As many people were focused on the sad news that Queen Elizabeth II had passed away, the stock market had a tough time getting its bearings yesterday. It saw four different moves of over 1% during the day, but it ended the day solidly in positive territory, so it turned out to be a good day for the bulls in the end. The fact that yesterday’s action was able to resolve itself to the upside on a day where Chairman Powell had reiterated his hawkish stance toward monetary policy was something that should stabilize sentiment a little bit over the short-term.

As we highlighted on Wednesday, the Nasdaq fallen 7 days in a row (6 out of 7 for the SPX) and was becoming oversold on a short-term basis. Also, sentiment was becoming quite bearish once again…and oil prices were falling towards $80. Therefore, we said, the market was getting ripe for a very-short-term bounce. With the bounce yesterday…and the upside movement in the futures this morning…it seems like a near-term rally is indeed taking shape. Of course, as it progresses, many pundits will say that it is proof that the impact of inflation…and the Fed’s rate hikes…are already priced into the market and thus the worst is behind us. However, we believe it will merely be something that is telling us that the market had become oversold and sentiment had become too extreme…and this has to be worked-off before we resume the second leg of this bear market.

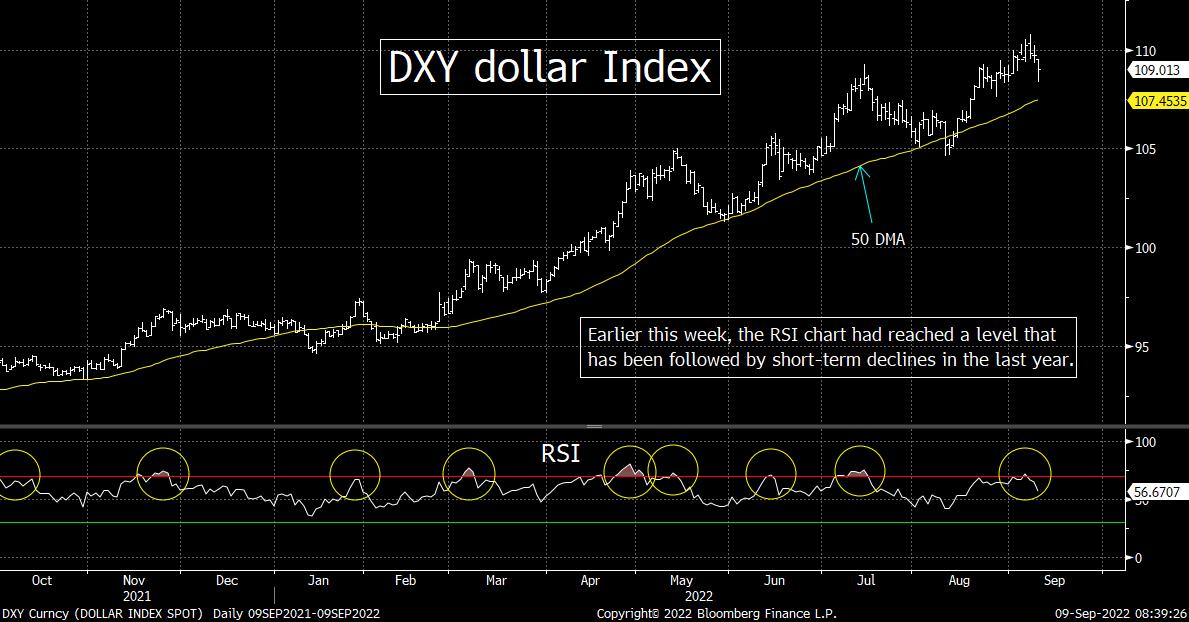

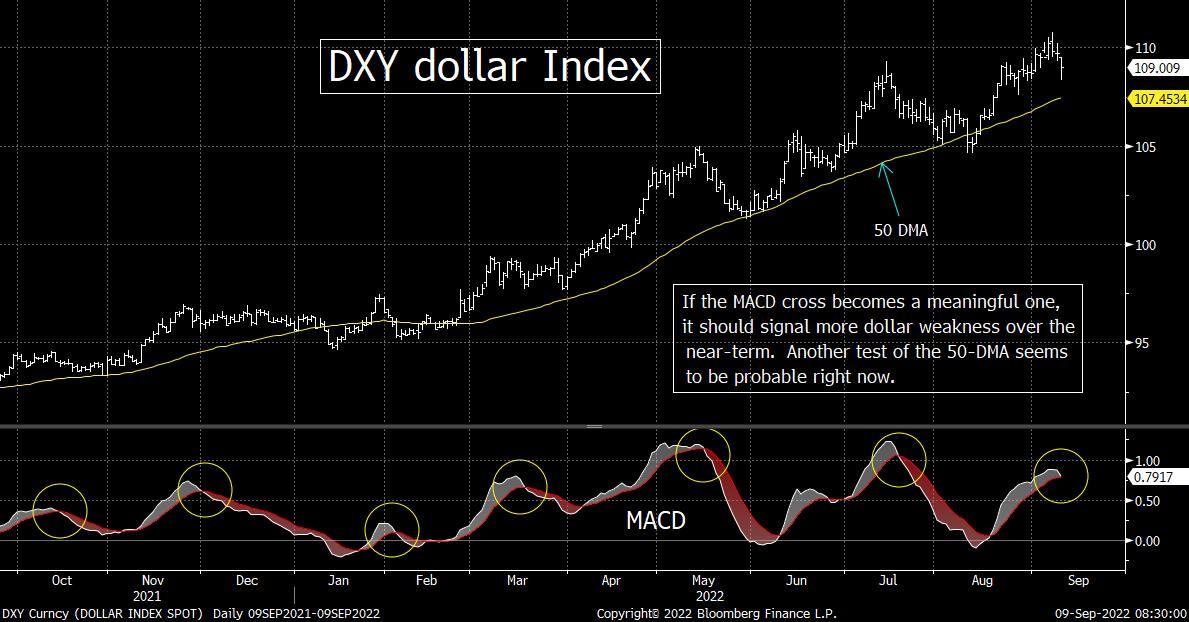

One development that could help this rally over the short-term is the weakness we’re seeing in the dollar. Earlier this week, the DXY dollar index had become quite overbought its RSI chart…and when that has taken place in the last year, the dollar has seen a short-term pullback. Similarly, its MACD chart is now very close to a negative cross…and whenever it has seen a meaningful negative cross on its MACD cross in the last year, it has been followed by a decline in the greenback that has lasted for at least a week or two…..Finally, bullishness in the dollar had become extremely high…with bullishness among futures traders in the DSI data reaching 93% early this week!

No, this does not mean that the dollar is going to roll-over in a major way over many months…and help the earnings of many multi-national companies in a compelling way. However, these readings have reached a level that should lead to decline in the dollar that lasts for more than just 2 or 3 days. That, in turn, is something that could/should help the stock market…especially since it is coming off an oversold and over-hated hated. (Two charts on the DXY below.)

Finally, we just wanted to say how saddened we were to hear about the death of Queen Elizabeth. For many years, we have said that if there was somebody we could sit down and speak with for several hours, it was the Queen. She Americans have no idea how bad things were in England (and most of Europe) during WWII. She lived through those days…and it wasn’t like she was a young child living up in Scotland. (Don’t get us wrong, she was more protected than most, but she still saw what that country was going through during those horrible day.) Of course, she became Queen not long after the War…and she has seen an amazing number of changes in her country and in the world. Finally, she has met and spoken with an amazing number of people who have shaped the world as it is today in her life time as well.

In the coming days and weeks, you’ll hear and see a lot more (and much better) tributes to the Queen than we could possibly provide here, but we just couldn’t finish this week without saying something. Like all of us, Queen Elizabeth was far from perfect…but her’s was a life (very) well lived.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member