We were out of the office and almost completely away from the markets yesterday…and it looks like we missed a very active day. In fact, the composite volume was in line with the busiest days of the past two months. The breadth for the S&P 500 and the NDX 100 was negative, but not horrible (at 4.7 to 1 negative and 2.6 to 1 negative respectively). Thus, the breadth from yesterday might give the bulls a little bit of confidence, but the fact that these two indices closed on their lows of the day…and they’re both trading lower in pre-market trading today…shows that there is still plenty of selling pressure out there in the marketplace.

The strong rise in the U.S. 10yr yield seems to have gotten most of the blame for yesterday’s decline in stocks…as it jumped well above the 3.1% resistance level that we have been saying was the key to confirming that the trend towards lower long-term rates we saw over much of the summer has changed over the past several weeks. (The move above 3.1% has given it an important “higher-high”…and thus this is the “confirmation” we’re talking about.)

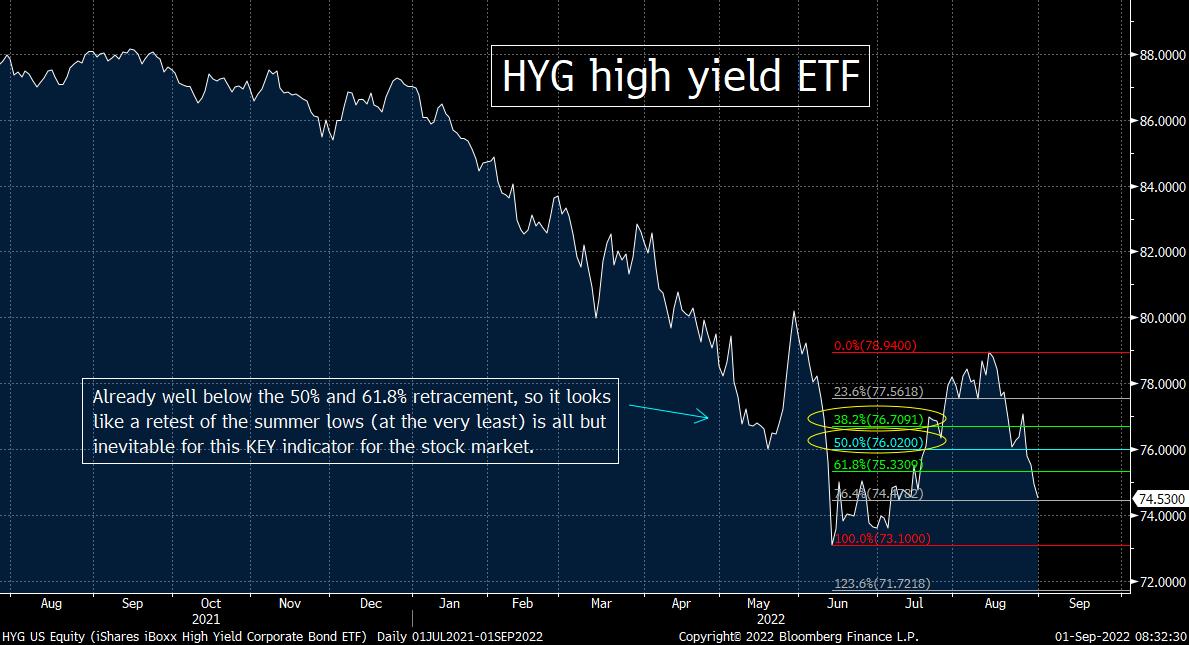

The DJIA, the S&P 500, the Nasdaq all fell below their 50-DMA’s yesterday…with the Russell 200 closing right on that line. We have also seen the SMH semiconductor ETF fall below its own 50-DMA…and the HYG has done so in a significant manner. If you’ll remember from our recent comments, the 50-DMA is more important for this high yield ETF, so the meaningful drop below this line is quite negative for this key leading indicator on the stock market.

So, where is the market heading over the near-term? Well, with the employment number coming out tomorrow morning, there is a good chance that investors will be a little bit less active today. Let’s face it, the rise in long-term rates has been a leading reason for the recent decline in the stock market (and the drop in rates was an important reason for the stock market rally earlier this summer). Since the employment report can have a critical impact on those long-term rates…at least when the report is a lot different than the consensus expectations…today could/should be a day when investors sit back and wait to see what this data brings before they act in a more meaningful manner……In other words, we could still get a big move in one direction or another today, but our guess is that it will be a rather muted day today. (Besides, it’s the first day of the month (no window dressing)…and we’re heading into a long weekend. So the institutional players can indeed sit on their hands if they want to.)

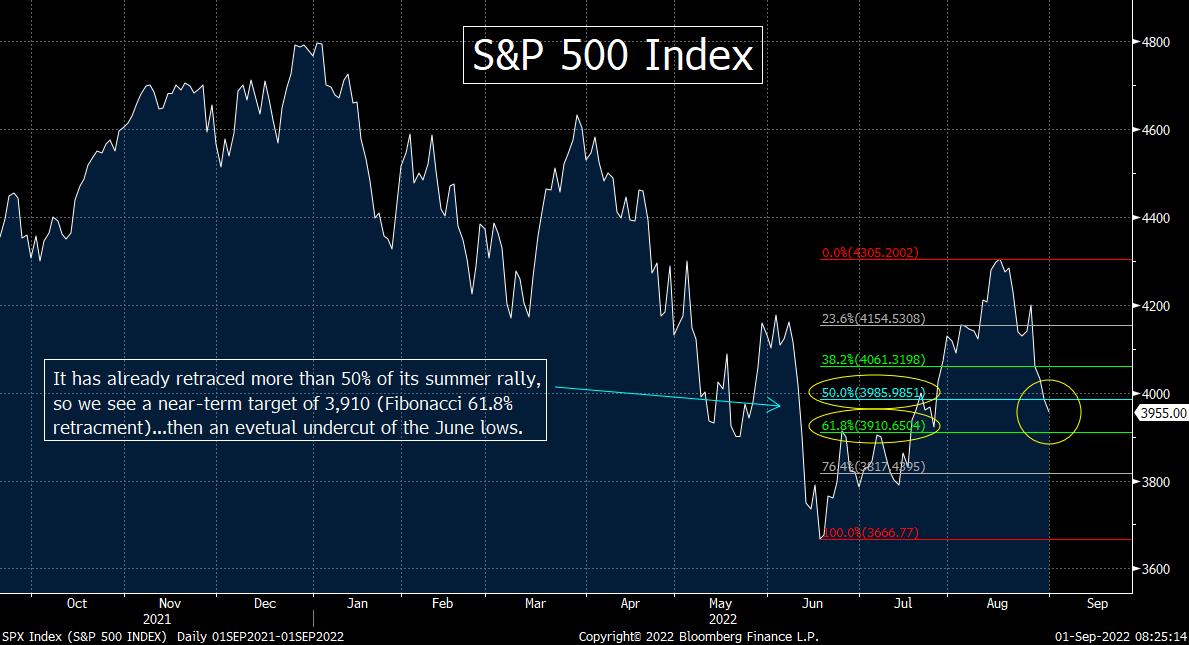

Again, we have spent a decent amount of time focusing on the S&P 500 and the NDX 100 indices…along with the SMH chip ETF and the HYG high yield ETF. As we just mentioned, they have all broken below their 50-DMAs. However, they’re also all broken well below their 50% retracement levels of the summer rallies. For SPX and NDX, this means that they’ll likely retrace a Fibonacci 61.8% of those rallies at the very least before they gain some traction. (As you know, we have been saying all summer that the June lows would be undercut, so we think that a 61.8% retracement will not create an important low. However, it could give some short-term support…so these levels should be used as target levels over the near-term for these two indices.)

For the S&P 500, a Fibonacci 61.8% retracement would take it down to 3910 before too long. (It might get a respite after tomorrow’s employment report, but we think the odds are very high that the SPX will test that level before very long.)….For the NDX 100, a 61.8% retracement would take it down to 12,100.

However, for both the SMH and the HYG, they have both ALREADY retraced more that 2/3 of their summer rallies…and thus a retest of the summer lows could come quite quickly for these two key ETFs………Of course, if the two most important indicators for the stock market test their summer lows soon, it would be long before the stock indices do the same thing.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member