It was an ugly day in the stock market yesterday as the 2.4% drop in the S&P 500 and the 3.5% dive in the Nasdaq came on a decent sized increase in volume and very poor breadth. In fact, the breadth on the S&P 500 was almost 10 to 1 negative...and it was 6.6 to 1 negative on the Nasdaq Composite Index. However, it was even worse on the NDX Nasdaq 100 Index...where the breadth was a whopping 50 to 1 negative! So as you can see, it was a broad decline. However, we’ve seen a several days like this in the last two months...only to see the stock market bounce-back strongly (rather quickly). Therefore, we’re going to have to see more downside follow-through to confirm that the correction we’ve been calling for recently has indeed begun.

Most of the blame for the decline went to the rise in long-term interest rates. Yesterday’s move was particularly strong...as it took the yield on the U.S. 10yr Treasury note above 1.6% in the middle of the day before settling in at 1.52% at the close. This move in the bond market...and the reaction it has created in the stock market...is not a surprise to us at all. Yes, most people thought that Chairman Powell’s comments in front of Congress was very dovish...and thus it should be very bullish for the stock market. However, we thought that the most important takeaway was that the Mr. Powell reiterated that the Fed will let inflation run hot for a while. THAT means that the Fed will not act if long-term interest rates rise more than the consensus has been thinking they will (for much of the rest of this year).

These higher long-term interest rates have an impact on what investors are willing to accept in terms of valuation. This is particularly important for the tech stocks...whose cash flows are a long-term play....and thus higher rates will create a situation where investors will not accept the kind of sky-high valuations that they’ve been willing to accept in recent years. Therefore, we believe that although what Chairman Powell said this week was bullish for the economy, it was not particularly bullish for the stock market.

In other words, the Fed pushed asset prices well above their economic value with the massive liquidity program last year...so now it’s time for the economy to play catch-up to the stock market.......The problem is that the economy & the market will likely meet at some point in the middle...which leaves the stock market vulnerable to a correction.

That is the situation we’re facing in a nut shell. If we said anything else, we’d just be making noise.....Therefore, we’ll finish by saying two things. The first one is that the stock market has declined less than 3% from its all-time record high...and thus it is still priced for perfection. The rise in long-term interest rates is one of several reasons to think that it is unlikely that we’ll get “perfection” for the rest of this year. Therefore, investors should be raising a little bit of cash...and adjusting their portfolios to this new reality.

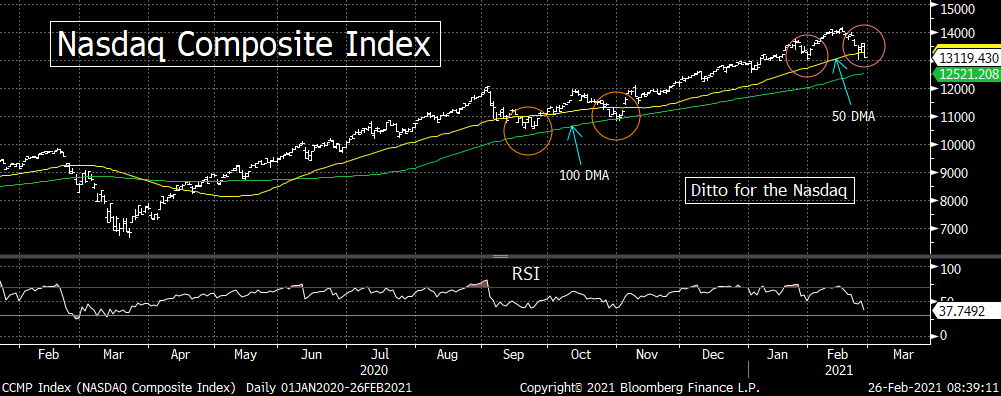

Second, we want to highlight the first couple of support levels for the S&P 500 and the Nasdaq Composite.....Today is the last day of the month, so we could get a bit of a relief rally today. However, if the stock market sees more weakness as we move into the month of March, the first two support levels we’ll be watching on both indices are well defined...and very easy to keep an eye on. For both indices, the first support level is the 50 DMA...and the second one is the 100 DMA. It’s usually not that easy, but it IS just that easy this time around.

The 50 DMA for indices is the line that held when the GameStop debacle was hitting the market late in January...and it held that line on Monday as well (when TSLA and Bitcoin got hit so hard). Actually, the Nasdaq fell slightly below that line on Monday...and closed slightly below it yesterday. So that is the first level we’ll be watching......That said, the 100 DMA is going to be more important. That was the line the stopped the declines we saw in both September and October of last year. Therefore, a meaningful break below that moving average would raise the concerns to a greater degree.

Don’t get us wrong, we’re not saying that the 100 DMA is some sort of major “line in the sand.” It’s just the second support level of the first two levels we’ll be watching over the near-term...if (repeat, IF) the market does indeed see some more downside follow-through in March. The much more important support level will be at the 3275 level on the S&P 500. That would give the SPX a Fibonacci 38.2% retracement of the total rally from last March...AND it was the lows we saw in September and October. So that level will be a much more important support level. However, that’s 16% below the recent all-time highs, so we’re not going to worry about that one just yet...........First things first...so the 50 & 100 DMA’s are the ones to be watching right now.

(If you'd like to get these unique insights during these fascinating times in the investment world, please click here to subscribe to “The Maley Report.”......Thank you!)

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

If you'd like to get these unique insights during these fascinating times in the investment world, please click here to subscribe to “The Maley Report.”......Thank you!

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member