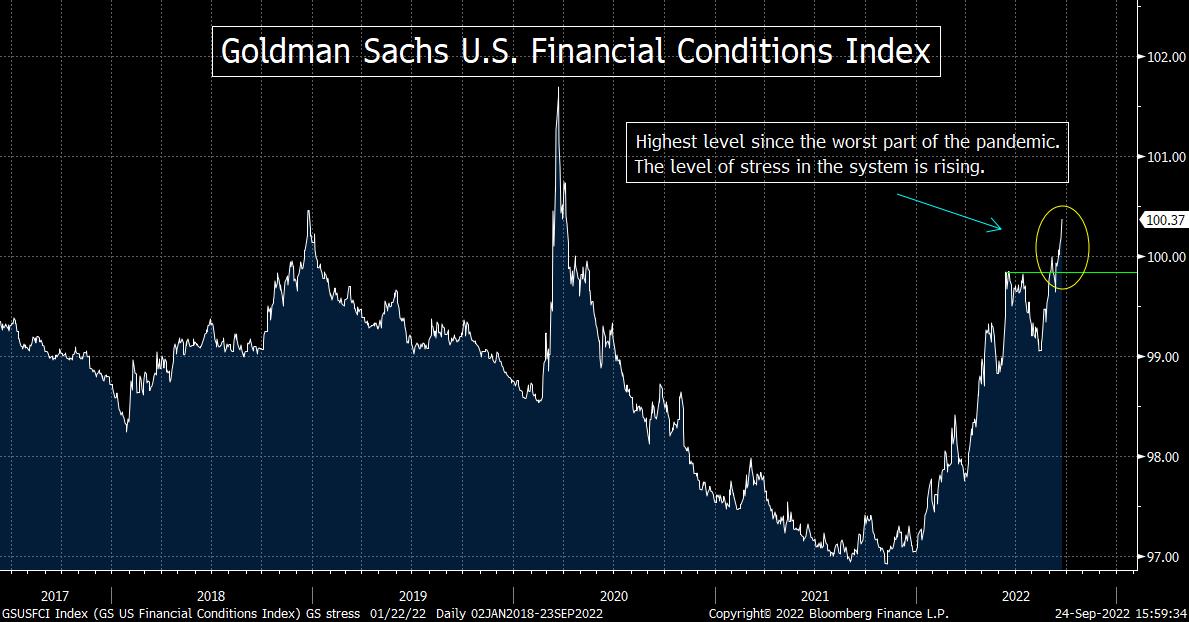

8) The level of stress in the system is rising as liquidity shrinks.

9) A look at the Senate races in WI, PA, GA and OH (and a few others).

10) Summary of our current stance.

1) Chairman Powell took a “soft landing” off the table last week….Despite what so many pundits have declared this year, they are not going to pivot when the economy falls into recession. The Fed is not going to pivot until inflation has come down significantly and the markets have fallen back to their natural/neutral levels…OR something breaks. None of those scenarios involves at sustained rally over the coming months.

We have believed for many, many, many months that a “soft landing” was extremely unlikely. We have talked about our reasons for thinking this way ad nauseam since the early months of this year, but the main thrust of our argument is that we could not see how a recession could be avoided when the Fed was moving from the largest accommodative policy in history…to a rather aggressive tightening policy…without it causing a recession. We felt that an recession became even more probable after the Russian invasion of Ukraine. That invasion…and the sanctions that went with it…meant inflation would become a bigger problem. This, in turn, meant that the aggressive tightening policy that the Fed had stated that they were intending to follow in 2021…had to become an even more aggressive one.

Well, Chairman Powell confirmed our thesis last week. By saying that a “soft landing” is becoming much less likely, he all but confirmed that we’re headed for a recession. (A Fed Chairman would never use those exact words, but he came as close as any Fed Chair will ever come.) In fact, we believe that his comments completely confirmed that the Fed will keep tightening even if it causes a further slowdown in growth and/or something more than just a mild recession. Mr. Powell’s use of the word “pain” 10,000 times in his press conference validated our thinking even more.

It is amazing to us that so many people still believe that the Fed will chicken out and step back from their tightening program when the economy slows down in a further (and meaningful) way. They don’t seem to realize that the Fed does not care if we fall into recession. (In fact, as we’ve been saying for a long time, they have known since the beginning that they were going to cause a recession with their tightening policy.) As they say in the state of Maine, “You can’t get there from here.” (I wish I could write with a Maine accent.) You cannot remove the kind of massive liquidity program the Fed engaged in (to save the global financial system from completely shutting down in 2020) without causing a significant slow down in growth. A “soft landing” has always been a very big long shot…and the invasion of Ukraine made it impossible.

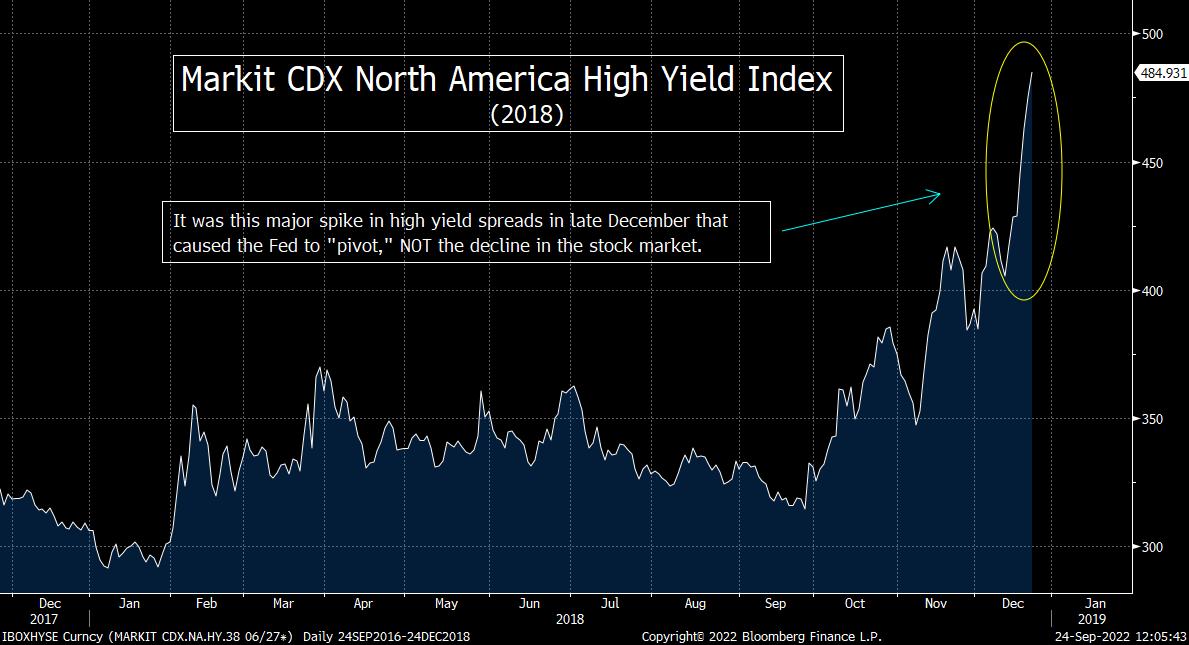

The only way the Fed is going to pivot before they get inflation under control…and before it get valuations back to neutral level…is if something breaks. Just look at what took place in 2018. We believe that these pundits think the Fed will chicken out when the economy slows further…because they are making the mistake in thinking that they chickened out in 2018. That is NOT what happened. The Fed did not suddenly “pivot” because the economy was slowing too fast or because the stock market was falling in a significant way. In fact, as these two things were taking place in December, the Fed actually said they were going to KEEP tightening in the months ahead. That’s right, at their December 2018 meeting (which took place on Dec 18 & 19), they confirmed their intention to keep tightening policy…even though the stock market had fallen deep into correction territory. It was not until the fixed income market began to freeze up in a significant way (led by the high yield market) that the Fed quickly pivoted…and made a 180-degree turn.

We believe that the same thing will be true this time around…and we’ve been saying this all year! Sure, the Fed will very likely throttle back on the pace of their tightening strategy, but they’re not going to pivot until inflation has come down significantly and the markets have fallen back to their natural/neutral levels…OR something breaks.

The problem with our long-held scenario for stock investors is that in order to tame inflation, the Fed is going to have to push us into recession. That means lower earnings and lower stock prices. Also (as we will discuss further in point #2), in order to reach the natural/neutral level for the stock market, this is also going to entail a further drop in the stock market. Finally, if something “breaks”…and the fixed income market seizes up again…the stock market is going to fall a lot further when that happens. (The stock market will fall quite hard in reaction to a big problem in the fixed income market BEFORE the Fed can react to it.)

This is why we believe that even though we will very likely see quite a few more sharp bounces in the stock market over the coming months, it will not bottom until it has broken well below its June lows. We can argue all we want about whether the Fed is doing the right thing or the wrong thing…but investors have to stop ignoring the fact that this is the path the Fed IS going to follow for quite some time.

2) Valuations remain elevated (P/E) or very elevated (price/sales). Bear markets don’t just take valuations back to fair value, they take them to undervalued levels. Relatively low interest rates will not help on this issue. Interest rates at the lows in 2000, 2009, 2018 and 2020 were ALL lower than they are today…and yet the stock market still fell below a 15x multiple before it bottomed each time.

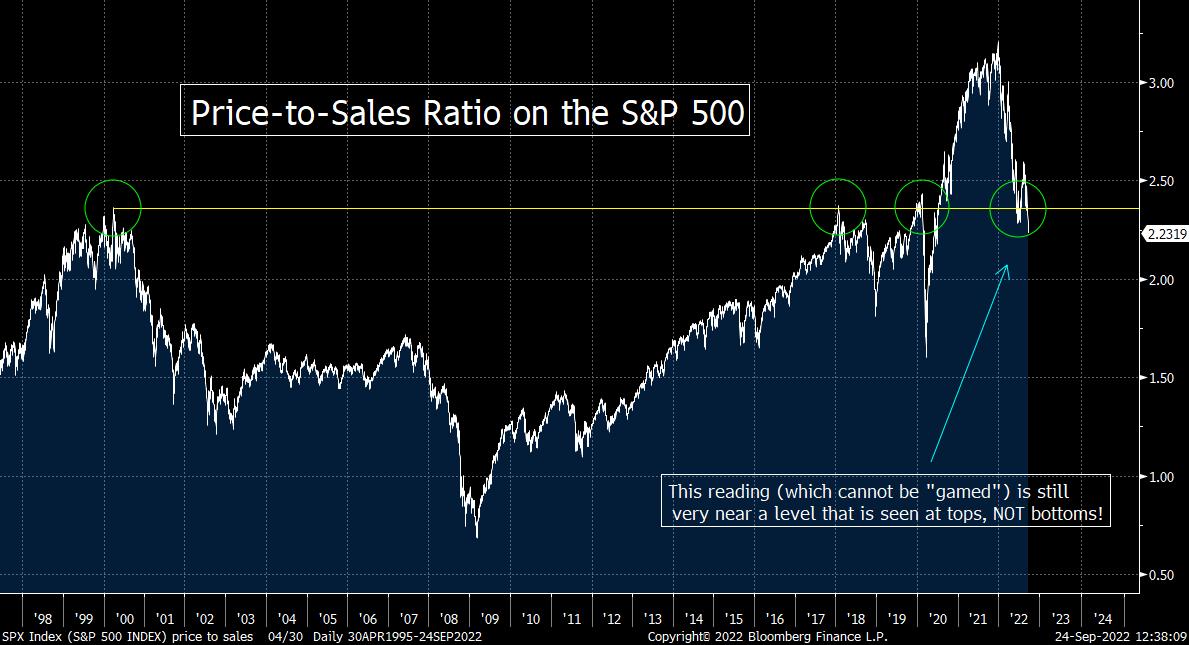

One issue that we continue to harp on every week…because it is extremely important in our opinion…is that of valuation levels. The recent decline in the stock market has taken the forward P/E on the S&P 500 down to 16.5x and its price-to-sales ratio down to 2.3x….Needless to say, those readings are lower than the 22x and 3x numbers that we saw at the beginning of the year. However, these are still somewhat expensive levels. In fact, it’s VERY expensive when it comes to price/sales ratio. This price/sales issue is particularly discouraging for the bulls because you cannot fake sales. People can massage their “earnings” in many ways, but unless a company is completely lying, their sales are their sales.

We’d also note that the consensus earnings estimates for both 2022 and 2023 have barely come down at all this year. Given that it has become all but a certainty that we’re headed for a recession…and every recession since WWII has given us a decline in earnings…this means that the 16.7x forward P/E on the S&P 500 is really still up in the 18x-20x range. Therefore, even though the stock market has already fallen well into bear market territory, it is very likely that it still has further to fall before it reaches its ultimate bottom.

It is also important to point out that every bear market since WWII has seen the stock market decline PAST “fair value”…and reach an “undervalued” or “cheap” level before it has bottomed. The P/E ratio on stated earnings for the S&P 500 has fallen below 15 before it has bottom in every bear market since WWII….even the bottoms in 2003, 2009, 2018 and 2020…when interest rates were lower than they are today. (Every bear market of the past 30 years has fallen to at least 15x forward earnings as well, but we can only get the forward P/E data going back to 1990…so we mentioned both measures.)…….With this in mind, the S&P 500 is going to have to fall below 3,300 before it reaches even the highest “bear market valuation” level of the past 75 years. AND, it’s going to have to fall even further if earnings estimates come down (which is HIGHLY likely) and/or if the bottom comes in the lower half of its historical range of valuations for bear market lows.

The same is true for price-to-sales. At 2.2x sales, the S&P 500 is still trading at a level that is very near the same level as the we saw at the market TOP in 2000, 2018 and 2020! In order to reach a level that is associated with a market BOTTOM, the price/sales ratio is going to have to at least 1.8x (the low in late 2018)…and much more likely below the 1.5x level. These numbers will take the S&P down into the low 3,000s before the market bottoms as well.

We have been using the 3,000-3,200 level for many, many, months. Even when the stock market was rallying strongly over the summer, we called it a sucker’s rally and stayed with our targets. Most of Wall Street will do what it usually does. They’re lower their targets gradually…and when the market finally bottoms and rallies in a strong way, they’ll claim they were right about the market all along…and then say how stupid many people were for staying bearish at the bottom………..That time will come…but not for a quite a while.

3) Even though we believe that the stock market has further to decline, we do admit that it’s getting oversold and over-hated. Several technical readings are reaching oversold levels and we also see the sentiment polls returning to the kind of bearish levels that are frequently seen at near-term bottoms. Therefore, we could see a short-term bounce at any time.

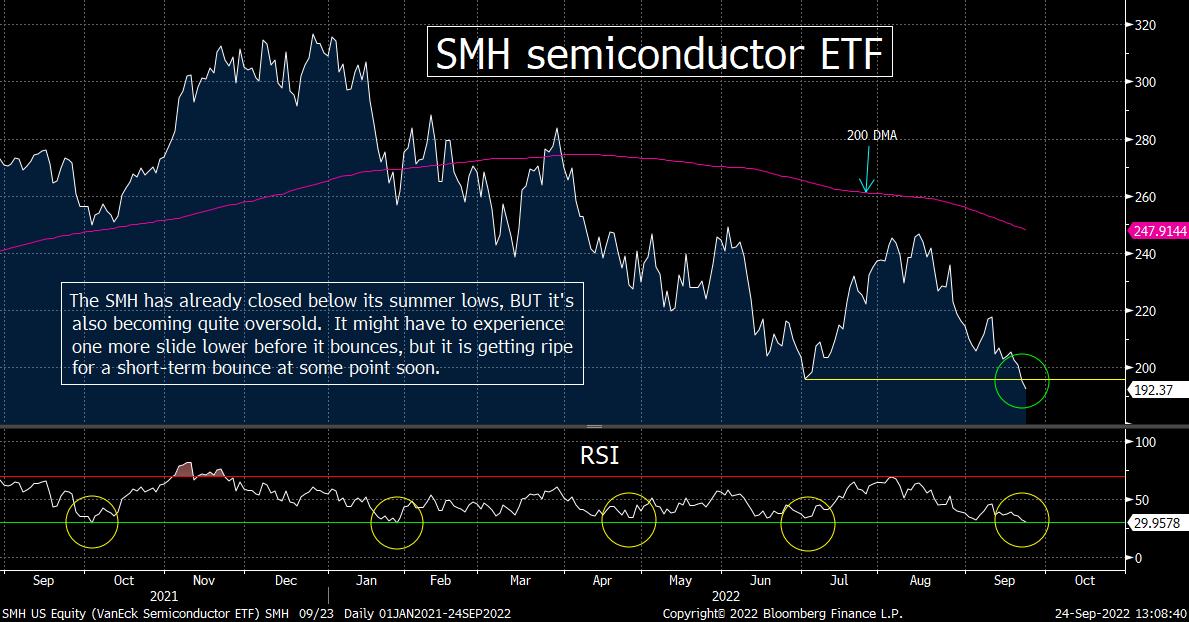

Well, so much for the thought that the stock market had bottomed in June. It barely took a month for the market to erase all of its summer gains. (Technically, the DJIA was the only index to reach a new closing low for the year, but given that the SPX and NDX both traded below their June closing lows on Friday…and closed just slightly above those lows…so we can count this move as a retest of the 2022 lows.) As we have said many times, we believe that the June lows will be breached in a meaningful way before the ultimate bottom for this bear market is reached, but we do have to admit that we’re seeing the key indices (the S&P 500 and the NDX 100) reaching oversold levels…and the same is true for the most important leadership group in the stock market (the semiconductors).

Also, sentiment has become quite bearish…with the percentage of bears pushing above 60% last week. That is the highest reading since March of 2009…and only the fifth time that bearishness has been above 60% since 1987! Also, the ratio of bulls to bears in the Investors Intelligence survey fell to 0.96. Whenever that reading falls below 1.0, it usually signals that a buying opportunity is just around the corner…..So as you can see, this market is become quite “over-hated”…at least on a short-term basis.

As you can see from the three RSI charts below, they’re all becoming oversold on a short-term basis. No, they’re not extremely oversold. In fact, both the SPX and NDX reached levels that were more oversold in January before they bounced. Therefore, we could still see some more downside follow-through before we get the kind of bounce that lasts for more than one or two days…..What we’re saying is that we should see a sharp bounce soon…in terms of time.

However, in terms of price, it’s still not out of the question that the market could still fall a lot more before it sees a bounce. Put another way, we could see a bounce begin on one of the first three days of next week…so it would come quickly in terms of time. However, it could still come at a much lower level in terms of price.

We have to remember that “forced selling” takes place from an oversold condition. We don’t get margin calls after the market has fallen 5%. It’s only after it has fallen in a meaningful way (and becomes oversold) that the margin calls are executed. Also, its when the stock market has fallen in a big way (especially during the second leg of a bear market) that those who are “swimming naked” are exposed. Therefore, we could get some sort of “blow up” at any time…including next week. This is something else that could cause “forced selling” to exacerbate the recent decline before we see a bounce.

(We are NOT aware of any pending blow ups…so we do NOT want to start any rumors. We’re just saying that after the kind of decline we’ve seen so far this year, it frequently produces some problems in the marketplace at some time or another.)

This is a long-winded way of saying that the stock market is getting ripe for a sharp bounce, BUT investors and traders need to be careful about assuming that the level this bounce starts from is near where the markets closed on Friday. Either way, as we have highlighted above…and will discuss further below…any near-term bounce should be another one that provides an opportunity to take some chips off the table. We have a long way to go before interest rates and stock prices reach their “neutral” level.

4) The Treasury market is also getting ripe for a near-term reversal. The bond market is getting quite oversold on price…and thus quite overbought when it comes to its yield. Sentiment is also getting extremely bearish (in terms of price). In fact, we would argue that the Treasury market could be viewed as sitting in a “win/win” situation…for at least the near-term.

The Treasury market had another very rough week. Bond prices fell for the 8th time in 9 weeks…and it took yields to levels that have not been seen. The yield on the 2-year note now stands at 4.22%...and the 10yr yield finished the week at 3.68% (its highest weekly close since 2010). However, this left the Treasury market oversold in terms of price…and very overbought, in terms of yield. As you can see from the chart below, the RSI reading on the 10yr yield is now at a similarly overbought level that it has reached at other short-term tops in the last year. Therefore, you can see that it’s getting quite extended…at least on a near-term basis.

We’d also note that it’s getting very extended on its weekly Bollinger Bands chart. (This means that it is now more than two standard deviations above its 20-week moving average.)….On top of this, the Daily Sentiment Index reading of sentiment among futures traders shows that bullishness had fallen to just 7% at one-point last week. Therefore, not only is the Treasury market oversold, but it’s also over-hated. Therefore, at least on a technical basis, the Treasury market should be due for a bounce in price…and a pullback in yield…quite soon.

We ALSO want to point out that if the stock market gets hit further next week…with some sort of “blow-up”…that should actually be quite bullish for the Treasury market. Instead of higher yields CAUSING the stock market to decline, it could become a situation where lower stock prices would actually CAUSE the Treasury market to rally…in a “flight to safety” trade. (The stock market usually takes its lead from the bond market, but when the stock market falls under serious duress, the situation can flip flop.)

Of course, nothing is guaranteed, but it seems to us that the bond investors should get some relief before too long. It might only last a couple of weeks…and maybe only a few days. However, we do think that the Treasury market will see a surprising rally soon…which is something that could catch a few players off sides for a while.

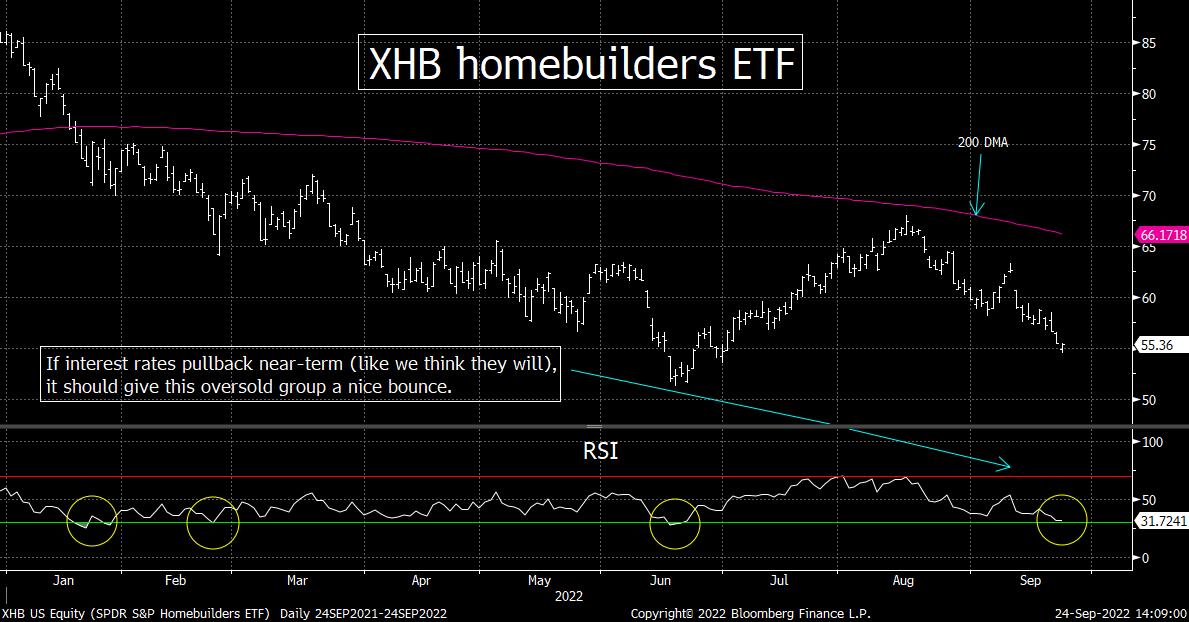

5) Despite what we hear from some very respected pundits, the housing market has not crashed. Sure, it has slowed…and will likely slow further. However, the housing stocks are becoming quite cheap…and on a technical basis, they’ve also become quite oversold. They should be ripe for at least a short-term bounce soon.

Despite the fact that one very, very well-respected real estate investor said last week that the housing market is crashing, the evidence is just not there to back up this claim. This does not mean that housing prices will not fall in a substantial manner…it just means that this has not yet taken place. Although some experts predict that price could as much as 10% even if we don’t fall into a recession, prices on a national level have not come down much at all…at least not yet. Don’t get us wrong, when you listen to the management of some of real estate companies, they’re scared to death. They remember what happened 15 years ago. However, this industry is a long way from experiencing a “crash” yet.

No, we are not trying to say that everything is hunky dory in the housing industry. However, there is still a SIGNIFICANT shortage of single family homes in this country! Some estimates show that America is still 3.8 million homes short of meeting the housing needs of our country…while the National Association of Realtors says the nation needs to build 5.5 million more homes. Besides, residential real estate can be seen as a nice hedge against inflation several times in the past (like it was in the 1970s).

We are not experts in real estate and the housing market…and we do agree that home prices could/should come down in the coming months. However, if you look as the valuations of some of the homebuilders, it sure looks like they have already priced-in a lot of pain. You look stocks like DR Horton (DHI), Lennar (LEN) and PulteGroup (PHM)…they’re trading at 4.5x, 5.1x, 4.4x stated earnings…which is right in-line with their lows at the bottom of the real estate crash of 15 years ago! Again, we are not real estate analysts, but it sure looks like this real estate crisis is going to fall more on the commercial side than on the residential side…and thus investors should be taking a close look at the home builders at current levels.

Whether this is a great level to invest in these names on a long-term basis or not might be in question. However, on a short-term basis, they do look like they’re ripe for a nice rally over the near-term. The XHB homebuilders ETF has become oversold on its RSI chart…and has reached a level that has been followed by some nice bounces in the past year. Also, as we mentioned in the previous bullet point, interest rates are poised to come down…at least over the near-term. Therefore, if interest rates come down over the coming weeks…at a time when the home buying market is in the middle of a seasonally busy time for home buyers (Sept/Oct)…AND a time when the group has become quite oversold…we could/should see a nice bounce in the homebuilders before too long.

6) It was a rough week for oil and natural gas last week…and they could be in for a bit more downside follow-through. However, we believe that this will create a good buying opportunity for the energy stocks soon. The issue of the price of oil and gas is still primarily one of supply, not demand…so the demand destruction that is taking place during this period of stagflation will not keep these stocks down for long.

Chairman Powell’s comments from last week…and the recessionary fears that accelerated along with them…helped create another drop in oil and natural gas prices last week. In fact, WTI crude oil closed below the $80 level on Friday for the first since January 10th. However, we do not believe this drop will continue for much longer. (It will be extremely interesting to see how prices act after the early November mid-term elections…especially since the SPR sales will have ended by then.)

However, the main reason we see oil and natural gas bottoming over the next 4-6 weeks is because the rise in energy prices is still primarily a supply issue. Of course, we have the issue of the sanctions on Russia…and the lack of supply to Europe that this has created. It’s great that they’ve been able to store more energy than they thought they would have by now, but Europe still readily admits that it’s going to fall well short of their needs. There just hasn’t been enough investment in fossil fuels in recent years in the U.S (from the administrations of both parties)…nor has there been enough in other parts of the world.

Demand destruction will only go so far when it comes to cooling the price of energy. People and business will still need to burn fossil fuels for the foreseeable future…and there just isn’t enough of it to push prices down to a level that will have a material impact on the earnings of many/most of the U.S. energy companies. (In other words, stagflation is what we’re facing.)

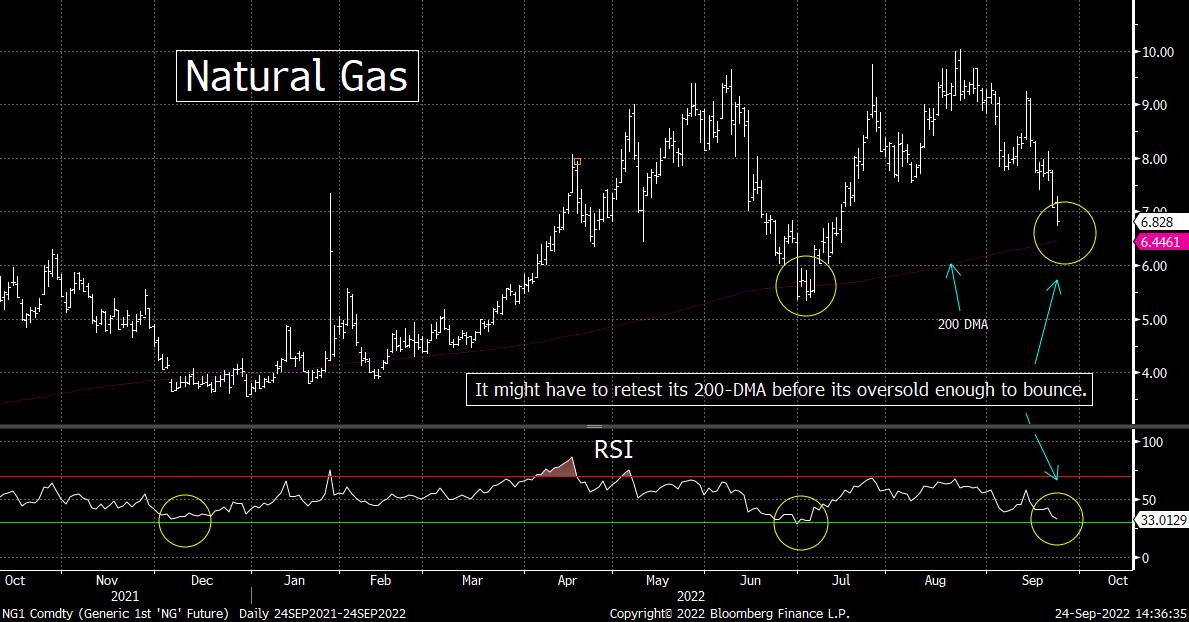

This does not mean that oil and natural gas cannot fall further over the very-near-term. In fact, we’re starting to think that nat gas might to have to drop down to (or slightly below) its 200-DMA before it bottoms (just like it did this past summer). However, WTI is definitely getting oversold…and although it could get more oversold before it sees a significant bounce, it’s downside potential is not very durable in our opinion.

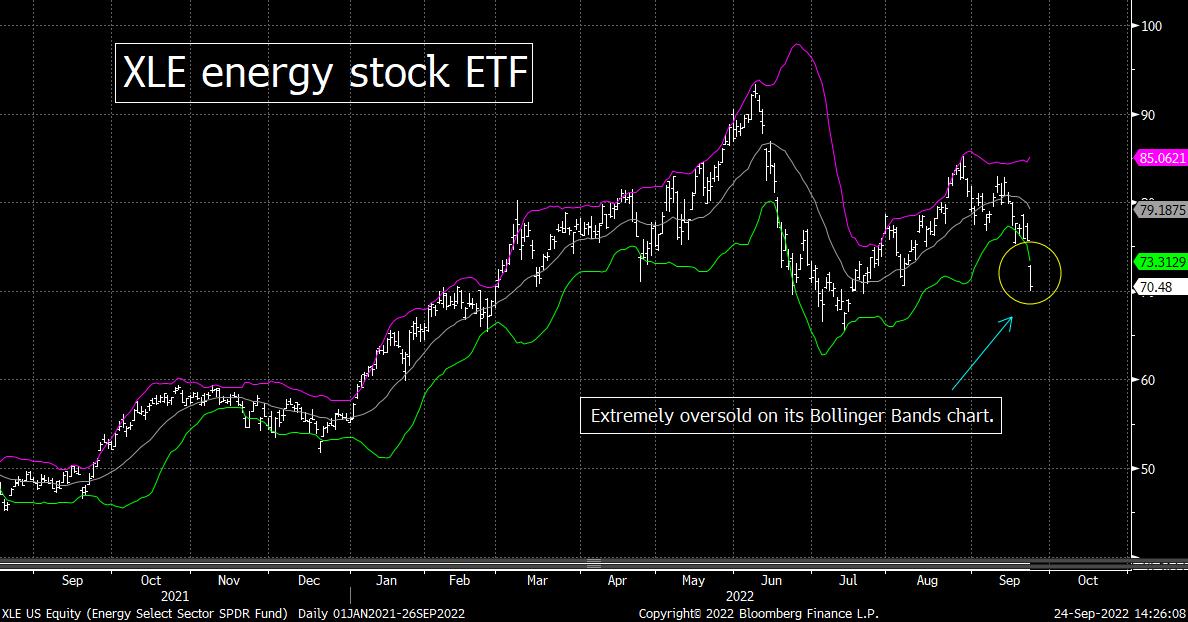

We’d also note that the XLE energy stock ETF and the XOP oil and gas E&P ETF have both reached the kind of oversold levels that have been followed by nice bounce in the past year. Again, this does not mean that the energy stocks cannot fall a bit further on a very-short-term basis. However, we are reaching a level where some of our favorite stocks are staring to look quite enticing on a longer term basis. Therefore, nibbling on these names at current levels…and getting more aggressive on them between now and the end of October…should be a very good idea for investors and traders alike.

7) We still believe that people are not spending enough time concentrating on the impact the slowdown in the economy is going to have on earnings. The Fed has strongly hinted that they want to get the unemployment rate up and housing prices down. Both of these are going to dampen consumer confidence and consumer spending. That’s not good for an economy that is 70% dependent on the consumer…and stock market that is expensive.

It was quite interesting that Chairman Powell used the word “pain” as many times as he did in his press conference this past week. While doing this, he cited the “tight labor” market…and the fact that housing prices probably needed to come down…several times. As the labor market and home prices come down, it’s going to cause more pain……We’d also note that in their official announcement, the Fed predicted that the unemployment rate would reach 4.4% next year (up from the 3.5% low of this year). Given that every time the unemployment rate has risen by 0.5%, the U.S. economy has fallen into a recession, this is another reason to think that Mr. Powell took a soft landing off the table this past week.

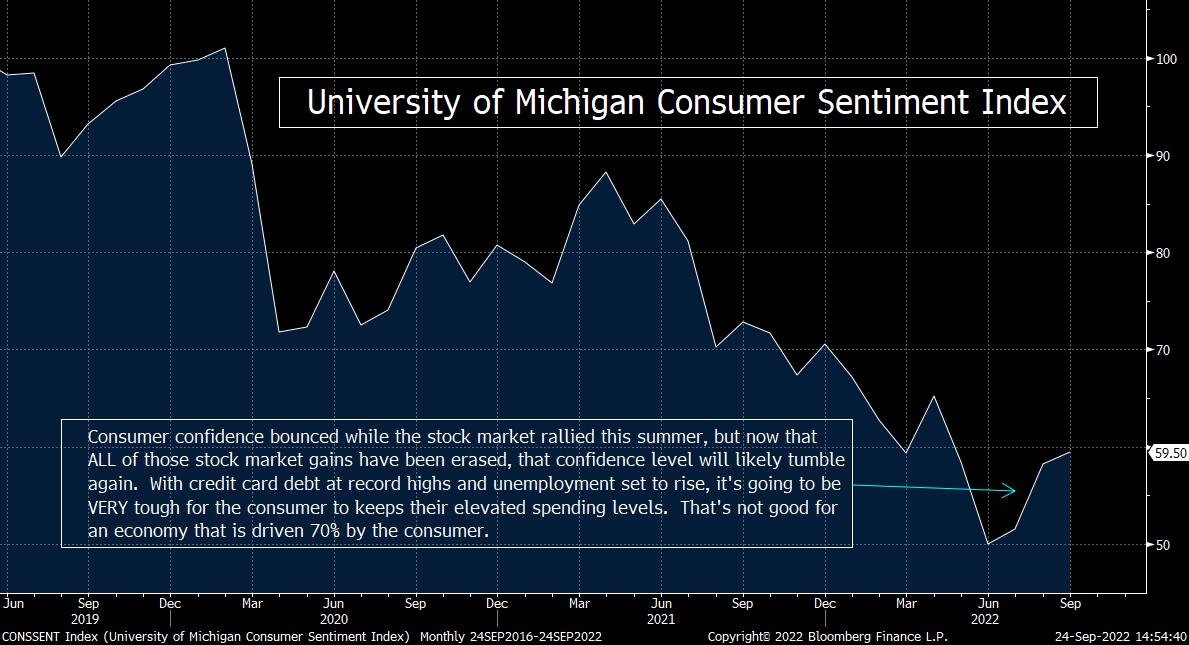

As we’ve highlighted many, many times this year, whenever we have a recession, it has always created a decline in earnings since WW((…and since the stock market is still expensive at these levels, what the Fed is predicting is not good for the stock market. Yes, we HAVE seen a bounce in consumer confidence, but that coincided with the rally in the stock market in July and August. Now that the market has rolled back over and re-tested its lows for the year, it’s not a stretch to think that upcoming readings of consumer confidence have rolled-over once again.

Of course, at least some of that increase in confidence has revolved around the lower price of gasoline. Those prices continue to fall, so it is unlikely that consumer confidence will quickly drop back down to its 2022 lows. However, a rise to 4.4% on the unemployment rate means 1.2 million people are going to lose their jobs. We’ve already seen the average workweek in the manufacturing sector shrink four out of the last six months. This is something companies do before they start laying off people, so the writing is already on the wall…..In other words, it’s great that it doesn’t cost as much to fill your car as it did a couple of months ago, but that won’t help one’s spending patterns much if they lose their job!

This will not be a good development at a time when credit card debt is reaching all-time highs. More than 60% of Americans live paycheck to paycheck. Well, if they don’t have a paycheck…and their credit cards are leveraged to the hilt…how are consumers going to be able to keep spending to the degree that have since the economy re-opened from the pandemic??? They’ve already spent their money in the second wave of “pent up demand” that was unleashed this spring and summer…so their willingness to spend was already going to go down. With stock prices going down…home prices starting to weaken…and job cuts on the horizon…it’s hard to think that the consumer is going to remain strong (like they had through the first 2/3 of this year).

If the consumer is going to pull-in his/her horns…in our consumer driven economy…it’s hard to think that earnings estimates for 2022 and 2023 are going to stay anywhere near where they are today. Therefore, even though the S&P has fallen 23% this year…and the NDX has declined 31% from its all-time highs…the stock market is not fairly valued yet. In fact, it is very likely still much closer the expensive side of history.

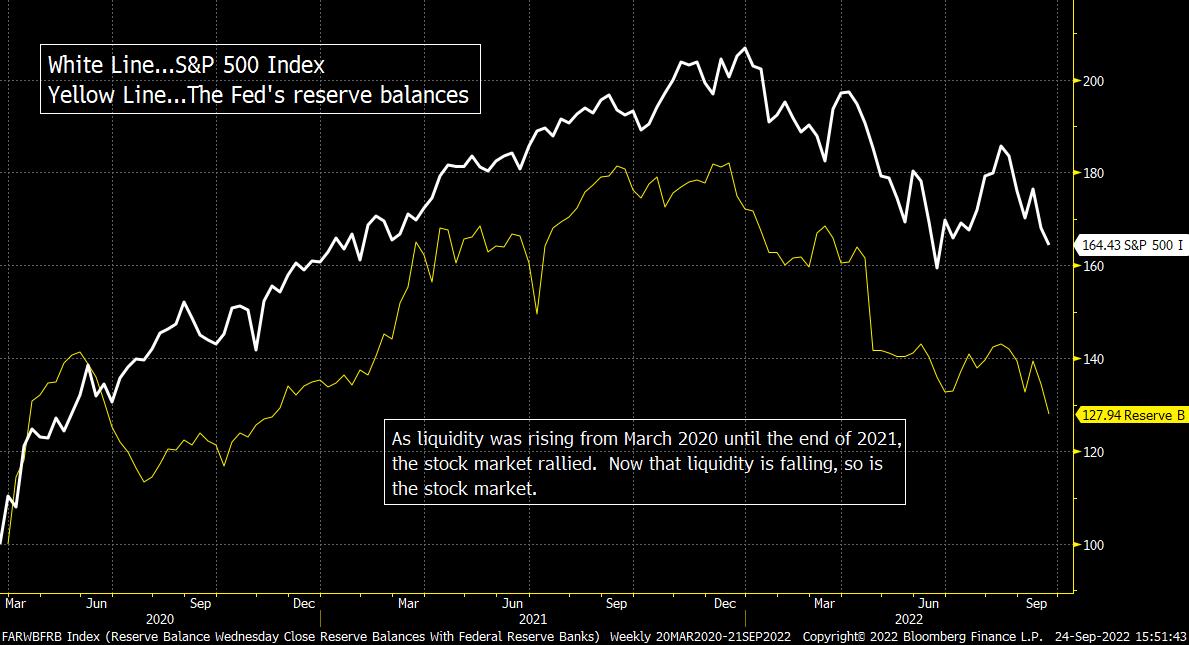

8) Liquidity has been a very important driver in the marketplace since the bottom of the Great Financial Crisis…and it has been THE key driver since the 2020 pandemic. The Fed’s balance sheet is just beginning to shrink, but reserve balances have been declining all year. This tells us just how the lower level of liquidity is hurting the markets in 2022. It also tells us that the stress in the system will likely grow in the weeks and months ahead.

We have spent a lot of time talking about the Fed’s balance sheet and how it is scheduled to shrink at a much faster pace now that we’ve moved into the autumn months. However, we’d also note that changes in the reserve balances have had a big impact on the stock market over the years…particularly since the massive QE program and zero interest rate policies were initiated in the spring of 2022. As the Fed has raised interest rates this year, it has led to a rise in the interest rate in their reverse repo facility…and reserve balances have fallen to their lowest level in over a year. Voila, less liquidity.

Less liquidity creates more stress in the system. This is why we have seen credit spreads begin to widen out again in recent weeks…and measures like the Goldman Sachs Financial Conditions Index move to new highs for the year…leaving it at its highest level since the worst time during the pandemic (in March of 2020). As we said in a previous point, we are not aware of any imminent blow up in the system…and we’re not looking for a repeat of anything like we saw with the banking system in 2008 and 2009. We’re just saying that there is less liquidity in the system…and as the Fed continues to raise interest rates and shrink its balance sheet, it’s going to increase the level of stress in the system going forward. Very simply, that’s not good for risk assets at a time that many of them are still expensive.

9) Politics…..This week’s political run down by Matt Maley Jr. will cover some of the most important races in the upcoming midterm election. This includes the races in Wisconsin, Pennsylvania, Georgia and Ohio…along with some brief tidbits about several other races. It’s going be a very tight race in several key states…and the Senate is still very much up for grabs.

Hello all – Over the past two installments of this weekly note I’ve discussed how recent events have dramatically changed the fortunes of the Democratic party in 2022. But make no mistake, these changes have only evened the odds. Joe Biden and the Democrats now have a fair chance of holding their ground against a Republican party that was all but certain to capture both chambers of Congress just a few weeks ago. Over the next few entries, I’ll be breaking down the biggest races of the 2022 midterms that will decide control of both chambers of Congress.

New Hampshire, Delaware, and Rhode Island were the final states to hold their primaries on Sept 13th. With those rounds of voting complete, the stage is set for the final push to the general election.

Senator Ron Johnson is the most likely incumb

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member